Cost Of Sr22 Insurance In Illinois

What is SR22 Insurance and How Much Does It Cost In Illinois?

SR22 insurance is a type of auto insurance that is required by the state of Illinois for drivers who have been convicted of certain traffic offenses, including DUI/DWI, reckless driving, and driving without insurance. SR22 insurance is not a type of coverage, but rather a form that must be filed with the state. It serves as proof that the driver has the minimum amount of liability insurance required by law. The cost of SR22 insurance in Illinois depends on a variety of factors, including the driver’s age, driving record, and the type of vehicle being insured.

What Is SR22 Insurance?

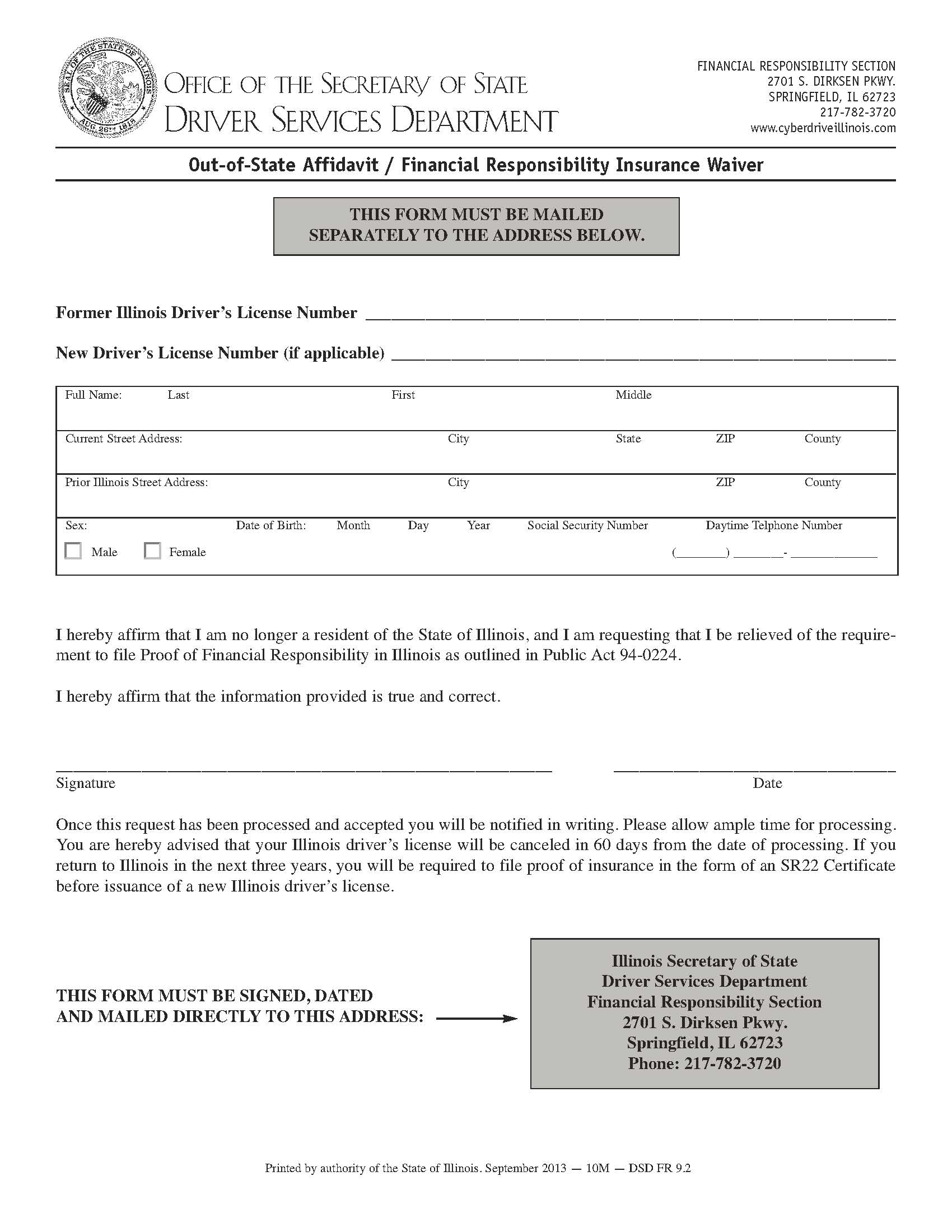

SR22 insurance is a certificate that must be filed with the state of Illinois by a driver’s auto insurance company. The certificate serves as proof that the driver has the minimum amount of liability insurance required by law. The SR22 must be filed for three years after the driver’s license is reinstated. The certificate is required for certain traffic offenses, such as DUI/DWI, reckless driving, and driving without insurance.

How Much Does SR22 Insurance Cost in Illinois?

The cost of SR22 insurance in Illinois depends on a number of factors. The driver’s age, driving record, and the type of vehicle being insured all play a role in determining the cost of the insurance. Generally, the cost of SR22 insurance in Illinois is higher than the cost of traditional auto insurance, due to the higher risk associated with the driver.

What Are Some Other Factors That Affect SR22 Insurance Costs in Illinois?

In addition to the driver’s age, driving record, and the type of vehicle being insured, there are a few other factors that can affect the cost of SR22 insurance in Illinois. The insurance company’s experience and financial stability also play a role in determining the cost of the insurance. The amount of coverage purchased and the type of policy also have an effect on the cost of SR22 insurance.

How Can I Find Affordable SR22 Insurance in Illinois?

The best way to find affordable SR22 insurance in Illinois is to compare rates from different insurance companies. It is important to compare quotes from at least three different companies to ensure that you are getting the best deal. You should also make sure to ask about discounts and other ways to lower your premiums. Additionally, you should look for an insurance company that has experience with SR22 insurance and is financially stable.

Conclusion

SR22 insurance is a certificate that must be filed with the state of Illinois in order for certain traffic offenders to have their driver’s license reinstated. The cost of SR22 insurance in Illinois varies depending on a number of factors, including the driver’s age, driving record, and the type of vehicle being insured. The best way to find affordable SR22 insurance in Illinois is to compare quotes from multiple companies and look for discounts and other ways to lower premiums.

How Much Does SR22 Cost in Illinois

Illinois SR22 Insurance Quotes - YouTube

Illinois SR-22 Insurance with Cheap Rates $22/month | Insured ASAP

SR22 Insurance - YouTube

SR22 Auto Insurance Illinois, Cheap Chicago SR22 Insurance | American Auto