Sr22 Insurance Cost Per Month

Everything You Need To Know About SR22 Insurance Cost Per Month

What Is SR22 Insurance?

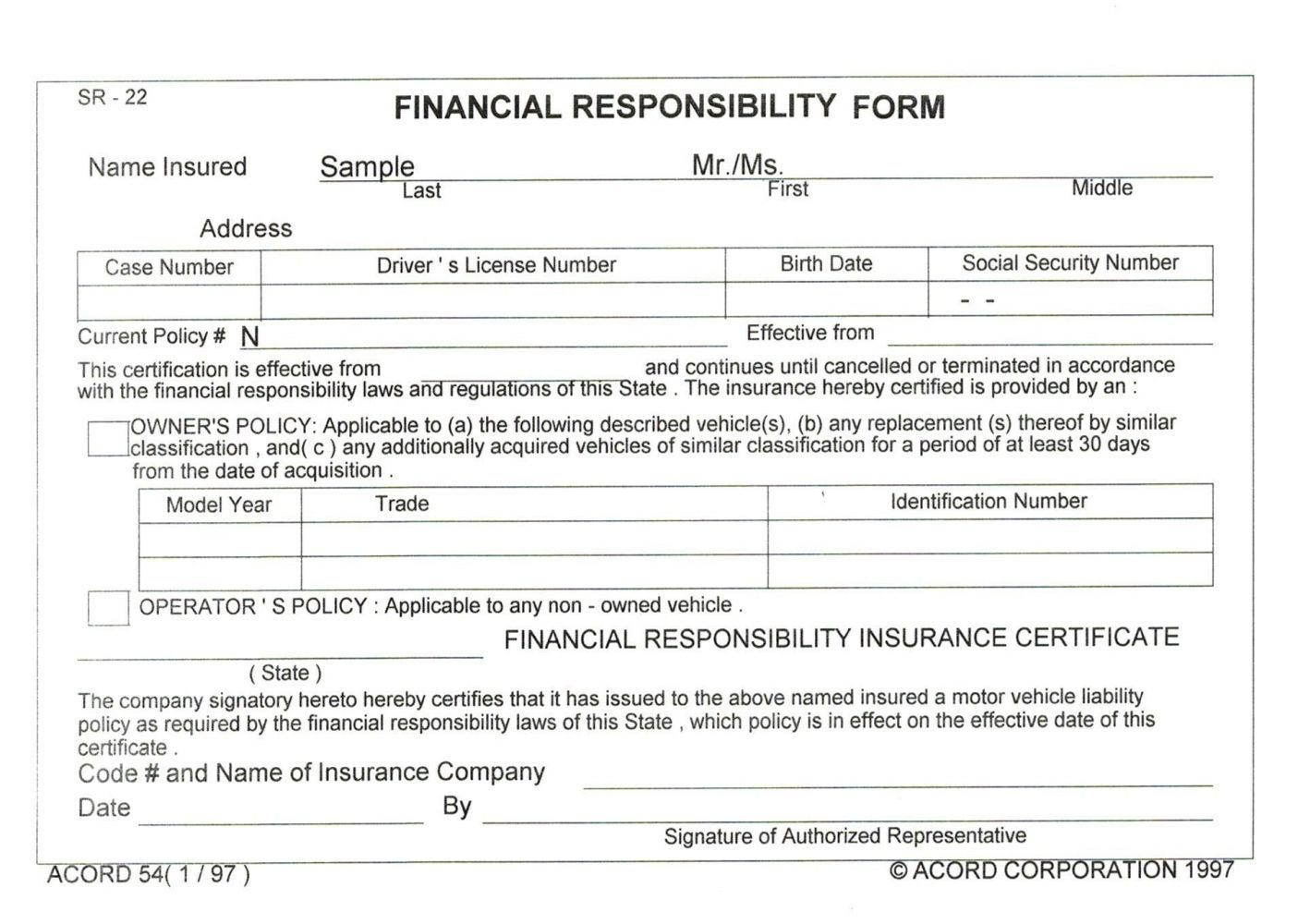

SR22 insurance is a type of auto insurance that provides proof of financial responsibility to the state in which you live. It is a certificate issued by an insurance company that is filed with the state’s Department of Motor Vehicles. SR22 insurance is required for drivers who have been convicted of certain traffic violations, such as DUI/DWI, reckless driving, or driving without insurance. It is also required for drivers who have had their license suspended or revoked. The SR22 certificate is in effect for a specific period of time, typically three years, and it must be maintained during that time.

How Much Does SR22 Insurance Cost Per Month?

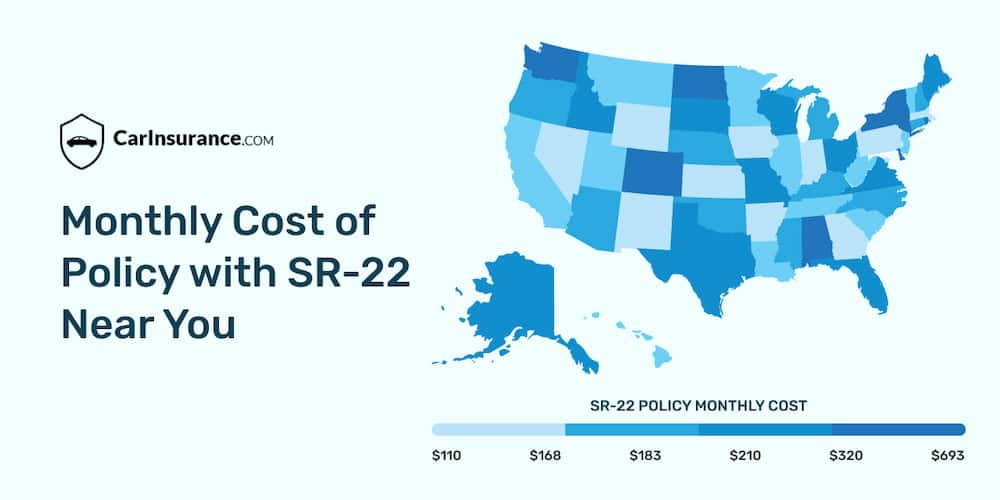

The cost of SR22 insurance depends on a variety of factors, such as the type of car you drive, the amount of coverage you need, and your driving history. Generally speaking, SR22 insurance can cost anywhere from $15 to $25 per month. However, in some cases, it can be as much as $50 per month. It is important to shop around and compare rates from different insurance companies to make sure you are getting the best rate.

What Does SR22 Insurance Cover?

SR22 insurance typically provides coverage for the same items as a regular auto insurance policy. This includes liability coverage for bodily injury and property damage, as well as coverage for medical payments and personal injury protection. In some cases, SR22 insurance may also include uninsured motorist coverage and collision coverage. The exact coverage varies from state to state and from company to company, so it is important to review the policy carefully before purchasing.

How Long Does SR22 Insurance Last?

SR22 insurance typically lasts for three years, but the exact timeframe can vary depending on the state. In some states, it may be required for five years or more. In other states, the SR22 insurance period may be shorter. After the SR22 insurance period has ended, the driver may no longer be required to carry it.

What Happens If I Let My SR22 Insurance Lapse?

If a driver fails to maintain their SR22 insurance, their policy will be canceled and their license may be suspended or revoked. This can have serious consequences, such as the inability to drive or to obtain a new license. Additionally, the driver may be subject to fines or other penalties. It is important to maintain your SR22 insurance in order to avoid these problems.

Conclusion

SR22 insurance is a type of auto insurance that is required for drivers who have been convicted of certain traffic violations. The cost of SR22 insurance can vary widely, but it typically ranges from $15 to $25 per month. SR22 insurance typically covers the same items as a regular auto insurance policy, and the policy must be maintained for a specific period of time, usually three years. If a driver fails to maintain their SR22 insurance, their policy will be canceled and their license may be suspended or revoked.

What is SR22 Insurance - Detailed Guide | CarInsurance.com

What is SR22 Insurance - Detailed Guide | CarInsurance.com

How Much Does SR22 Cost in Illinois

Ohio SR22 Insurance: Getting cheap coverage (Updated 2016) – Select

SR-22 Fairfield OH: Get Insured Fast! Call us Today