New Mexico Motor Vehicle Insurance Plan

New Mexico Motor Vehicle Insurance Plan: Comprehensive Guide

What Is the New Mexico Motor Vehicle Insurance Plan?

The New Mexico Motor Vehicle Insurance Plan is a state-mandated program designed to help drivers who have difficulty finding auto insurance coverage. The plan offers insurance coverage to individuals who may have difficulty obtaining coverage due to their driving record, credit history, or other factors. The plan is administered by the New Mexico Insurance Plan Association (NMIPA) and is regulated by the New Mexico Office of Superintendent of Insurance.

Under the plan, insurers must offer coverage to any eligible driver. Coverage includes liability, collision, comprehensive, and other types of coverage. Insurers must also offer minimum coverage limits and deductibles, which vary depending on the type of coverage purchased. The plan also requires insurers to offer discounts for safe drivers, good students, and other qualifying drivers.

Who Is Eligible for the New Mexico Motor Vehicle Insurance Plan?

The plan is available to drivers who have been unable to obtain insurance coverage in the voluntary market due to their driving record, credit history, or other factors. Eligibility is determined by the NMIPA, and drivers must meet certain criteria to be eligible. To be eligible, drivers must have a valid driver’s license and a clean driving record. Drivers must also be able to demonstrate financial responsibility, either through a deposit or by obtaining a bond.

In addition, drivers must be able to demonstrate that they have been unable to obtain insurance coverage in the voluntary market. This includes showing that they have been denied coverage by at least two insurers or that the cost of coverage is too high. Drivers who meet the eligibility criteria will be assigned a risk rating, which will determine the cost of their coverage.

What Types of Coverage Are Available Under the Plan?

The New Mexico Motor Vehicle Insurance Plan offers a variety of coverage options. Liability coverage is required for all drivers, and covers the cost of damages caused by the insured driver to another person’s property or person. Collision and comprehensive coverage are optional, but recommended. Collision coverage covers the cost of repairs to the insured vehicle in the event of an accident, while comprehensive coverage covers the cost of repairs due to theft, vandalism, or other non-accident related causes.

Other types of coverage, such as medical payments and uninsured motorist coverage, are also available under the plan. Medical payments coverage covers the cost of medical bills incurred by the insured driver or passengers due to an accident, while uninsured motorist coverage covers the cost of damages caused by an uninsured driver. In addition, the plan offers discounts for safe drivers, good students, and other qualifying drivers.

What Are the Cost and Benefits of the Plan?

The cost of coverage under the plan varies depending on the risk rating assigned to the driver. The cost of coverage can also vary depending on the type and amount of coverage purchased. In general, the cost of coverage is lower than the cost of coverage in the voluntary market. The plan also offers discounts for safe drivers, good students, and other qualifying drivers.

In addition to lower costs, the plan also offers additional benefits. Drivers who purchase coverage through the plan are not required to carry proof of financial responsibility, and any claims filed through the plan will not count against the driver’s record. The plan also offers additional protection for drivers in the event of an accident, including the cost of medical bills and other damages.

Conclusion

The New Mexico Motor Vehicle Insurance Plan is a state-mandated program designed to help drivers who have difficulty finding auto insurance coverage. The plan offers insurance coverage to individuals who may have difficulty obtaining coverage due to their driving record, credit history, or other factors. The plan also offers discounts for safe drivers, good students, and other qualifying drivers, as well as additional benefits such as the cost of medical bills and other damages.

2016-2021 Form NM MVD-10901 Fill Online, Printable, Fillable, Blank

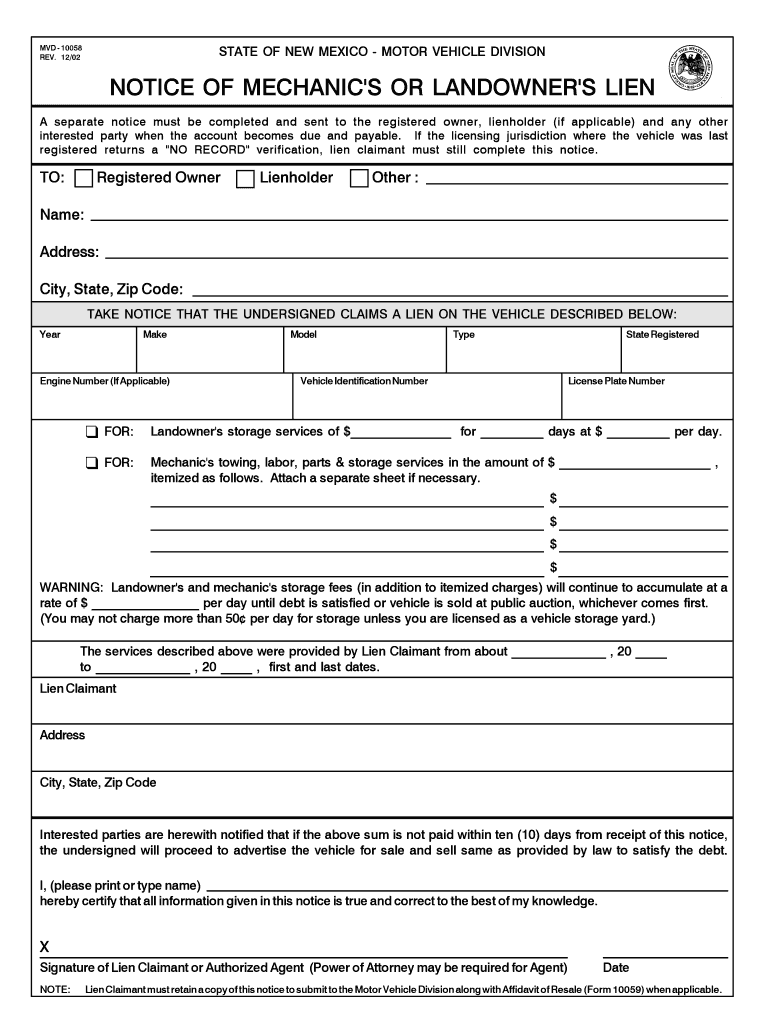

Nm Mvd Abandoned Vehicle Lein Pdf - Fill Online, Printable, Fillable

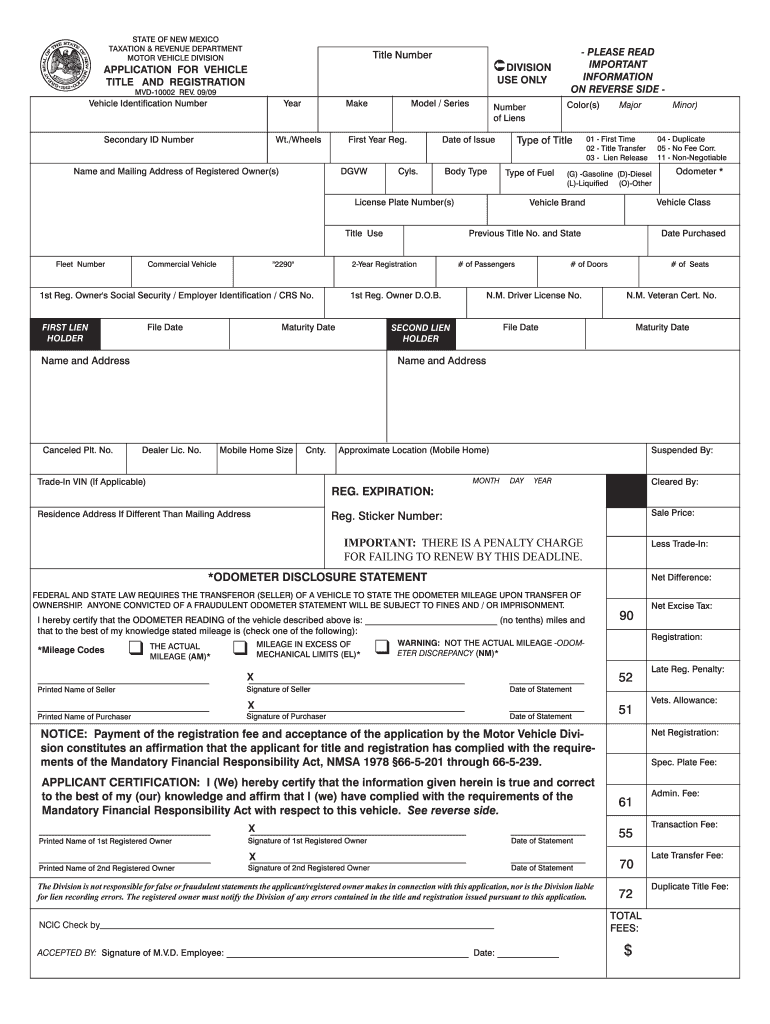

New Mexico Title Application - Fill Out and Sign Printable PDF Template

Cash for Cars Roswell, NM | Sell Your Junk Car | The Clunker Junker

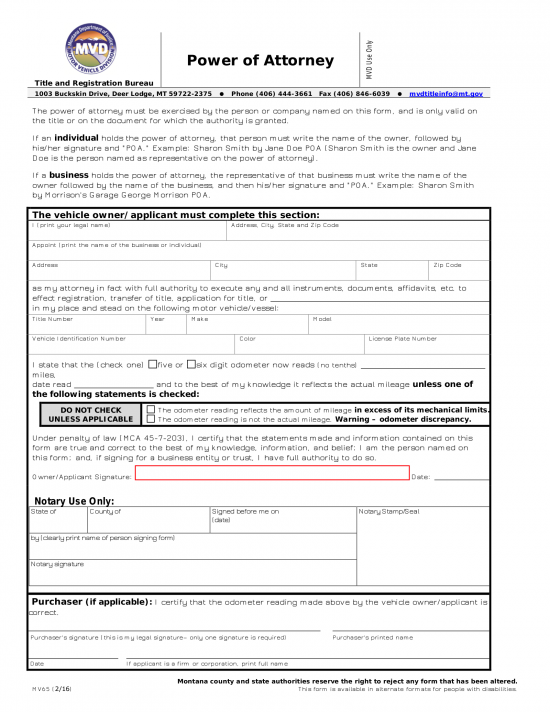

Free Montana Motor Vehicle Power of Attorney (Form MV65) - PDF – eForms