Changing Insurance Policy To New Car

Monday, November 18, 2024

Edit

Changing Your Insurance Policy When You Buy a New Car

Why You Should Change Your Insurance Policy When Buying a New Car

Buying a car is a big step. It’s a big investment and you’ll want to make sure that you’re covered in case something happens to it. That’s why it’s important to change your insurance policy when you buy a new car. Your current policy may not cover the new car or may not provide enough coverage. It’s important to understand your policy and know what it covers so you know what kind of policy you need for your new car.

What Kind of Insurance Do You Need for a New Car?

The type of insurance you need for a new car depends on the car and what you plan to do with it. For example, if you’re buying a sports car or an expensive luxury vehicle, you’ll want to make sure you have enough coverage to replace or repair it if it’s damaged. You’ll also want to make sure you have liability coverage to protect yourself in case you cause an accident. If you’re buying a used car, you may need less coverage, but it’s still important to get enough to cover the car if something happens.

What Kind of Coverage Do You Need?

The kind of coverage you need for your new car depends on the car and what you plan to do with it. Generally, you need collision coverage, which pays for repairs to your car if it’s damaged in an accident. You also need liability coverage, which pays for damages you cause to other people’s property or medical expenses if you’re at fault in an accident. You may also need uninsured/underinsured motorist coverage, which pays for medical expenses and property damage if you’re in an accident with someone who doesn’t have insurance or doesn’t have enough.

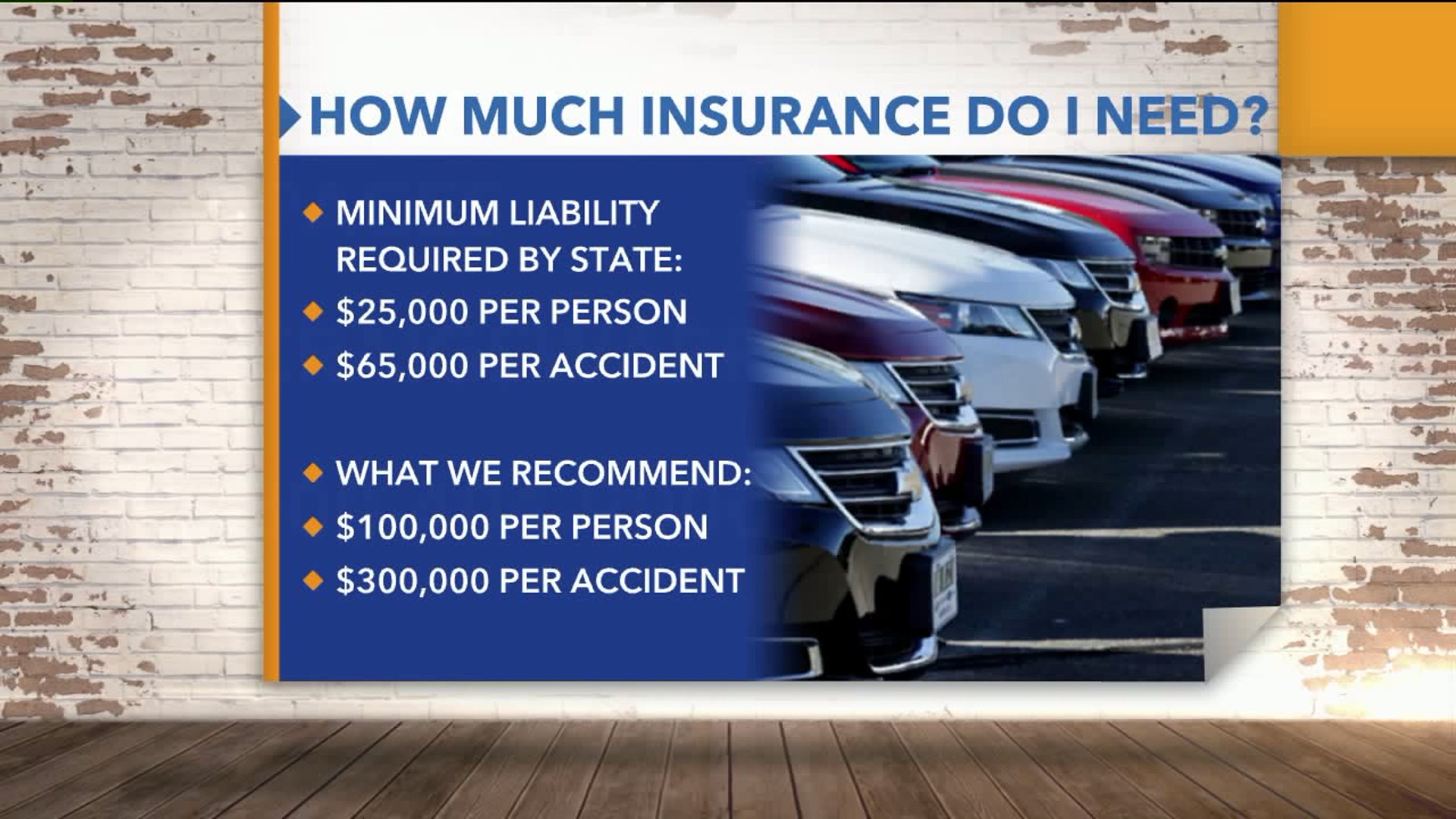

How Much Coverage Do You Need?

The amount of coverage you need for your new car depends on the car and what you plan to do with it. Generally, you want enough coverage to replace or repair your car if it’s damaged in an accident, and enough liability coverage to protect yourself if you cause an accident. If you’re buying a used car, you may need less coverage, but it’s still important to get enough to cover the car if something happens.

When Should You Change Your Insurance Policy?

It’s important to change your insurance policy when you buy a new car. You should talk to your current insurance provider to see what kind of coverage they can offer you for the new car, and if they don’t offer enough, you should shop around for a new policy. It’s important to make sure that your new policy covers the car and provides enough coverage so you’re covered in case something happens.

Conclusion

Changing your insurance policy when you buy a new car is important. You need to make sure that your policy covers the car and provides enough coverage so you’re covered in case something happens. Make sure to talk to your current insurance provider to see what kind of coverage they can offer you for the new car, and if they don’t offer enough, shop around for a new policy.

2017 Auto Insurance Basics | How to Change to a New Car Insurance

If You Carry An Average Car Insurance Policy, Look Into Changing It

How To Cancel Car Insurance Policy ? - PolicyBoss

Cancellation of Car Insurance and Refund Process - PolicyBachat

Understanding auto insurance