General Liability Insurance Vs Umbrella Policy

General Liability Insurance Vs Umbrella Policy

What is General Liability Insurance?

General Liability Insurance, sometimes referred to as Business Liability Insurance, is a type of insurance that covers the costs associated with any claims of third-party bodily injury or property damage resulting from your business operations. This type of insurance is often required by law and can help protect you, your business, and your customers in the event of a lawsuit or legal action taken against you. General Liability Insurance covers a wide range of potential liabilities and is often included as part of a business insurance package. It is important to understand that General Liability Insurance does not cover any damage or losses you may experience yourself.

What is Umbrella Policy?

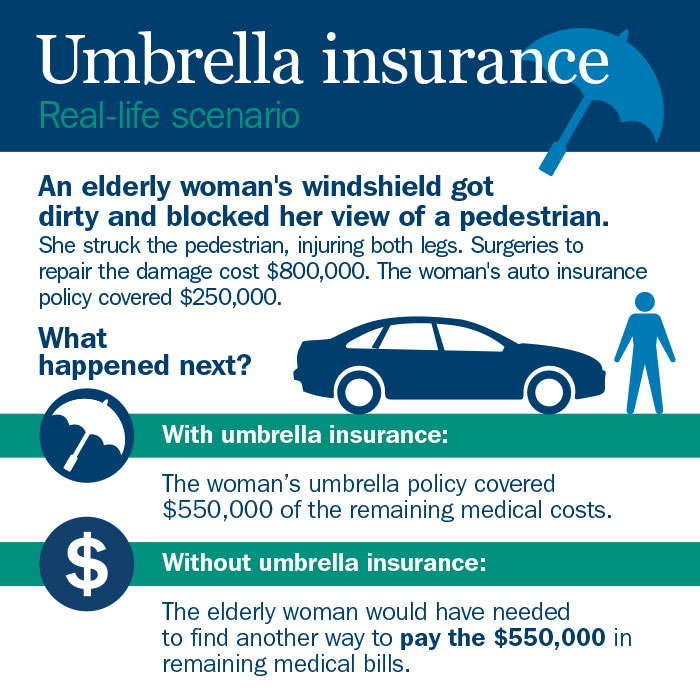

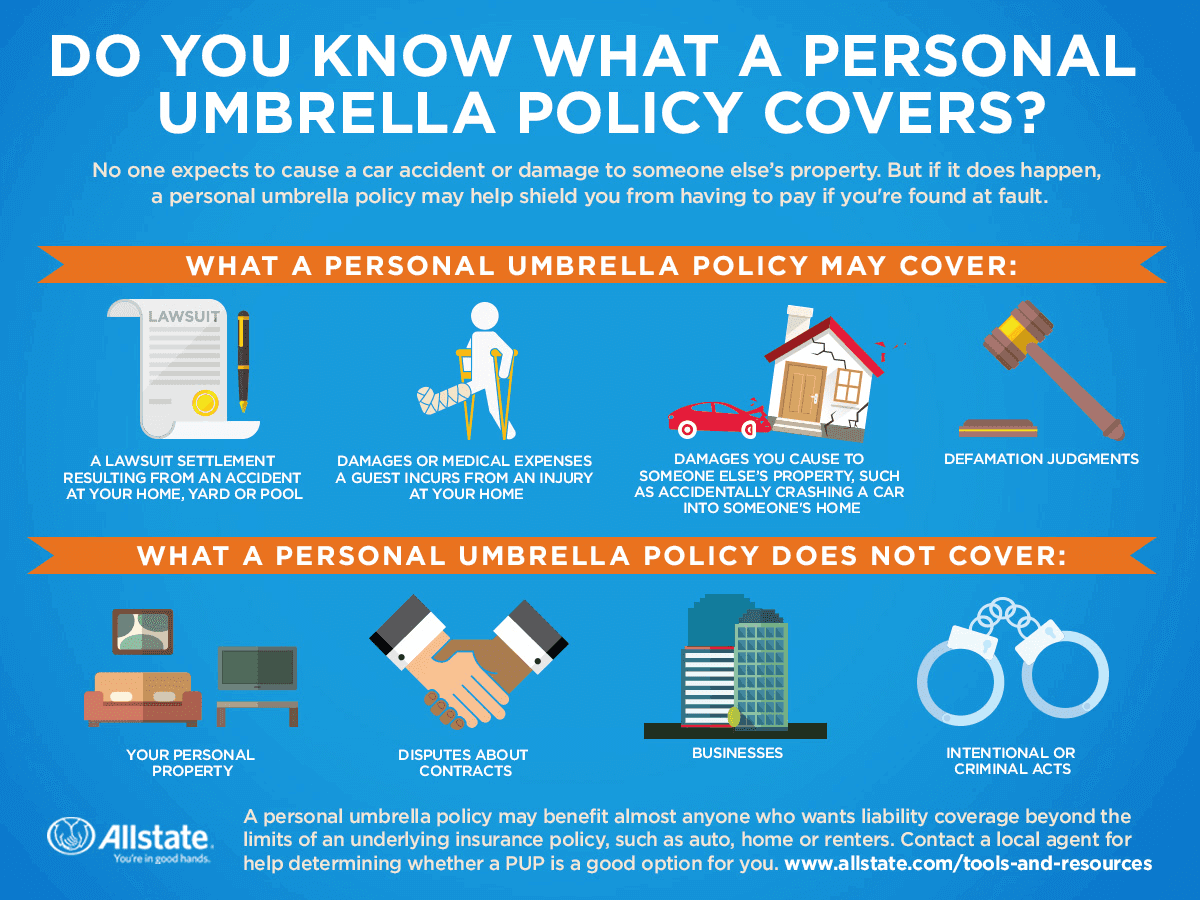

Umbrella policies are a type of insurance designed to provide additional protection when you are sued for something that is not covered by your existing insurance. For example, if you have an auto insurance policy and you are sued for an accident that is not covered by your auto insurance policy, an umbrella policy may provide additional protection. Umbrella policies also provide additional protection for liability claims that are higher than the limits of your existing insurance policies. They can also provide protection for some liabilities that are not covered by your existing policies, such as libel and slander.

Difference between General Liability Insurance and Umbrella Policy

The main difference between General Liability Insurance and an Umbrella Policy is the scope of coverage. General Liability Insurance covers claims of third-party bodily injury or property damage resulting from your business operations, while Umbrella Policies are designed to provide additional protection for liabilities that are not covered by existing insurance policies. It is important to understand that an Umbrella Policy does not replace your existing insurance policies, rather it provides additional coverage for liabilities that may exceed the limits of your existing policies.

General Liability Insurance

General Liability Insurance covers a wide range of potential liabilities and is often included as part of a business insurance package. It covers claims of third-party bodily injury or property damage resulting from your business operations and can help protect you, your business, and your customers in the event of a lawsuit or legal action taken against you. It is important to understand that General Liability Insurance does not cover any damage or losses you may experience yourself.

Umbrella Policy

Umbrella policies are a type of insurance designed to provide additional protection when you are sued for something that is not covered by your existing insurance. They can provide additional protection for liability claims that are higher than the limits of your existing insurance policies, as well as provide protection for some liabilities that are not covered by your existing policies, such as libel and slander. It is important to understand that an Umbrella Policy does not replace your existing insurance policies, rather it provides additional coverage for liabilities that may exceed the limits of your existing policies.

Conclusion

General Liability Insurance and Umbrella Policies are two types of insurance that provide coverage for different types of liabilities. General Liability Insurance covers claims of third-party bodily injury or property damage resulting from your business operations, while Umbrella Policies are designed to provide additional protection for liabilities that are not covered by existing insurance policies. It is important to understand the differences between these two types of insurance and to make sure you have the coverage you need to protect your business from potential liabilities.

Umbrella Insurance Policy Business - All Information about Quality Life

Here Are 11 Reasons We Have An Umbrella Liability Insurance Policy — My

What Is Umbrella Insurance & What Does It Cover? | Allstate

GEICO says umbrella insurance offers a canopy of extra protection for

Do you have Umbrella Insurance? - Savin Jones Insurance Agency