Car Insurance Monthly Cost Average

Friday, April 12, 2024

Edit

The Average Car Insurance Monthly Cost

Car insurance is an important part of owning a vehicle. However, car insurance can be expensive, and it is important to understand the average car insurance monthly cost. Knowing this information can help you plan for the cost of car insurance when you buy a vehicle.

Factors That Affect Car Insurance Monthly Cost

There are a variety of factors that can affect the average car insurance monthly cost. The most important factor is the type of car you are driving. Cars with higher safety ratings and those that are more expensive to repair are typically more expensive to insure. Additionally, the type of coverage you choose can affect your car insurance monthly cost. Liability coverage, which is required by law, is typically the least expensive type of coverage. Other types of coverage, such as comprehensive or collision coverage, are more expensive and can significantly increase your monthly car insurance cost.

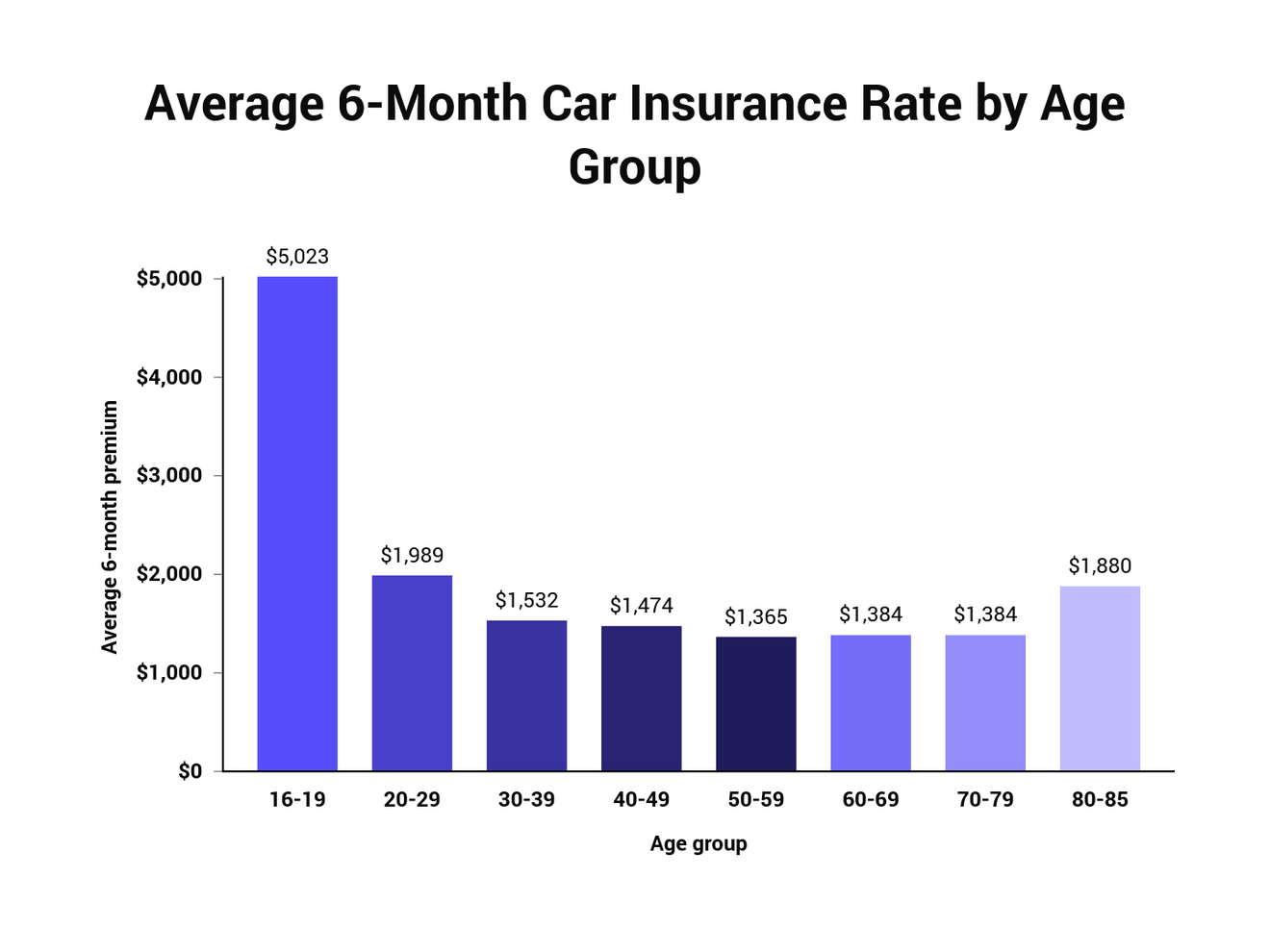

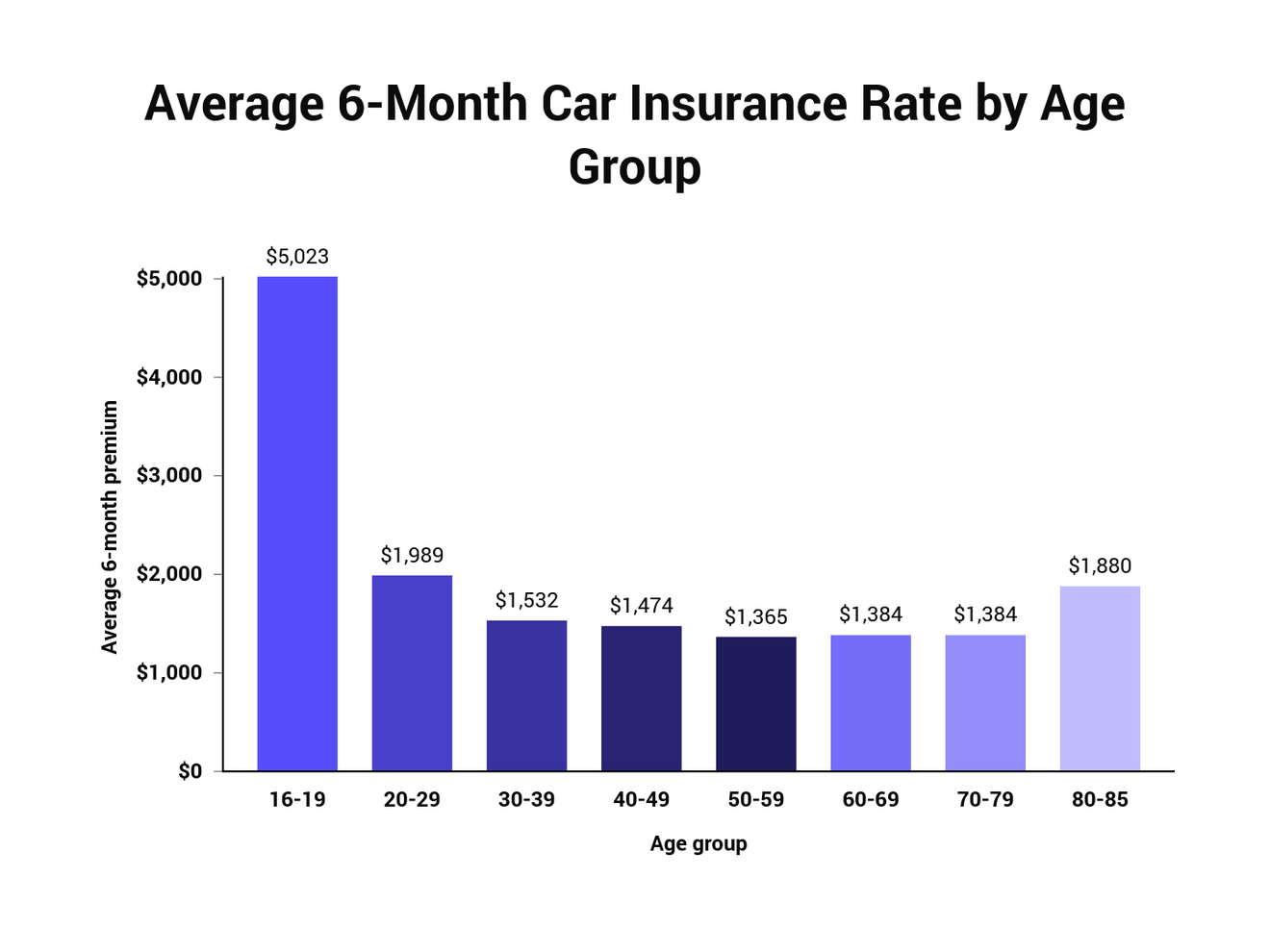

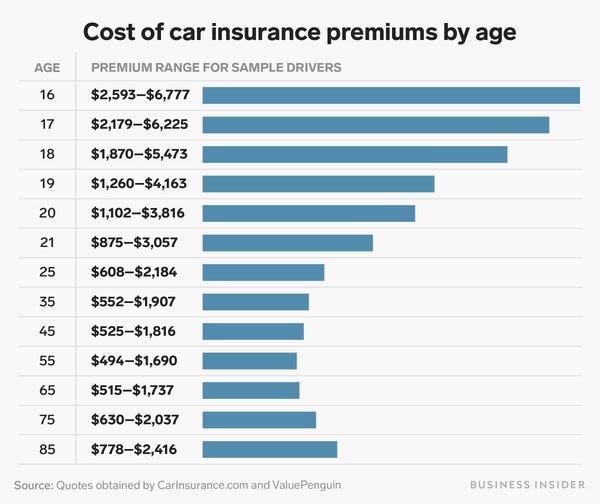

Your driving record is also a factor that can affect your car insurance monthly cost. People with a history of accidents or moving violations will typically pay more for their car insurance. Finally, your age and gender can also affect your car insurance monthly cost. Generally, younger drivers and male drivers tend to pay higher rates for car insurance.

Average Cost of Car Insurance

It is difficult to determine the exact average cost of car insurance, as there are so many factors that can affect the cost. However, according to the Insurance Information Institute, the average cost of car insurance in the United States is $1,311 per year, which works out to $109 per month.

The cost of car insurance varies significantly from state to state. For example, according to the Insurance Information Institute, the average cost of car insurance in California is $1,783 per year, which works out to $149 per month. In contrast, the average cost of car insurance in Iowa is $845 per year, which works out to $70 per month.

Tips for Lowering Your Car Insurance Monthly Cost

There are several tips that you can use to help lower your car insurance monthly cost. One of the best ways to lower your car insurance cost is to shop around for the best rate. Different insurers offer different rates, and it is important to compare rates and coverage to ensure you get the best deal. You should also consider raising your deductible as this can help lower your premium. Additionally, if you have a good driving record, you may qualify for a good driver discount. Finally, you can also consider bundling your car insurance with other types of insurance, such as home or life insurance, as this can help you save money.

Conclusion

The average car insurance monthly cost can vary significantly, depending on a variety of factors. It is important to understand the average monthly cost of car insurance so that you can plan for the cost when buying a vehicle. Additionally, there are several tips you can use to help lower your car insurance monthly cost, such as shopping around for the best rate and raising your deductible.

ALL You Need to Know About the Average Car Insurance Cost

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Average Price Of Car Insurance Per Month - designby4d

How Much Does Car Insurance Cost on Average? | The Zebra

What is the Average Cost of Car Insurance in the US? | The Zebra