Igo4 Car Insurance Policy Wording

Igo4 Car Insurance Policy Wording Explained

What is Igo4 Car Insurance?

Igo4 Car Insurance is a comprehensive car insurance policy that provides cover for your car and personal belongings against theft, damage, and liability. It also covers third party losses, including medical expenses and repair costs for their vehicle, in the event of an accident. The policy offers a range of coverage options, including third party only cover, third party fire and theft cover, and comprehensive cover.

What’s Covered by Igo4 Car Insurance?

The Igo4 Car Insurance policy offers a range of coverages, depending on the type of policy you choose. With third party only cover, you’re only covered for the damage you cause to another person’s vehicle or property. Third party fire and theft cover includes liability cover for the damage you cause to another person’s vehicle or property, as well as cover for fire and theft of your own car. With comprehensive cover, you’re covered for all of the above, plus vandalism and legal costs.

What is the Excess Amount?

The excess amount is the amount of money you’ll have to pay towards the cost of any claim you make. This amount varies depending on the type of policy you have, the make and model of your car, and other factors. The excess amount is usually stated in the policy wording.

What are the Benefits of Igo4 Car Insurance?

Igo4 Car Insurance offers a range of benefits, including: flexible payment options, optional extras such as windscreen cover, breakdown cover, and courtesy car cover, and discounts for careful drivers, including no claims discounts. The policy also offers protection for your no claims bonus, so you won’t lose it if you make a claim.

How Do I Make a Claim?

Making a claim on your Igo4 Car Insurance policy couldn’t be simpler. You can make a claim online, by phone, or by post. You’ll need to provide details of the incident, along with supporting evidence, such as photos or witness statements. Once your claim has been submitted, you’ll be given a claim number and you’ll be able to track the progress of your claim online.

Conclusion

Igo4 Car Insurance is a comprehensive car insurance policy that provides cover for your car and personal belongings against theft, damage, and liability. It also covers third party losses, including medical expenses and repair costs for their vehicle, in the event of an accident. The policy offers a range of coverage options, and benefits such as flexible payment options, optional extras, and discounts for careful drivers. Making a claim couldn’t be simpler – you can do it online, by phone, or by post.

Understanding Your Car Insurance Declarations Page | Policygenius

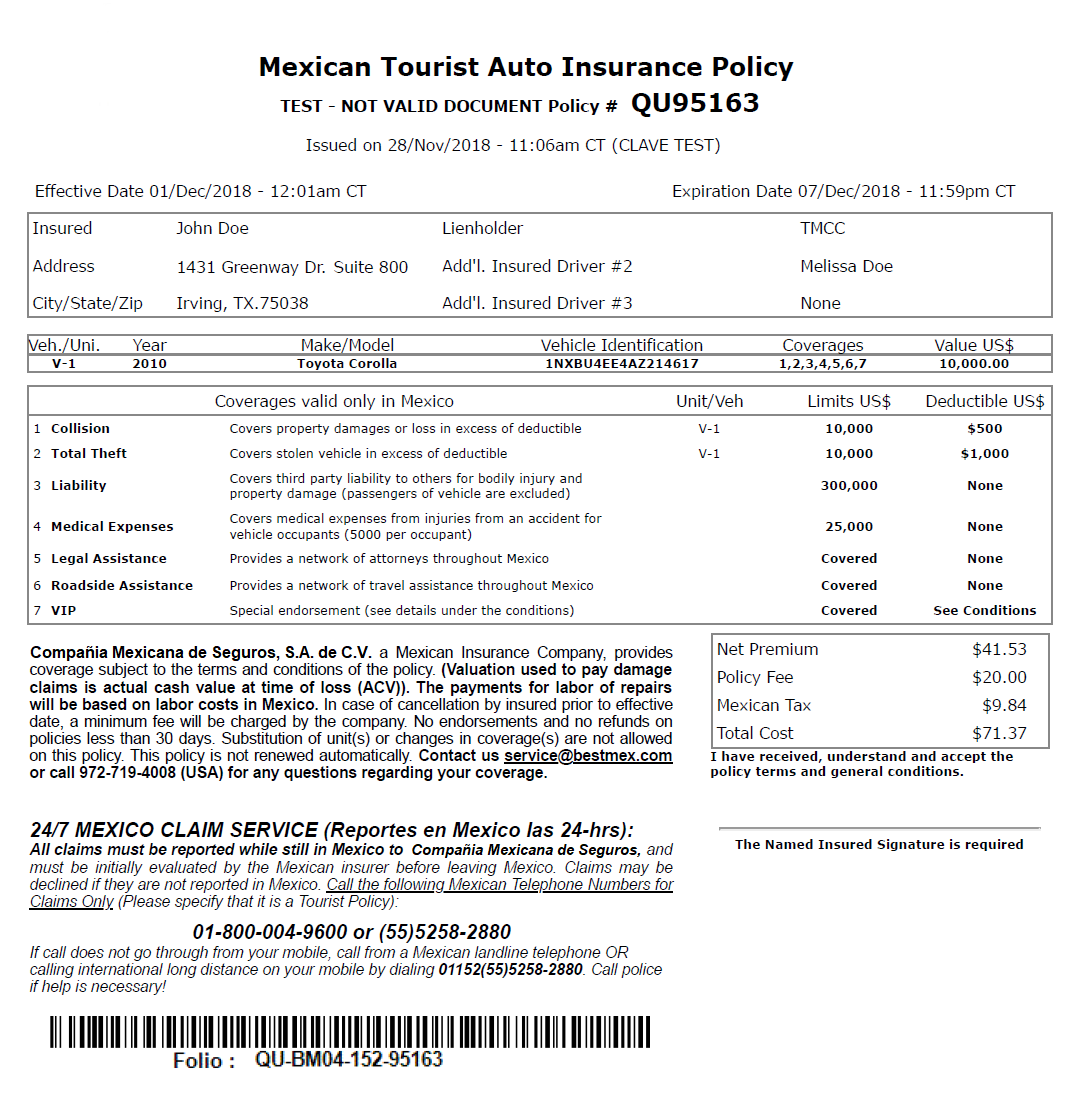

Sample Mexican Car Insurance Policy - Bestmex Blog

Car Insurance Policy Template - How To Make A Fake Car Insurance Card

[PDF] Bharti AXA Smart Drive Private Car Insurance Policy PDF Download

![Igo4 Car Insurance Policy Wording [PDF] Bharti AXA Smart Drive Private Car Insurance Policy PDF Download](https://instapdf.in/wp-content/uploads/pdf-thumbnails/bharti-axa-private-car-insurance-policy-2436.jpg)

Hdfc Ergo Car Insurance Policy Download Online - linxydesigns