Average Home Insurance Cost Per Month Woolworths

Average Home Insurance Cost Per Month Woolworths

Are you considering getting home insurance from Woolworths? You’re not alone. Woolworths is one of the largest insurance companies in Australia, offering a variety of different insurance packages to suit different needs. However, when it comes to home insurance, it is important to consider the average cost per month Woolworths charges for its home insurance packages. This article will provide an overview of what the average cost of home insurance from Woolworths is and some tips to help you find the best deal.

Average Cost of Home Insurance from Woolworths

When it comes to home insurance, Woolworths offers a range of different packages to suit different needs. The average cost of home insurance from Woolworths is approximately $30 per month. This cost can vary depending upon the level of coverage you choose, where you live and the type of property you own. It is important to note that this figure is an average and that the exact cost of home insurance from Woolworths for any particular policy will depend upon the type of coverage you choose and the size of your property.

Factors That Affect the Cost of Home Insurance from Woolworths

The cost of home insurance from Woolworths can be affected by a number of factors. The first factor is the type of coverage you choose. The more comprehensive the coverage, the more expensive the policy will be. Additionally, the size of the property you own will also affect the cost of home insurance from Woolworths. Properties with larger square footage or more valuable contents will usually cost more to insure than smaller properties or those with fewer valuable contents.

How to Get the Best Deal on Home Insurance from Woolworths

When shopping for home insurance from Woolworths, it is important to shop around. Comparing home insurance policies from different providers can help you get the best deal. Additionally, some providers may offer discounts for bundling home and contents insurance or for having multiple policies. It is also important to make sure that you read the policy documents carefully to determine what is and isn’t covered by the policy. This will help you make sure that you are getting the coverage you need, without paying for unnecessary coverage.

How to Make a Claim on Home Insurance from Woolworths

If you need to make a claim on home insurance from Woolworths, you should contact the insurer as soon as possible. You will need to provide detailed information about the claim, including proof of ownership, photos of the damage or loss and any relevant documents. Woolworths will then assess the claim and advise you of the outcome. If your claim is successful, you will be reimbursed for any losses or damages. It is important to note that some claims may not be accepted, so it is important to make sure that you read and understand the terms and conditions of the policy before making a claim.

Conclusion

Woolworths is one of the largest insurance companies in Australia, offering a variety of different insurance packages to suit different needs. The average cost of home insurance from Woolworths is approximately $30 per month, however, this cost may vary depending upon the level of coverage you choose, where you live and the type of property you own. When shopping for home insurance from Woolworths, it is important to shop around and compare policies from different providers. Additionally, it is important to make sure that you read the policy documents carefully to determine what is and isn’t covered by the policy. Finally, if you need to make a claim on home insurance from Woolworths, you should contact the insurer as soon as possible to discuss the claim.

Here's Why It Costs $1,204 a Month to Maintain the Average Home

How Much Would A Home Equity Loan Cost Per Month

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

Health Insurance Average Cost Per Month - Health Tips,Music,Cars and Recipe

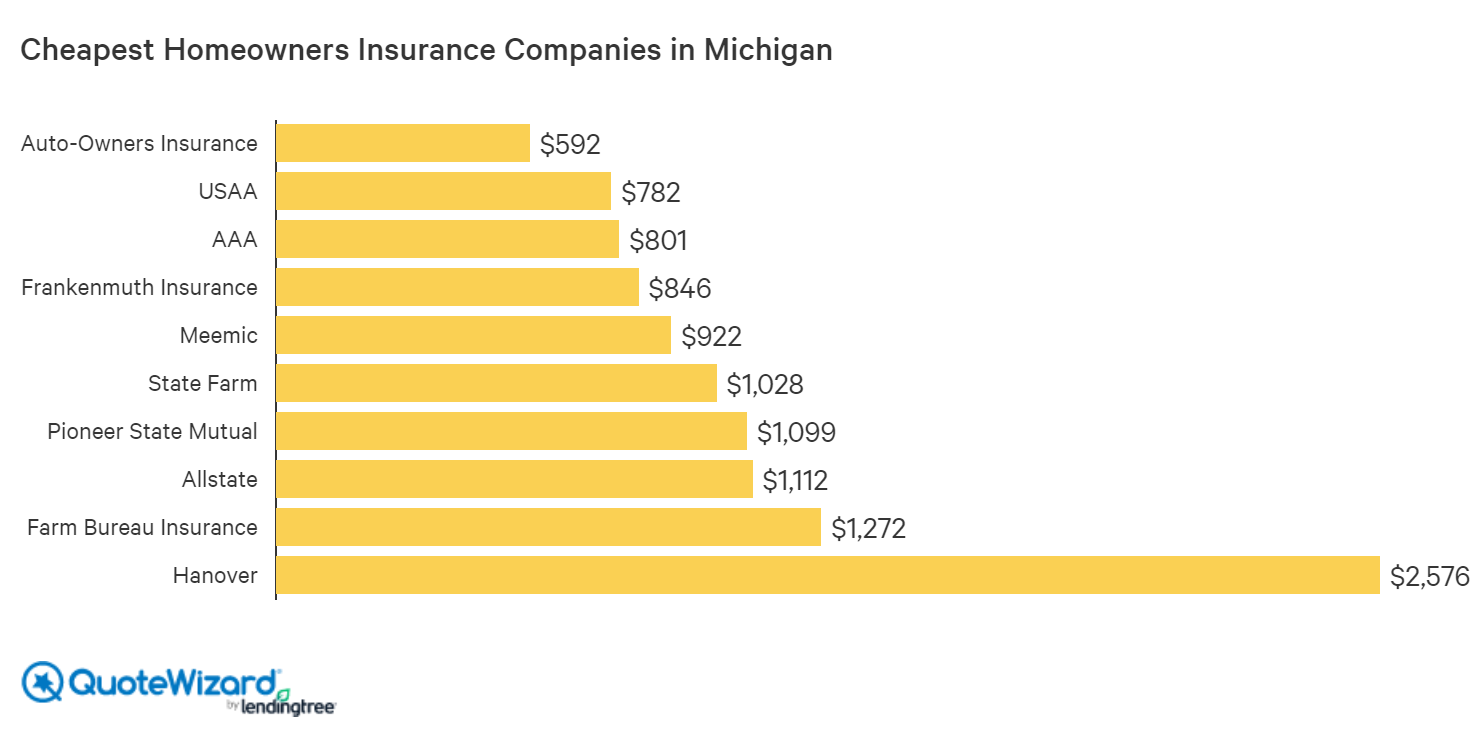

Best Home Insurance Rates In Michigan - dearjohndesigns