Car Insurance With Student Discount

Car Insurance with Student Discounts

Why Students Need Car Insurance

As a student, it can often feel like you’re being hit with expenses from all sides. Between tuition, rent, and your daily needs, it can be difficult to find extra money to cover car insurance. Car insurance is a necessity for any driver, and can be especially important for students who may not have an established credit history. Car insurance helps protect the driver and their car in the event of an accident or other related incident. As a student, having the right car insurance can help ensure that you won’t be stuck with large bills in the event of an incident.

Finding the Right Student Car Insurance

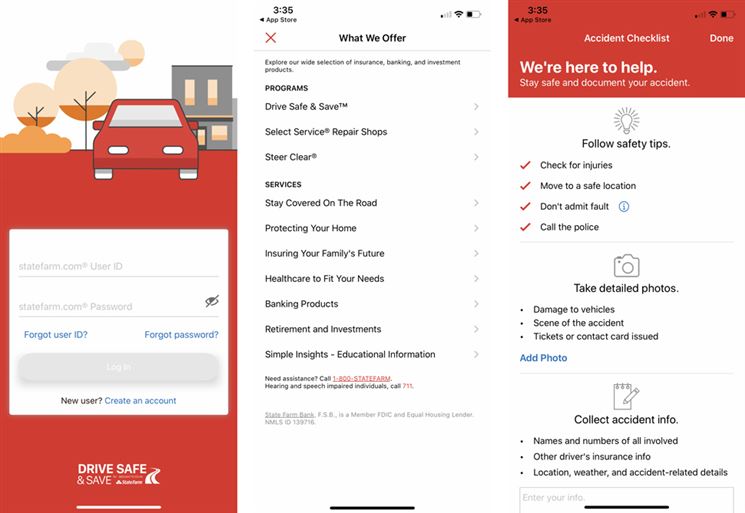

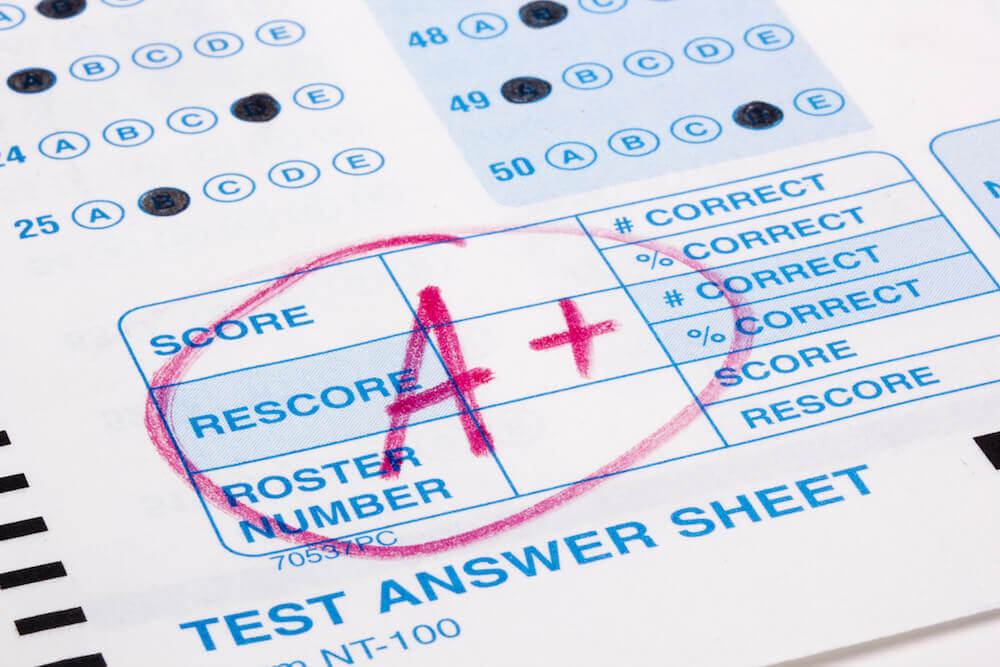

Finding the right car insurance for students can be a challenge, as many companies don’t offer special deals specifically for students. However, many companies are willing to work with students on finding a plan that fits their needs and budget. It’s important to shop around and compare different plans in order to find one that fits your needs. It’s also important to look for deals targeted at students, such as discounts for maintaining good grades or for completing driver’s education courses.

Benefits of Student Discounts

Student discounts can offer a number of benefits for young drivers. For starters, they can help reduce the cost of car insurance for students who may not have a lot of money to spare. Student discounts can also help students build a good credit history, as many companies offer discounts for good grades or for completing driver’s education courses. Finally, student discounts can help young drivers learn how to be responsible on the road, as they may be more likely to drive safely when they know their car insurance rates are lower.

Tips for Finding the Best Student Car Insurance

When looking for the best car insurance for students, there are a few tips to keep in mind. Firstly, shop around and compare different companies and plans. Don’t be afraid to ask questions and negotiate if necessary. Secondly, look for deals specifically targeted at students, such as discounts for maintaining good grades or for completing driver’s education courses. Finally, be sure to read the fine print of any plan you’re considering, and make sure you understand what is and isn’t covered.

Conclusion

Car insurance is a necessity for any driver, and students should take the time to shop around and find the best plan for their needs. Student discounts can help reduce the cost of car insurance for young drivers, and can also help them build a good credit history. Be sure to read the fine print of any plan you’re considering, and make sure you understand what is and isn’t covered. With the right plan, students can save money on car insurance and be protected against any possible incident on the road.

Car insurance discounts for students | CarInsurance.com

How to Get Student Discounts on Car Insurance | The Zebra

What’s the Good Student Discount and how can it help me save on Atlanta

Good student discount car insurance - BadDrivingCarInsurance's blog

Best Car Insurance for College Students 2020