Act Only Motor Insurance Policy

Act Only Motor Insurance Policy – Everything You Need to Know

What is an Act Only Motor Insurance Policy?

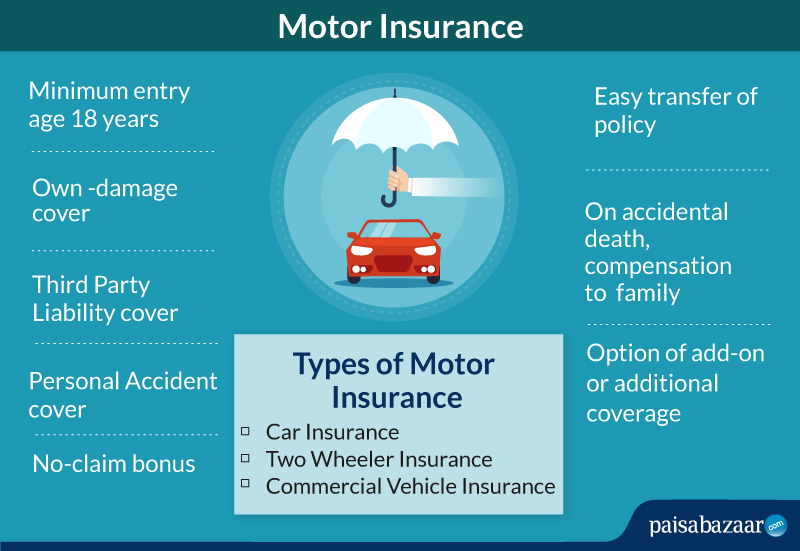

An Act Only Motor Insurance Policy is a type of vehicle insurance policy that covers damage or loss to the vehicle caused by a third party. It is one of the two main forms of motor insurance available in India. The other type of motor insurance policy is Comprehensive Motor Insurance Policy. An Act Only Motor Insurance Policy does not cover damage to the insured vehicle caused by the owner/insured. It provides coverage for legal liability due to bodily injury and property damage to a third party.

Who is Eligible for an Act Only Motor Insurance Policy?

Any individual who owns a motor vehicle in India is eligible to purchase an Act Only Motor Insurance Policy. This policy is available for private cars, commercial vehicles, two-wheelers and three-wheelers. The policyholder must have a valid driving license to be eligible for this policy.

What Does an Act Only Motor Insurance Policy Cover?

An Act Only Motor Insurance Policy covers legal liability due to bodily injury, death or property damage to a third party caused by the insured vehicle. It also covers legal expenses incurred in defending the insured against a legal suit. The policy also covers the cost of medical expenses incurred by the third party in case of an accident. The policy does not cover damage to the insured vehicle caused by the owner/insured.

What is the Duration of an Act Only Motor Insurance Policy?

An Act Only Motor Insurance Policy is generally valid for a period of one year from the date of purchase. The policyholder can renew the policy at the end of the policy term to continue the coverage. The policyholder must have a valid driving license at the time of renewal.

How to Buy an Act Only Motor Insurance Policy?

An Act Only Motor Insurance Policy can be purchased from the insurance company or its authorized agents. The policyholder must provide the necessary documents such as vehicle registration certificate and driving license to the insurance company. The insurance company will then issue the policy to the policyholder. The policyholder must pay the premium amount as mentioned in the policy document to the insurance company.

What are the Benefits of an Act Only Motor Insurance Policy?

An Act Only Motor Insurance Policy provides financial protection to the policyholder against legal liability due to bodily injury, death or property damage to a third party caused by the insured vehicle. It also provides coverage for legal expenses incurred in defending the insured against a legal suit. The policy also covers the cost of medical expenses incurred by the third party in case of an accident. The policy also provides coverage for legal liability due to death or bodily injury caused to the driver of the insured vehicle.

Basics of Motor Insurance ppt.

Basics of Motor Insurance ppt.

Insurance Policy Sample : Business Insurance Policy Declarations

Motor Insurance in India: Types, Coverage, Claim & Renewal

Third Party Insurance: Buy & Renew Third Party Car Insurance Online