Cancel My Swinton Car Insurance

Wednesday, September 11, 2024

Edit

Canceling Your Swinton Car Insurance: Everything You Need To Know

Are you considering canceling your Swinton car insurance? If so, you’ve come to the right place. Canceling car insurance is a big decision and it’s important to know exactly what you’re getting into before making a final decision. In this article, we’ll give you all the information you need to make an informed decision.

What Are Your Options?

The first thing to understand is that you have several options when it comes to canceling your Swinton car insurance. You can cancel your policy at any time, but you should be aware of the consequences. If you cancel your policy before the end of the term, you’ll be subject to cancellation fees. Depending on the terms of your policy, these fees can be as much as 10% of the remaining premium.

You can also choose to switch to another car insurance provider. If you choose this option, be sure to check the terms of your policy to make sure that you’re not liable for any cancellation fees. You’ll also need to make sure that your new provider has coverage for your car.

Finally, if you’re not happy with your Swinton car insurance policy, you may be able to negotiate a better deal. Swinton is often willing to work with customers to make sure they’re satisfied with the coverage they receive.

How Do You Cancel Your Policy?

If you decide to cancel your Swinton car insurance policy, you’ll need to contact Swinton directly. You can do this by calling their customer service hotline or by visiting their website. Once you’ve made the decision to cancel, you’ll need to provide Swinton with your policy details and provide them with a written notice of cancellation.

If you’re canceling your policy before the end of the term, you’ll need to pay any applicable cancellation fees. You’ll also need to make sure that you’ve paid any outstanding premiums. Swinton will then process your cancellation and provide you with a confirmation.

What Happens After You Cancel?

Once you’ve canceled your Swinton car insurance policy, you may be entitled to a pro-rated refund. This will depend on the terms of your policy, so you’ll need to make sure that you understand what you’re entitled to. You’ll also need to make sure that you return any documents that were issued to you by Swinton.

You’ll also need to make sure that you have a new car insurance policy in place before you cancel your Swinton policy. If you don’t, you’ll be driving without insurance and this could have serious consequences.

Are There Any Other Considerations?

When canceling your Swinton car insurance policy, it’s important to remember that it will affect your credit score. Canceling a policy can have a negative impact on your score, so it’s important to make sure that you understand the implications before you make a final decision.

It’s also important to remember that canceling your policy may affect any no-claims bonuses that you’ve earned. Depending on the terms of your policy, you may be able to keep your no-claims bonus if you switch to another provider.

Conclusion

Canceling your Swinton car insurance policy is a big decision and it’s important to make sure that you understand all of your options before making a final decision. Be sure to contact Swinton directly and make sure that you understand all of the implications before you cancel your policy. With the right information, you can make an informed decision and be sure that you’re getting the coverage you need.

Swinton Insurance_RGB_800x500-01 - The Manchester Bike Show

Online form to cancel your Swinton subscription

Swinton Insurance | Neighbourly

Swinton Car Insurance Customer Service Number

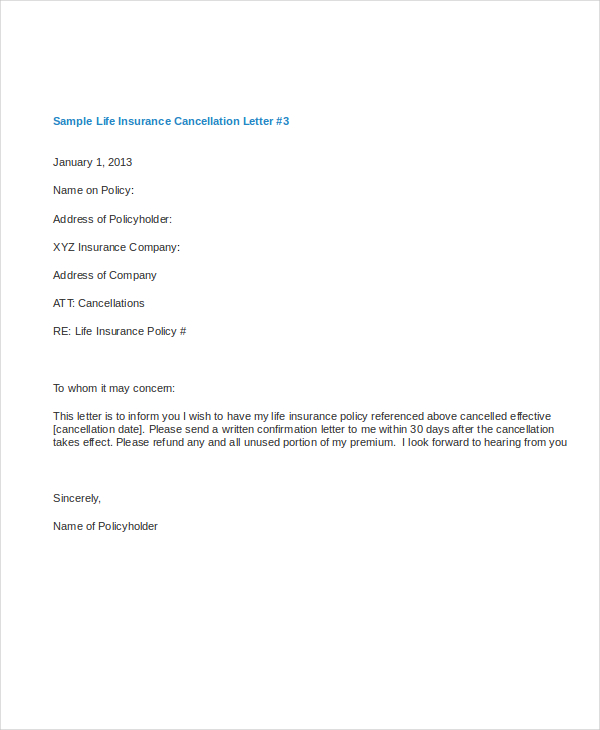

Cancellation Letter Template - 5+ Free Word, PDF Documents Download