What Happens If I Don t Have Car Insurance

Thursday, October 31, 2024

Edit

What Happens If I Don't Have Car Insurance?

Why You Need Car Insurance

Driving without car insurance is a serious offense. The law requires that all drivers have insurance to protect themselves, their passengers, and other drivers on the road. Car insurance provides financial protection in the event of an accident, collision, or other unfortunate event. Without insurance, you are responsible for the full cost of any damage or medical bills that result from an accident. This can be incredibly expensive, and even put you in debt.

In addition, car insurance provides liability protection, which means that if you are found to be at fault for an accident, your insurance company will pay for any damages incurred by the other driver. Without insurance, you are personally liable for all of the costs associated with an accident. This could include medical bills, property damage, legal fees, and any other costs related to the crash.

What Are The Penalties For Driving Without Insurance?

Driving without insurance is a serious offense and can result in a number of penalties. Depending on where you live, the penalties for driving without insurance can range from a small fine to a suspended driver's license. In some cases, you may even face jail time.

In addition to the legal penalties, driving without insurance can also have a negative impact on your credit score. Insurance companies report any lapse in coverage to the credit bureaus, and this can lead to a decrease in your credit score. A lower credit score can make it more difficult to get loans or secure a home or car loan.

How To Get Car Insurance

If you don't have car insurance, it's essential to get it as soon as possible. The first step is to shop around and compare rates from different insurance companies. You can use an online insurance comparison website to compare rates and coverage from a variety of insurers. This will help you find the best coverage at the lowest price.

Once you have found the right policy for your needs, you can apply for coverage online or over the phone. You will need to provide information about your vehicle, driving record, and other factors to get a quote. Once you have been approved, you can start driving with the peace of mind that comes with knowing you are covered.

Tips For Keeping Your Insurance Costs Low

Car insurance doesn't have to be expensive. There are a few simple steps you can take to keep your insurance costs down.

First, you should make sure to keep your car in good condition. Regular maintenance can help prevent serious breakdowns and accidents. Additionally, you should drive safely and obey all traffic laws to keep your premiums low.

Next, you should consider raising your deductible. This is the amount of money you must pay out of pocket before your insurance kicks in. Raising your deductible can significantly reduce your premiums, but be sure to only raise it to an amount you can afford to pay out of pocket if needed.

Finally, you should consider bundling your car insurance with other types of insurance, such as homeowner's or renter's insurance. Many insurance companies offer discounts for customers who bundle policies.

Conclusion

Driving without car insurance is a serious offense that can result in a variety of costly penalties. If you don't have car insurance, it's essential to get it as soon as possible. Shop around and compare rates to find the best policy for your needs. Additionally, you can take steps to keep your premiums low, such as driving safely and raising your deductible. With the right coverage, you can enjoy peace of mind when you're on the road.

What happens when you don’t have car insurance | ABS-CBN News

What happens when you don’t have car insurance | ABS-CBN News

What happens when you don’t have car insurance | ABS-CBN News

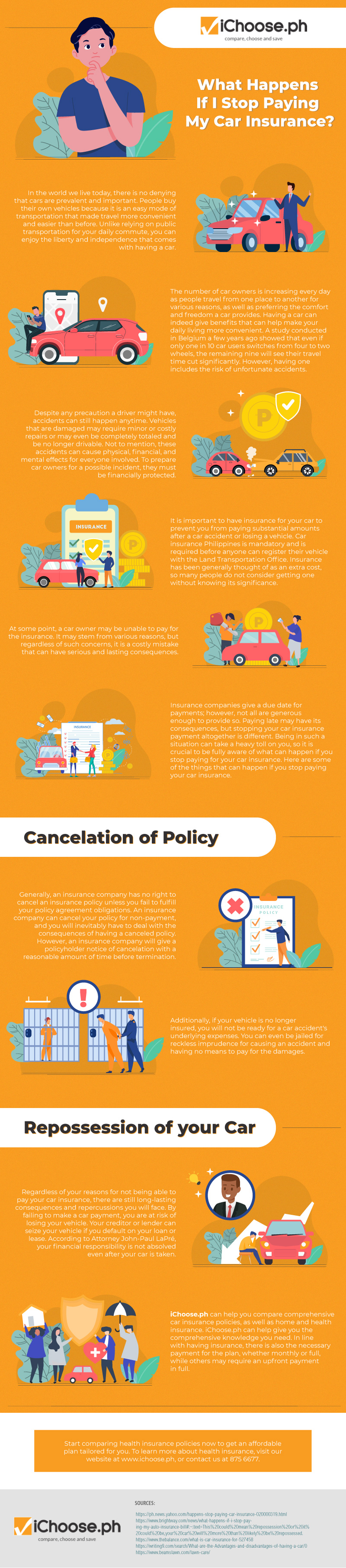

What Happens If I Stop Paying My Car Insurance? | Cubao

What Happens if I'm Hit By a Car and They Don't Have Auto In