How Much Does The Typical Level Car Insurance Cost

Understanding the Average Cost of Level Car Insurance

What is Level Car Insurance?

Level car insurance is a type of coverage that provides the same fixed benefits throughout the term of the policy. This means that no matter what happens, the insured party will receive a predetermined amount of money as a payout if they find themselves in an accident. The amount of money received by the insured party will be the same regardless of the severity of the accident or injury. This type of coverage is often preferred by those who want to be more certain of what they will receive in the event of an accident.

What Factors Affect the Cost of Level Car Insurance?

The cost of a level car insurance policy is determined by a variety of factors. These include the age of the driver, the type of car being insured, the driving record of the driver, the location of the driver, and the amount of coverage desired. Insurance companies also consider the type of car that is being insured, as well as the type of coverage being requested. The more coverage that is desired, the higher the cost of the policy.

How Much Does The Typical Level Car Insurance Cost?

The cost of a level car insurance policy varies greatly depending on the factors mentioned above. Generally speaking, the cost of a level car insurance policy is determined by the amount of coverage desired and the age and driving record of the driver. A younger driver with a clean driving record may be able to get a lower rate on their policy than an older driver with a record of infractions. The type of car being insured also has a great impact on the cost of the policy.

How Can Drivers Save Money On Level Car Insurance?

There are a few ways that drivers can save money on their level car insurance. The most obvious way is to maintain a clean driving record. Drivers who have a good driving record are less likely to be involved in accidents and are therefore less likely to have to pay out a large sum of money in the event of an accident. Other ways to save money include shopping around for the best rates and taking advantage of any discounts that may be offered. Many insurance companies offer discounts to drivers who have a good driving record, no claims, or a good credit history.

Conclusion

The cost of a level car insurance policy can vary greatly depending on a variety of factors. It is important for drivers to shop around for the best rates and to take advantage of any discounts that may be available. By doing this, drivers can save money on their level car insurance and be more certain of what they will receive in the event of an accident.

The average cost of car insurance in the US, from coast to coast

ALL You Need to Know About the Average Car Insurance Cost

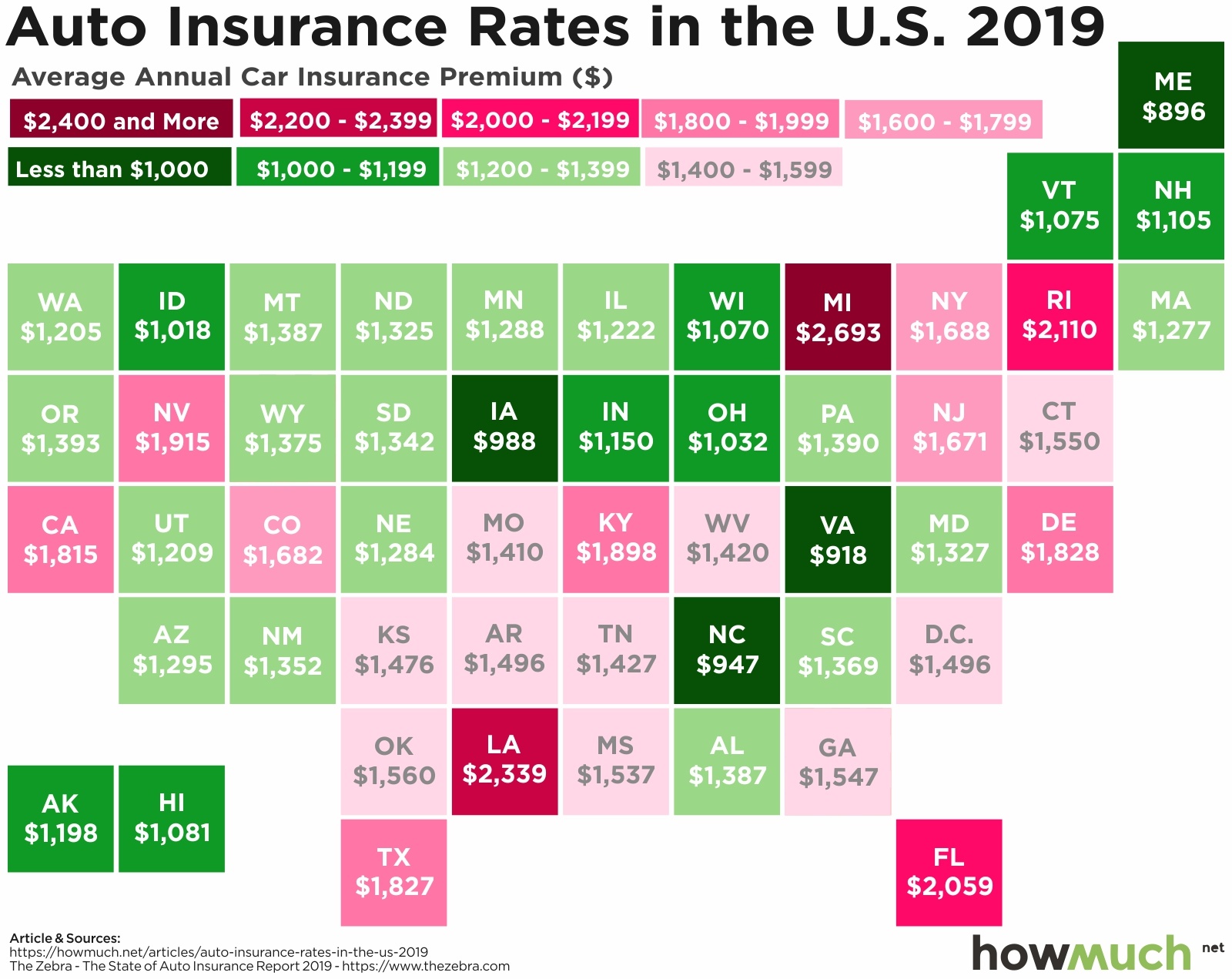

What do Americans Pay for Car Insurance in 2019?

Looking at the costs of auto insurance in Ontario, and ways motorists

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins