Listed Driver Vs Named Insured

Listed Driver Vs Named Insured: What You Need to Know

What is a Named Insured?

A named insured is the primary driver of a car insurance policy. This driver is the one who is responsible for paying the premiums and is the only one who can make changes to the policy. It's important to note that a named insured can also be an individual, not just a company or organization. In other words, if you are the primary driver of a car insurance policy, you are the named insured. If you are not the primary driver, then you are considered a listed driver.

What is the Difference Between Listed Driver and Named Insured?

The main difference between a listed driver and a named insured is that a listed driver is not the primary driver on the policy, but is still covered by the insurance policy. A named insured is the primary driver and is responsible for paying the premiums and making any changes to the policy. A listed driver is not allowed to make changes to the policy and is only covered if they are driving the insured vehicle. A listed driver is also not allowed to make any claims against the policy.

Who is Covered Under a Car Insurance Policy?

Typically, a car insurance policy will cover the named insured, any listed drivers, and any other drivers who are authorized to drive the insured vehicle. This means that if a friend or family member borrows your car, they are covered under your policy as long as they have permission to drive it. It's important to note that if an unauthorized driver is in an accident while driving your car, the policy may not cover the damages.

What are the Benefits of Being a Named Insured?

One of the main benefits of being a named insured is that you are the only one who can make changes to the policy. This means that you can adjust the coverage levels and add or remove drivers from the policy as needed. Being a named insured also means that you are responsible for paying the premiums, which can be beneficial if you have a good driving record as you are more likely to get a better rate.

What are the Benefits of Being a Listed Driver?

The main benefit of being a listed driver is that you are covered by the policy as long as you are driving the insured vehicle. This means that if you are ever in an accident while driving the insured vehicle, the policy will cover the damages. Being a listed driver also means that you do not have to pay any premiums and you are not allowed to make any changes to the policy.

Conclusion

Understanding the differences between a named insured and a listed driver is important for those who are looking to purchase car insurance. A named insured is the primary driver of the policy and is responsible for paying the premiums and making any changes to the policy. A listed driver is not the primary driver of the policy and is only covered if they are driving the insured vehicle. Being a named insured has its benefits, such as being able to make changes to the policy, but being a listed driver has its own benefits, such as not having to pay any premiums.

Named Insured Drivers Explained - What Is a Named Insured Driver?

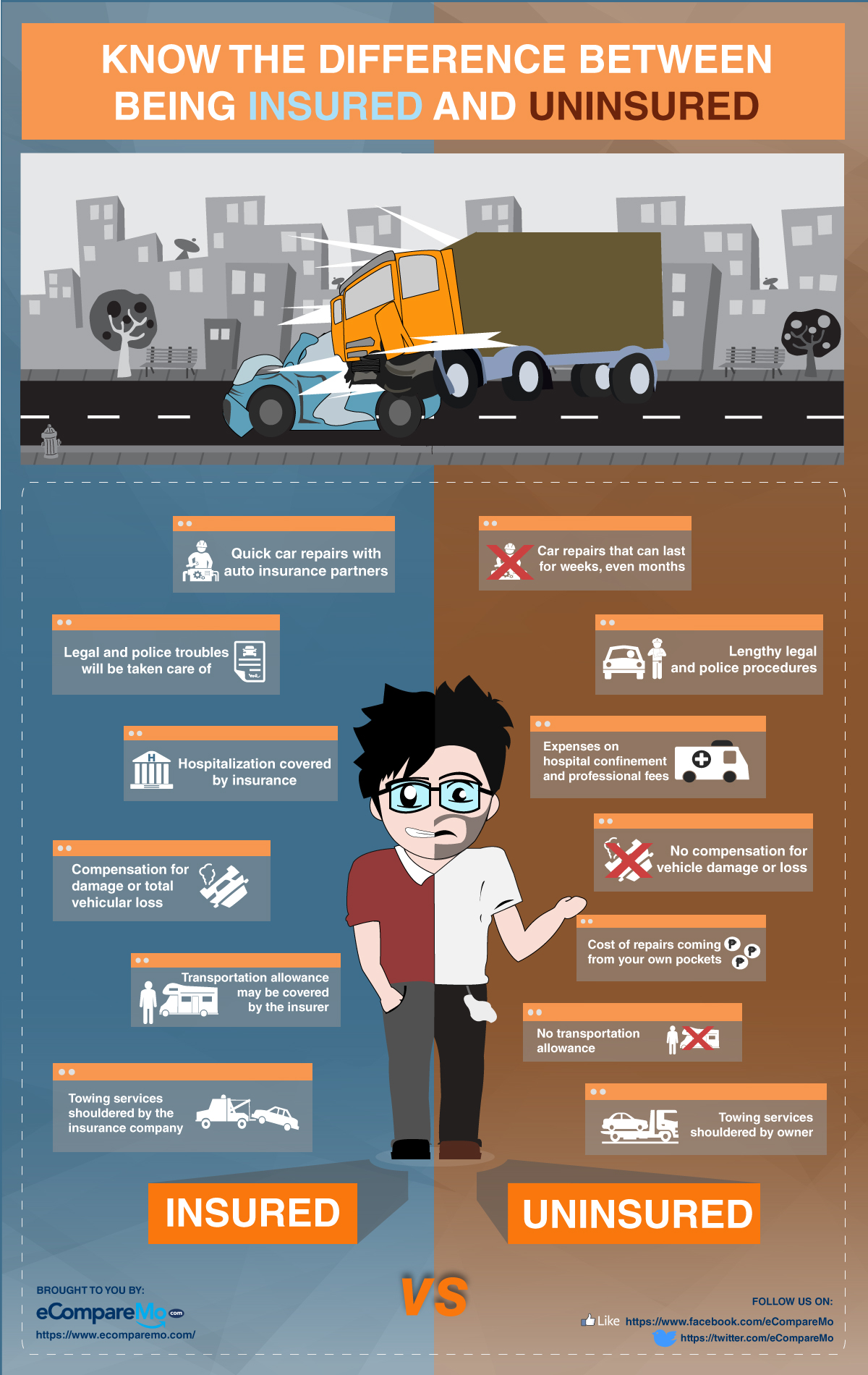

Know The Difference Between Being Insured And Uninsured

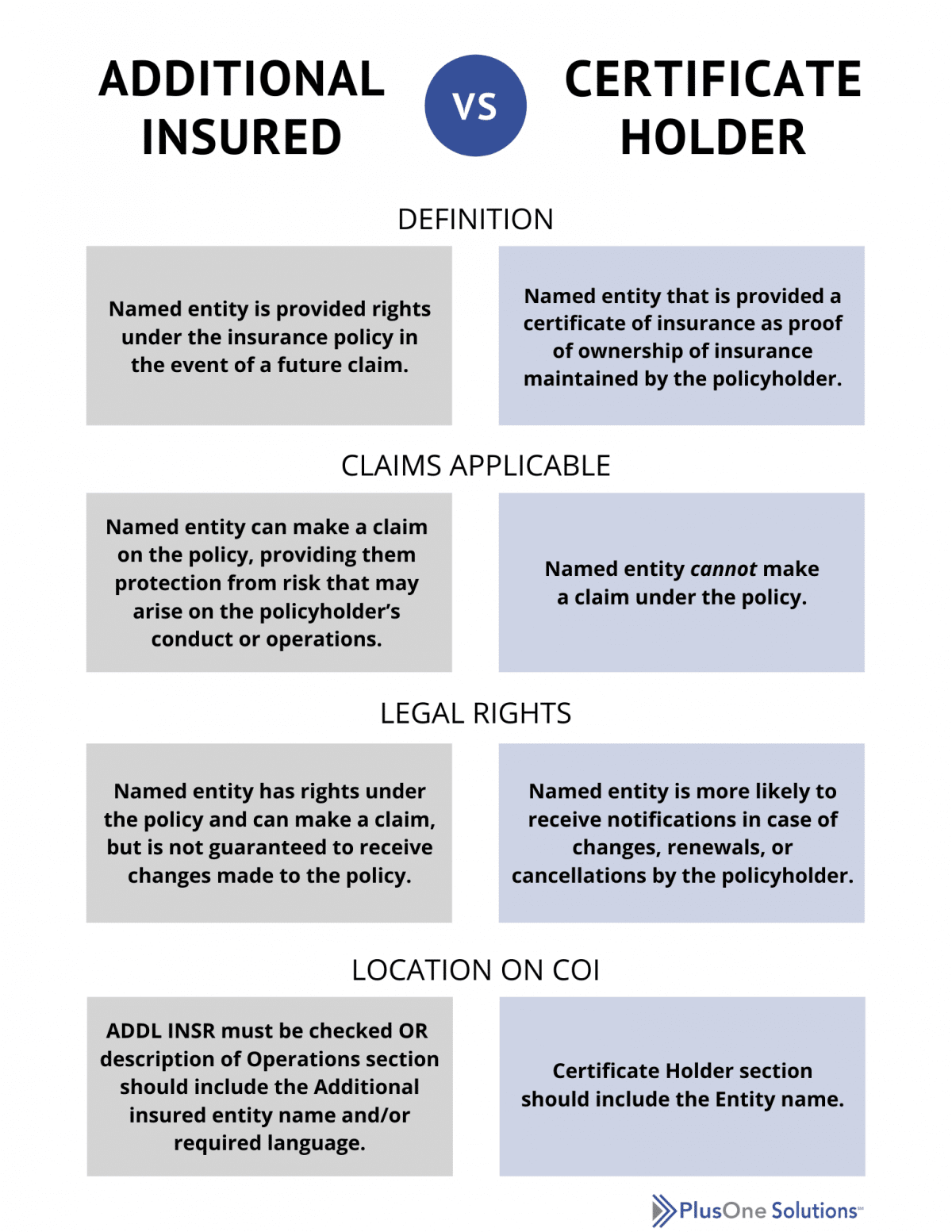

Understanding COIs - Certificate Holder vs. Additional Insured

Certificate Holder Vs Additional Insured / 3 Ways to Find Out if

Named Insured vs. Additional Insured Homeowners: What’s the Difference