Minimum Coverage Amount For Renters Insurance

Understanding Minimum Coverage Amount For Renters Insurance

Renters insurance is an important protection for people who rent a home or apartment. It can help protect your personal belongings in the case of theft, fire, or other disaster. It can also provide liability coverage if someone is injured while visiting you. Renters insurance typically provides coverage for losses up to a certain amount, known as the Minimum Coverage Amount. This article explains what the Minimum Coverage Amount for Renters Insurance is and how it can help protect you.

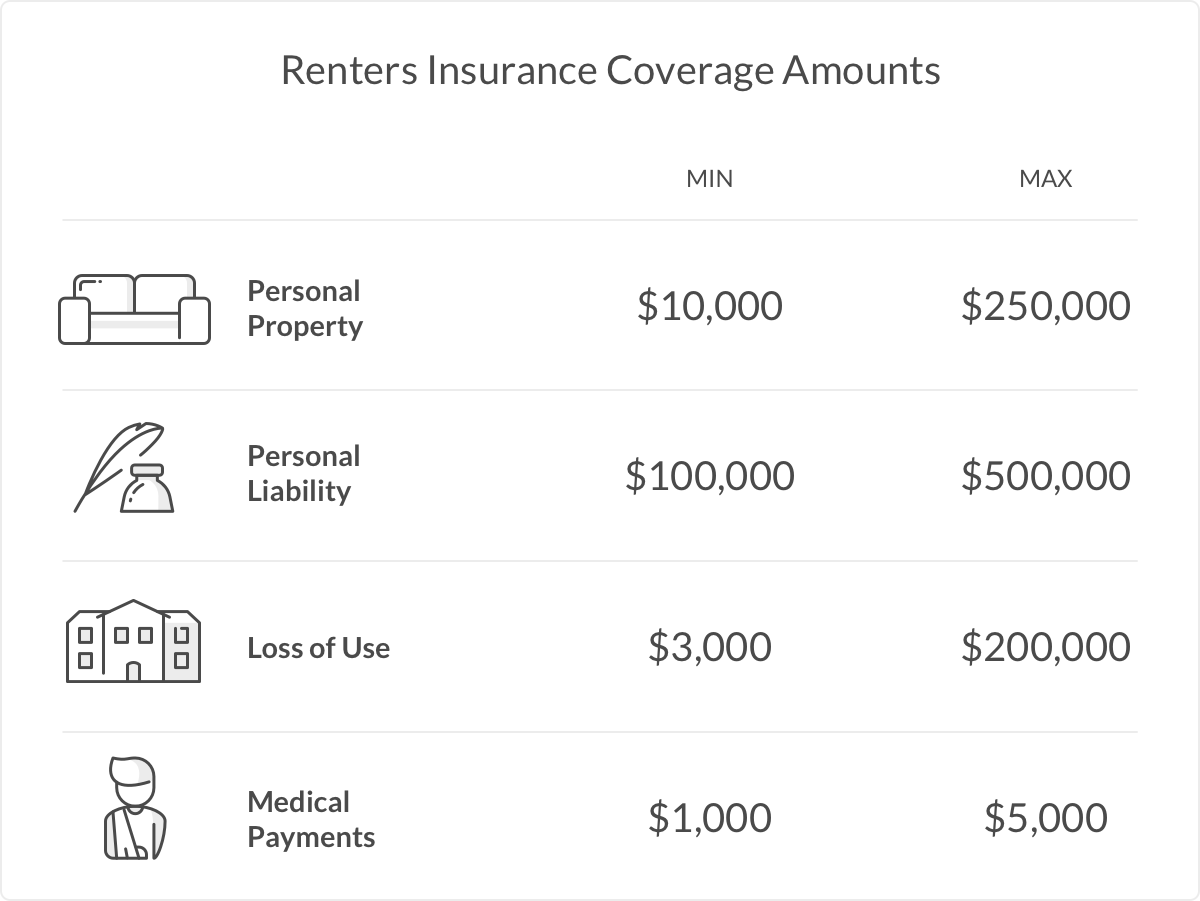

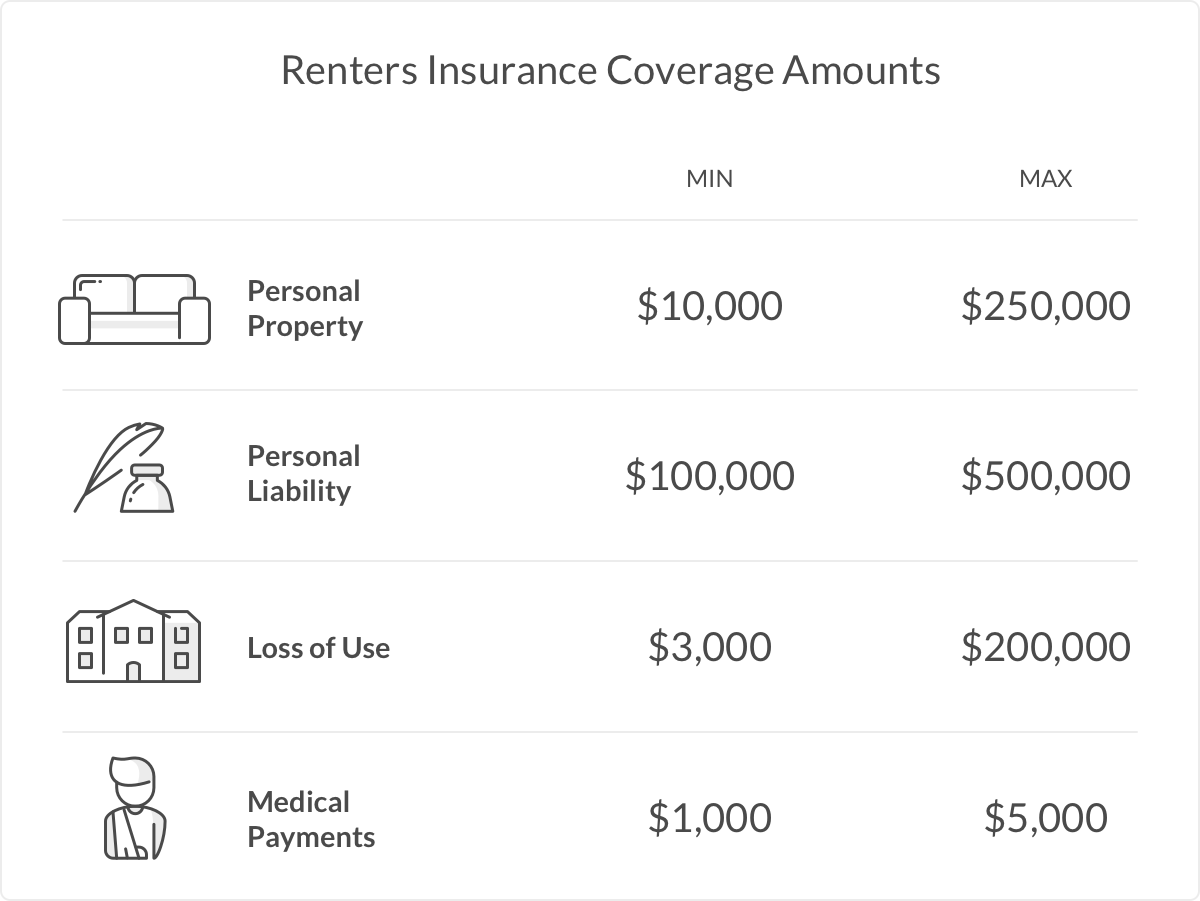

What is the Minimum Coverage Amount for Renters Insurance?

The Minimum Coverage Amount for Renters Insurance is the minimum amount of coverage required by the policy. This amount is set by the insurance company, and it is typically determined by the value of the possessions you are renting. The Minimum Coverage Amount is usually expressed as a percentage of the value of your possessions. For example, if your possessions are worth $10,000, the Minimum Coverage Amount might be 80%, meaning that the policy would cover up to $8,000 of the value of your possessions.

How Does the Minimum Coverage Amount Affect You?

The Minimum Coverage Amount can affect you in a few ways. First, it determines the amount of coverage you will receive if you suffer a loss. If the value of your possessions exceeds the Minimum Coverage Amount, then you will not receive the full value of your possessions from the insurance company. Additionally, the higher the Minimum Coverage Amount, the higher the premium for the policy will be. This is because the higher the coverage, the greater the risk that the insurance company is taking on.

How Can You Make Sure You Have the Right Amount of Coverage?

The best way to ensure you have the right amount of coverage is to review your policy and ensure that it meets or exceeds the Minimum Coverage Amount. You should also make sure that the coverage is adequate to cover the value of your possessions. You should also consider purchasing additional coverage if you have expensive items, such as jewelry or electronics, that you would like to protect. Finally, you should review your policy periodically to make sure that it still meets your needs.

What Happens if You Don’t Have Enough Coverage?

If you suffer a loss and do not have sufficient coverage, then you may be responsible for the difference between the value of your possessions and the amount of coverage you have. This means that you may be responsible for paying for the loss out of pocket. Additionally, if you do not have enough coverage, then the insurance company may not pay for any of the damages, leaving you to pay for them in full.

In Summary

The Minimum Coverage Amount for Renters Insurance is an important factor to consider when purchasing a policy. It is important to make sure that you have adequate coverage, as this will determine the amount of coverage you will receive if you suffer a loss. Additionally, it is important to review your policy periodically to make sure that it is still adequate for your needs. Failure to do this could leave you financially responsible for any losses that occur.

The Ultimate Guide to Renters Insurance Coverage, Made Easy | by

Renters insurance: What it covers and how much you need

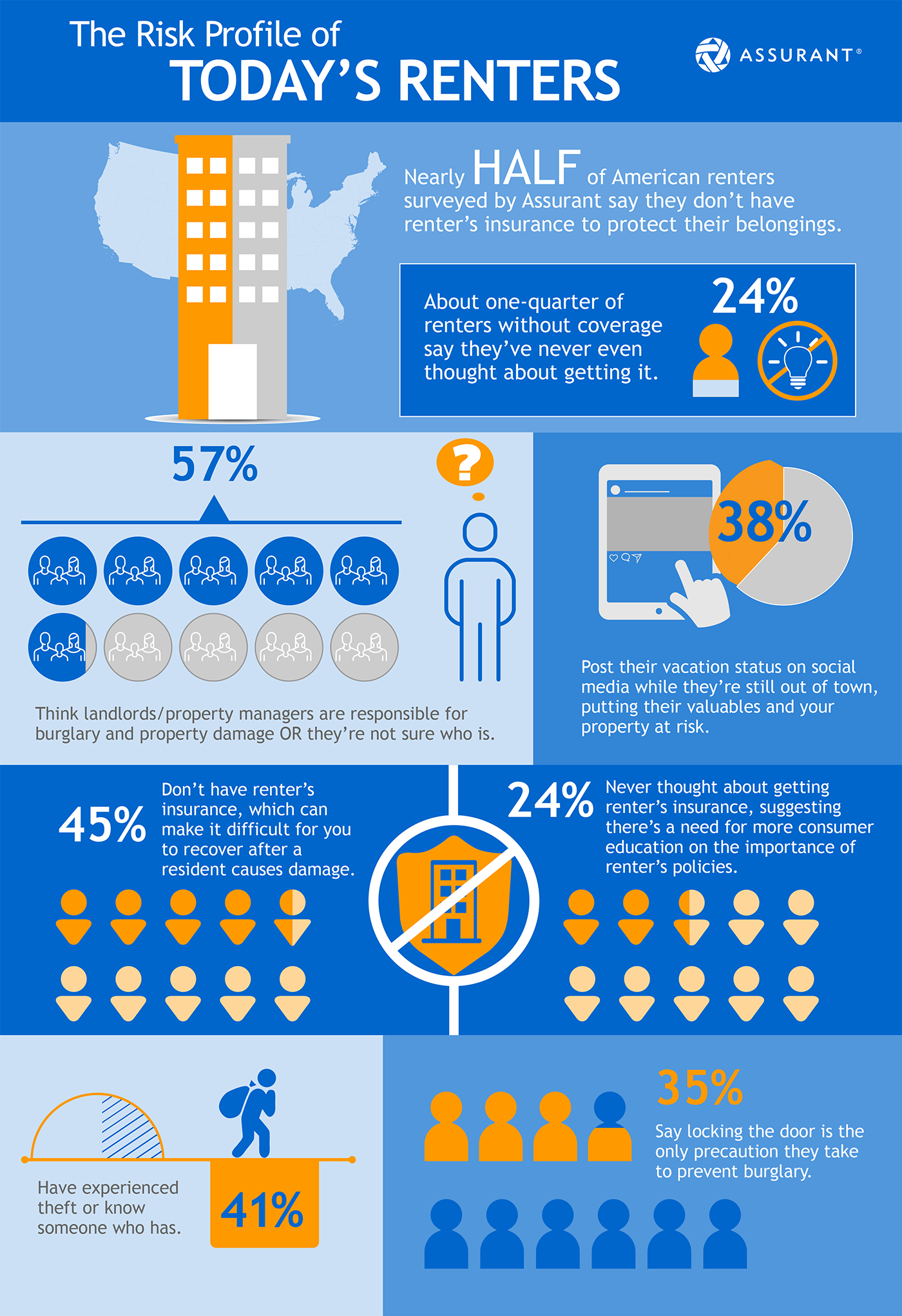

The Risk Profile of Today’s Renters

Renters Insurance Rates State Farm

Minimum Car Insurance Coverage - Is It Enough?