How Much Should Gap Insurance Cost

Monday, October 14, 2024

Edit

Gap Insurance: How Much Should It Cost?

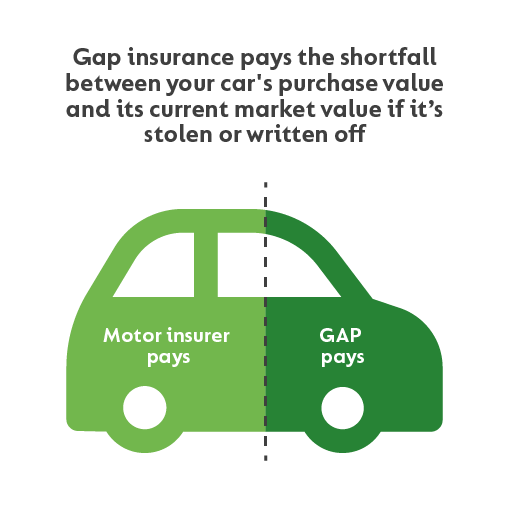

Gap insurance is an important financial protection for car owners. It’s a form of insurance that covers the difference between the amount you owe on your car loan and the amount your car is worth in the event of an accident. It’s a great way to protect yourself financially if you get into an accident and your car is totaled or stolen. But how much should gap insurance cost?

What Is Gap Insurance?

Gap insurance is an optional add-on to your car insurance policy that pays the difference between the amount you owe on your car loan and the amount your car is worth in the event of an accident. It’s also known as “loan-lease gap coverage” or “guaranteed asset protection”. It protects you from having to make up the difference if your car is totaled or stolen.

When Should You Consider Gap Insurance?

You should consider gap insurance if you’re financing or leasing a new car, or if you’re financing a used car with a loan. It’s especially important for drivers who owe more on their car loan than their car is worth, as it can help you avoid having to pay a large amount out of pocket. It’s also a good idea for drivers who are making a sizable down payment on their vehicle, as they may still owe more than the car is worth.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies based on several factors, including the type of car you have and the amount of coverage you choose. Generally, gap insurance costs anywhere from around $20 to $400 per year. However, some insurance companies may offer discounts if you purchase gap insurance with your auto insurance. It’s important to shop around and compare rates to find the best deal.

Should You Buy Gap Insurance?

Gap insurance is a great way to protect yourself financially if you get into an accident and your car is totaled or stolen. It can help you avoid having to pay a large amount out of pocket. However, it’s important to consider whether gap insurance is right for you. If you owe more on your car loan than your car is worth, it’s definitely worth considering.

Conclusion

Gap insurance is an important financial protection for car owners. It’s a form of insurance that pays the difference between the amount you owe on your car loan and the amount your car is worth in the event of an accident. The cost of gap insurance varies, but generally it costs anywhere from around $20 to $400 per year. It’s important to shop around and compare rates to find the best deal. Gap insurance can be a great way to protect yourself financially if you get into an accident and your car is totaled or stolen, so it’s worth considering if you owe more on your car loan than your car is worth.

Is GAP insurance worthwhile? - babybmw.net

What Is Gap Insurance? - Lexington Law

How Much Car Insurance Do You Really Need? | DaveRamsey.com

How Much Is Gap Insurance In Texas / Desperation Road: Great Depression

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?