Guide To Making A Motor Insurers Bureau Claim

Guide To Making A Motor Insurers Bureau Claim

What is the Motor Insurers Bureau?

The Motor Insurers Bureau (MIB) is a fund set up to provide compensation for victims of accidents caused by uninsured or untraced drivers. It is funded by a levy on all motor insurance policies. In the UK, it is a legal requirement to have car insurance, and the MIB ensures that those who own up to their responsibility and are insured are not out of pocket if the other driver isn't. The MIB also works to reduce uninsured driving.

Can I make a claim to the Motor Insurers Bureau?

If you have been involved in an accident with an uninsured or untraced driver, then you can make a claim to the Motor Insurers Bureau. This can include claims for personal injury, property damage or economic loss. It is important to note that the MIB will only consider claims for accidents that happened in the UK or in a country where the MIB has an agreement in place. In addition, there are certain criteria that must be met in order for a claim to be successful.

What are the criteria for making a Motor Insurers Bureau claim?

In order to make a successful claim to the Motor Insurers Bureau, a number of criteria must be met. Firstly, the accident must have been caused by an uninsured or untraced driver. Secondly, the accident must have happened in the UK or a country where the MIB has an agreement in place. Thirdly, you must have suffered some form of loss as a result of the accident, such as personal injury or property damage. Finally, any claim must be made within three years of the date of the accident.

How do I start a Motor Insurers Bureau claim?

To begin the process of making a claim to the Motor Insurers Bureau, you must first contact the MIB's claims department. You can contact them on 0330 024 8669 or via email at mibclaims@mib.org.uk. You will need to provide the MIB with details of the accident, including the date and location of the incident, as well as details of any insurance policies involved. Once the MIB has all the relevant information, they will assess your claim and let you know if it is successful.

What documents do I need to make a Motor Insurers Bureau claim?

To make a successful claim to the Motor Insurers Bureau, you will need to provide a number of documents. This includes a copy of your driving licence, your insurance policy documents, and any medical evidence you may have. You will also need to provide a detailed description of the accident and any other relevant documents, such as witness statements. Finally, you may need to provide proof of any financial losses you have incurred as a result of the accident.

What if my Motor Insurers Bureau claim is unsuccessful?

If your claim to the Motor Insurers Bureau is unsuccessful, then you may wish to consider taking legal action. This is a complex process, and it is highly recommended that you seek advice from a specialist solicitor. They will be able to advise you on the best course of action and may be able to help you make a successful claim. Alternatively, you may wish to contact the MIB's complaints department to discuss your case further.

Motor Insurers Bureau Compensation Of Victims Of Untraced Drivers Text

Guide to making an MIB claim

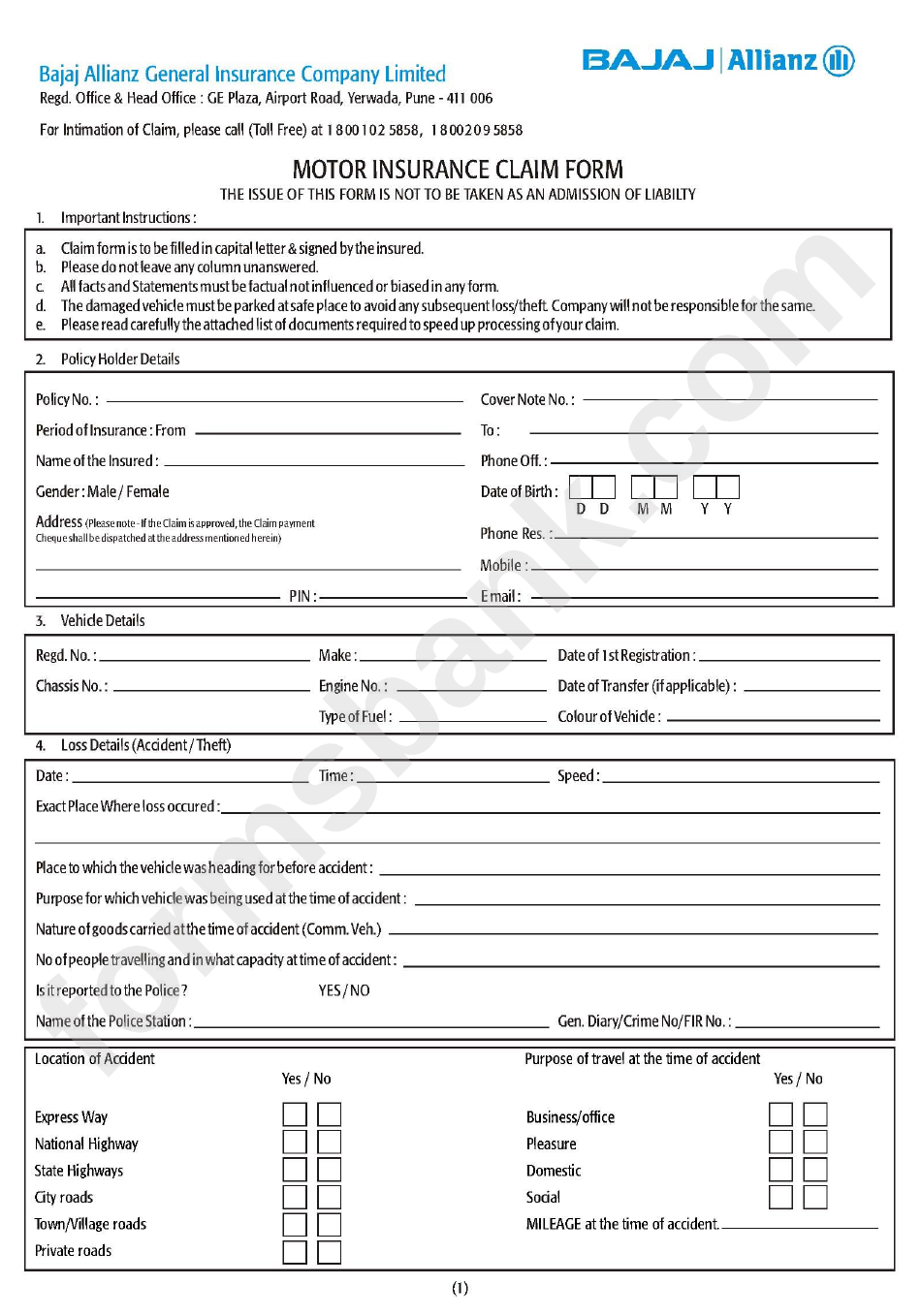

Motor Insurance Policy Claim Form Free Download

Making A Claim - Motor Insurers' Bureau of Singapore

Motor Claim Form - Bajaj Allianz printable pdf download