Does State Farm Require A Down Payment For Auto Insurance

Wednesday, May 29, 2024

Edit

Does State Farm Require A Down Payment For Auto Insurance?

What is a Down Payment?

A down payment is a payment made when purchasing an automobile or other large purchase. It is usually a percentage of the total cost of the item and is meant to reduce the amount of money that must be borrowed or paid in installments. The down payment is often the largest single payment made when buying a car and is often the most important payment made in the process.

Does State Farm Require a Down Payment?

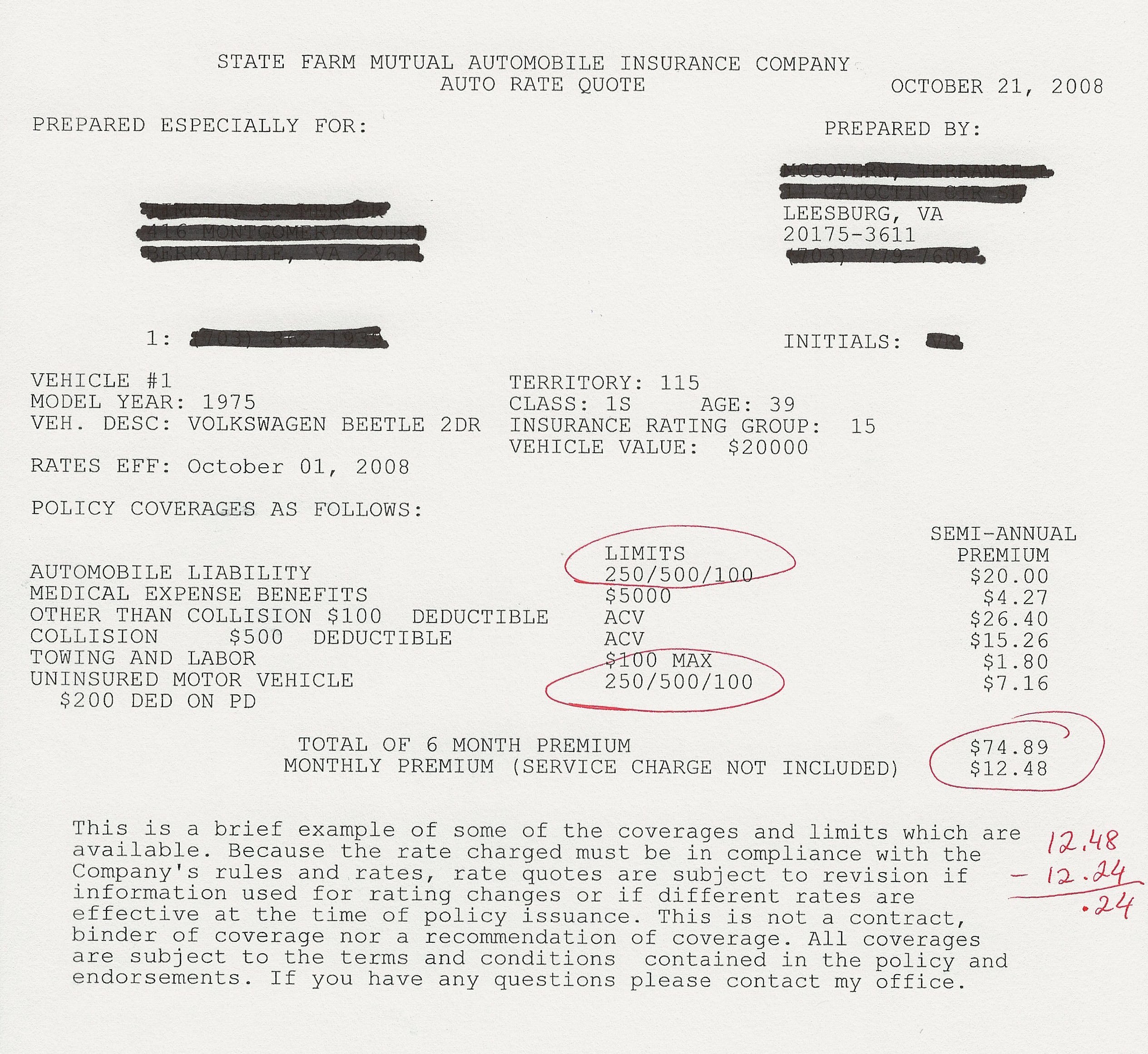

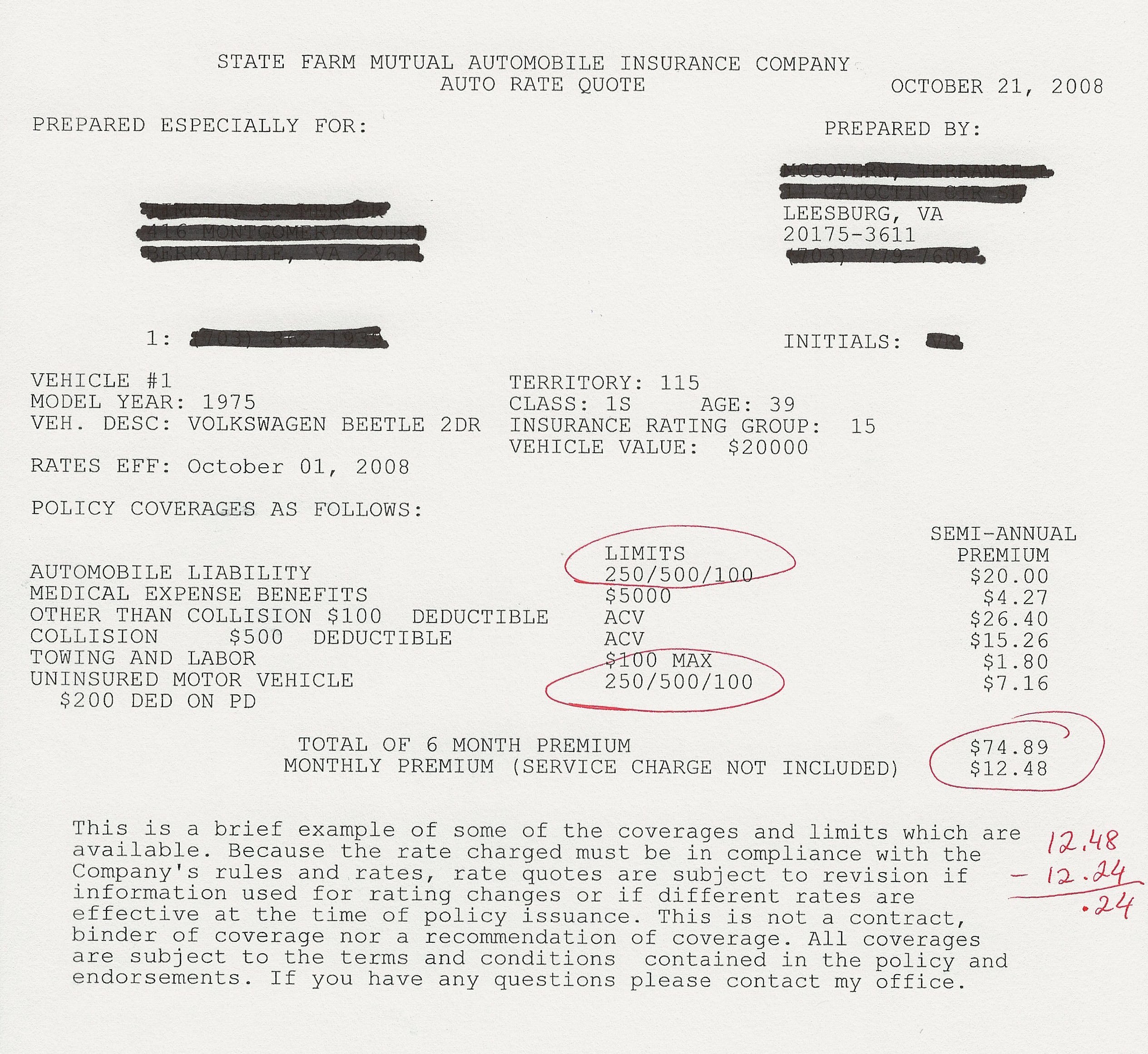

State Farm does not require a down payment for auto insurance, however, they do require a minimum amount of payment when you purchase a policy. This minimum amount will vary depending on the state and the type of policy you are purchasing. Generally, the amount is between $50 and $200. Additionally, State Farm does offer discounts for customers who are able to pay their policy in full.

What Happens if I Can't Make My Payment?

If you are unable to make your payment, State Farm may suspend or cancel your policy. This is why it is important to always make your payments on time. State Farm will not forgive or waive late payments, so it is important to keep up to date with your payments. Additionally, State Farm may also increase your premiums if you miss a payment or make a late payment.

What Is the Difference Between a Down Payment and a Premium?

The down payment is the initial payment you make when purchasing a policy, while the premium is the amount you pay each month or year to keep your policy active. The premium is usually a smaller amount than the down payment, but it is still important to make your payments on time. Additionally, if you miss a premium payment, State Farm may cancel your policy.

What Are the Benefits of Making a Down Payment?

Making a down payment has several benefits. First, it reduces the amount of money you need to borrow or pay in installments. Second, it can help you qualify for discounts. Third, it can help avoid late fees or policy cancellation. Finally, it can help you avoid any sudden changes in your premiums.

In Summary

State Farm does not require a down payment for auto insurance, however, they do require a minimum amount of payment when you purchase a policy. Making a down payment can help you qualify for discounts, avoid late fees and policy cancellation, and help you avoid any sudden changes in your premiums. It is important to always make your payments on time; otherwise, State Farm may suspend or cancel your policy.

State Farm Auto Insurance Eye Opener – Welcome to the Insurance World

Auto Insurance State Farm

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

Does State Farm Have A Grace Period For Payment - PEYNAMT

Does State Farm Have A Grace Period For Payment - PEYNAMT