Low Cost Car Insurance Alabama

Low Cost Car Insurance Alabama

The Best Way To Get Low Cost Car Insurance In Alabama

The cost of car insurance in Alabama can be high, but it doesn't have to be. In fact, there are many ways to get low cost car insurance in Alabama. The key is to shop around and compare different insurance companies and policies to find the best coverage and price for your needs. Here are a few tips to help you find low cost car insurance in Alabama.

Compare Prices and Coverage Options

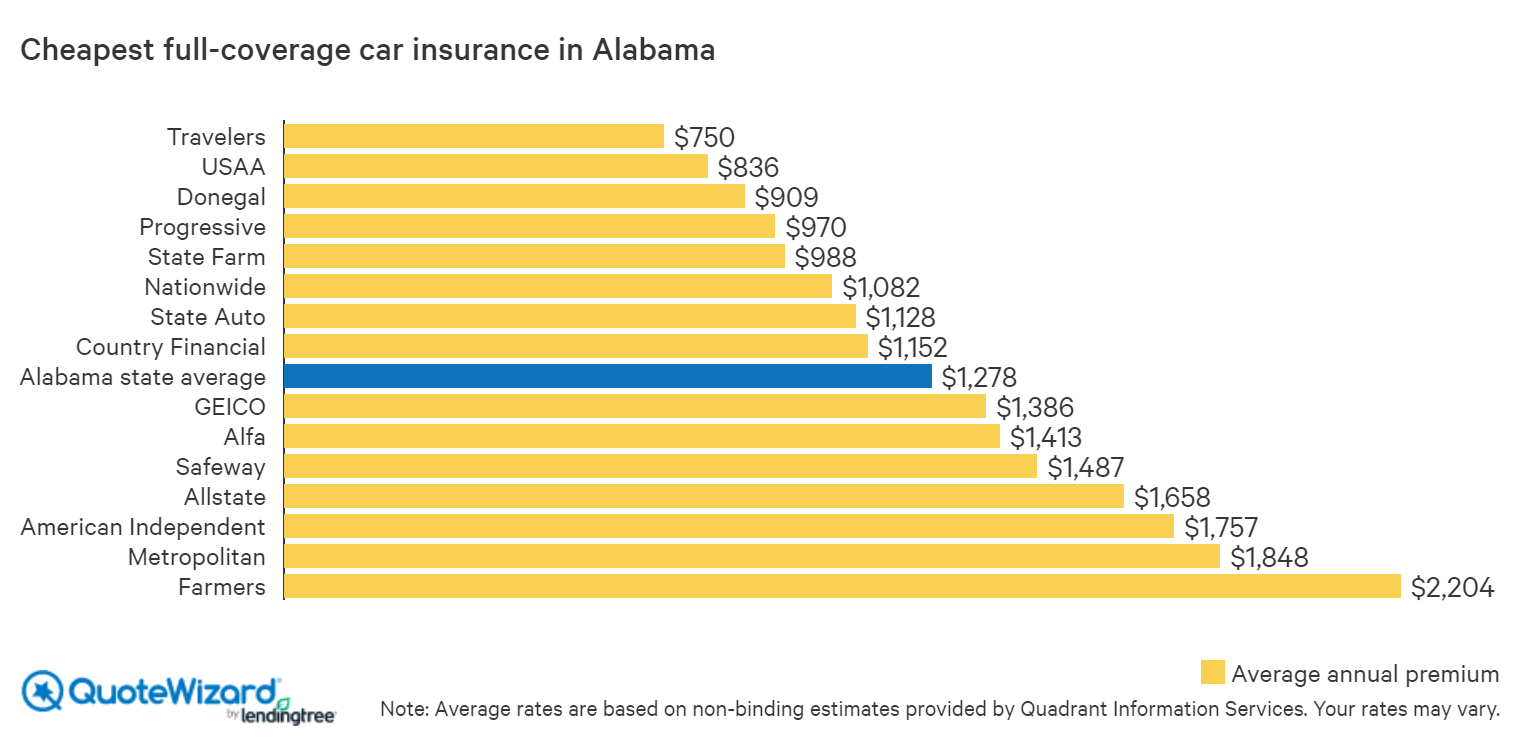

The most important thing to do when looking for low cost car insurance in Alabama is to shop around and compare prices and coverage options. You should get quotes from at least three different companies so you can see which one offers the best deal. Make sure to consider all of the different coverage options available, such as liability, collision, comprehensive, and uninsured motorist coverage, and make sure that the policy you choose covers all of the things you need. You should also make sure that the policy you choose has all of the discounts available.

Choose a Higher Deductible

Choosing a higher deductible is another way to get low cost car insurance in Alabama. A higher deductible means that you will have to pay more out of pocket in the event of an accident or other incident. However, it also means that you will be paying less up front for your premiums. Before you decide on a deductible, make sure to do some calculations to determine how much you can realistically afford to pay in the event of an accident.

Take Advantage of Discounts

Another way to get low cost car insurance in Alabama is to take advantage of discounts. Most insurance companies offer discounts for certain things such as good driving records, being a good student, having multiple cars insured with the same company, and more. Make sure to ask your insurance company about any discounts they may offer and take advantage of them if they are available.

Look for Companies with Lower Overhead Costs

Car insurance companies also have overhead costs, such as advertising and administrative costs. Companies with lower overhead costs may be able to provide lower premiums. When shopping for car insurance, make sure to ask about the company's overhead costs and compare them to other companies to find the one with the lowest overhead.

Check Your Credit Score

Your credit score can have an effect on your car insurance premiums. Insurance companies use credit scores to determine the risk of a customer. If you have a good credit score, you may qualify for lower rates. If your credit score is not so good, it may be wise to work on improving it before shopping for car insurance.

Compare The Best Low Cost Car Insurance Rates in Alabama Online with

Find Cheap Car Insurance in Alabama | QuoteWizard

Cheap Car Insurance in Alabama 2019

2017 Low Cost Auto Insurance Tips | Seniors | Find Low Cost Auto

Best Car Insurance in Alabama - Top Auto Insurance Companies in AL