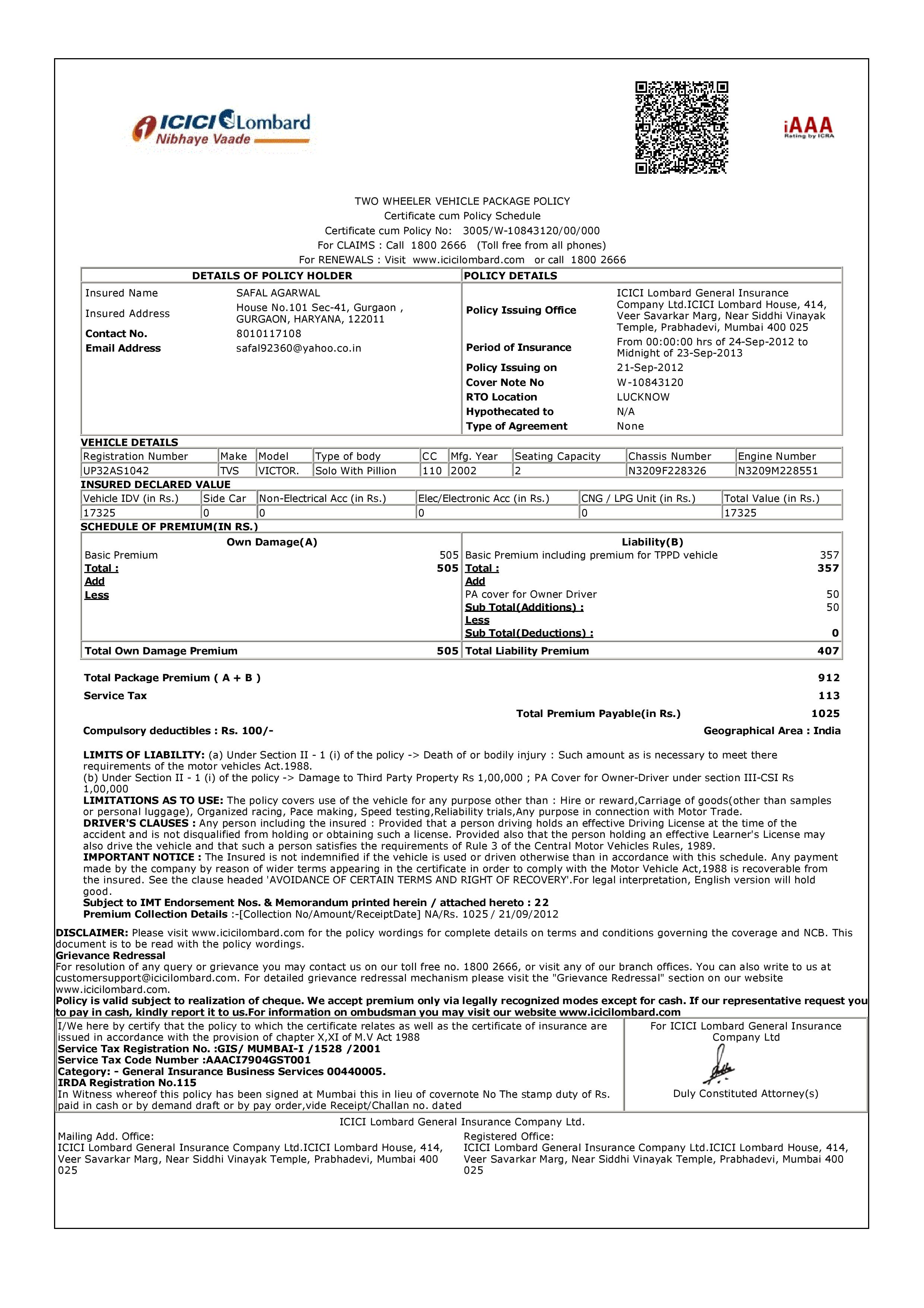

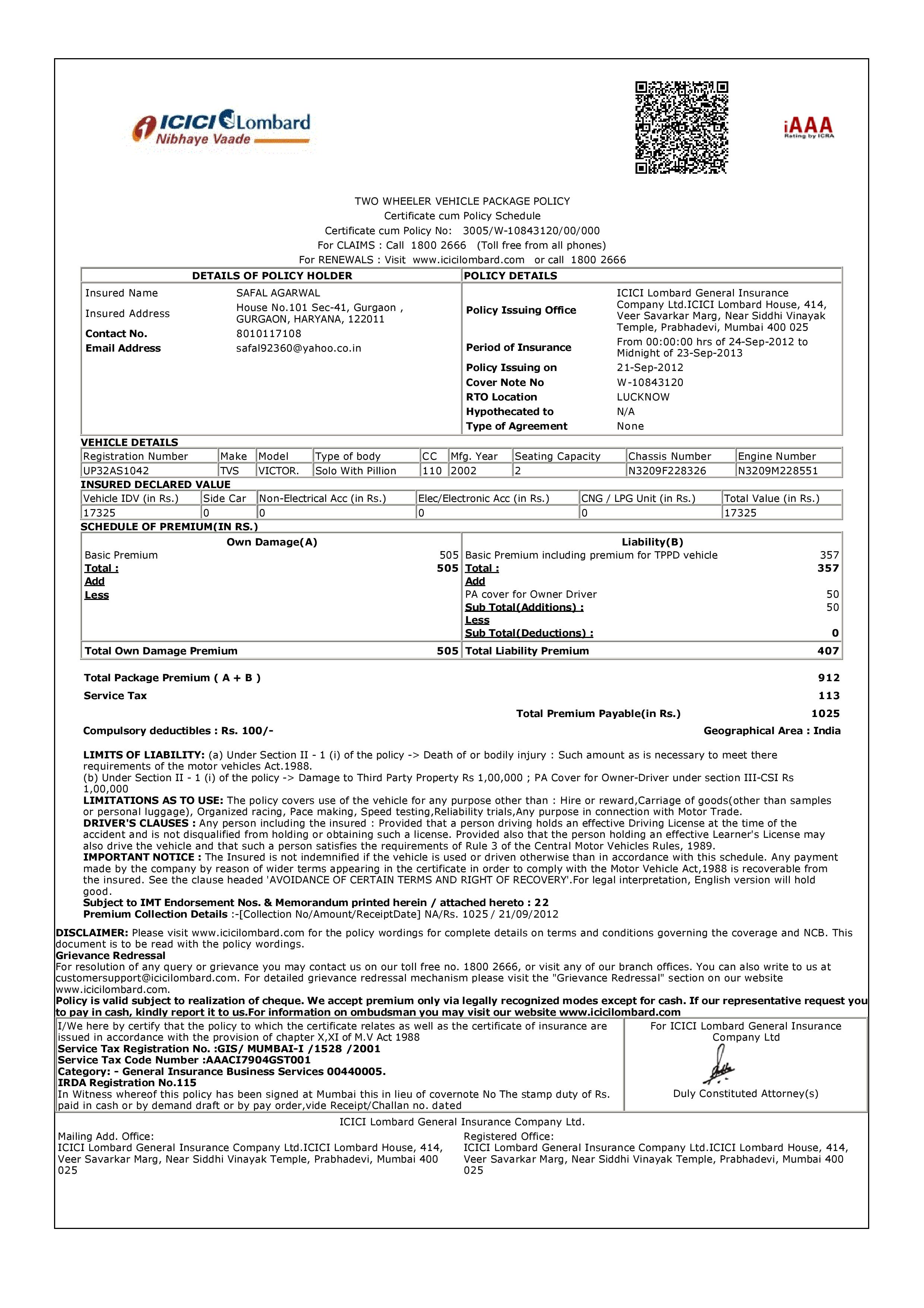

Icici Lombard Vehicle Insurance Details

ICICI Lombard Vehicle Insurance: All You Need to Know

Introduction to ICICI Lombard Vehicle Insurance

ICICI Lombard is one of the largest general insurance companies in India. It offers a wide range of insurance services and products, including vehicle insurance. ICICI Lombard vehicle insurance is one of the most comprehensive and reliable insurance policies available in the Indian market. It provides a comprehensive coverage for your vehicle, including damage due to natural disasters, accidents, theft, fire, and vandalism. It also provides coverage for third-party liabilities, legal fees, and other such costs.

Benefits of ICICI Lombard Vehicle Insurance

ICICI Lombard vehicle insurance offers a wide range of benefits for policyholders. Some of the key benefits include:

- Comprehensive Coverage: ICICI Lombard vehicle insurance provides comprehensive coverage for all kinds of vehicles, including private cars, commercial vehicles, and two-wheelers. It covers damage due to accidents, natural disasters, theft, fire, and vandalism.

- Third-Party Liability: ICICI Lombard vehicle insurance provides coverage for third-party liabilities, legal fees, and other such costs. It also provides coverage for personal accident and death of the policyholder.

- Cashless Claim Settlement: ICICI Lombard provides cashless claim settlements at its authorized network of garages and service centers.

- 24x7 Assistance: ICICI Lombard provides 24x7 assistance for all its policyholders. It offers round the clock assistance for any kind of query or claim related assistance.

- Discounts: ICICI Lombard offers discounts on its vehicle insurance policies for a variety of reasons, including no-claim bonus, loyalty discount, and more.

Eligibility Criteria for ICICI Lombard Vehicle Insurance

To be eligible for ICICI Lombard vehicle insurance, the policyholder should meet the following criteria:

- The policyholder should be at least 18 years old.

- The policyholder should have a valid driving license.

- The policyholder should be the registered owner of the vehicle.

- The vehicle should be registered in India.

How to Apply for ICICI Lombard Vehicle Insurance

Applying for ICICI Lombard vehicle insurance is easy and hassle-free. You can apply online or by visiting your nearest ICICI Lombard branch. To apply online, all you have to do is fill out an online application form, provide the necessary documents, and pay the premium. You can also avail additional discounts through online application.

Conclusion

ICICI Lombard vehicle insurance is one of the most comprehensive and reliable insurance policies available in the Indian market. It provides comprehensive coverage for your vehicle, including damage due to natural disasters, accidents, theft, fire, and vandalism. It also provides coverage for third-party liabilities, legal fees, and other such costs. It offers cashless claim settlements at its authorized network of garages and service centers, as well as discounts on its policies. Applying for ICICI Lombard vehicle insurance is easy and hassle-free. Thus, ICICI Lombard vehicle insurance is a great option for anyone looking for a reliable and comprehensive vehicle insurance policy.

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Icici Lombard Insurance Pdf Download

Motor Insurance: Icici Lombard Motor Insurance Policy Print

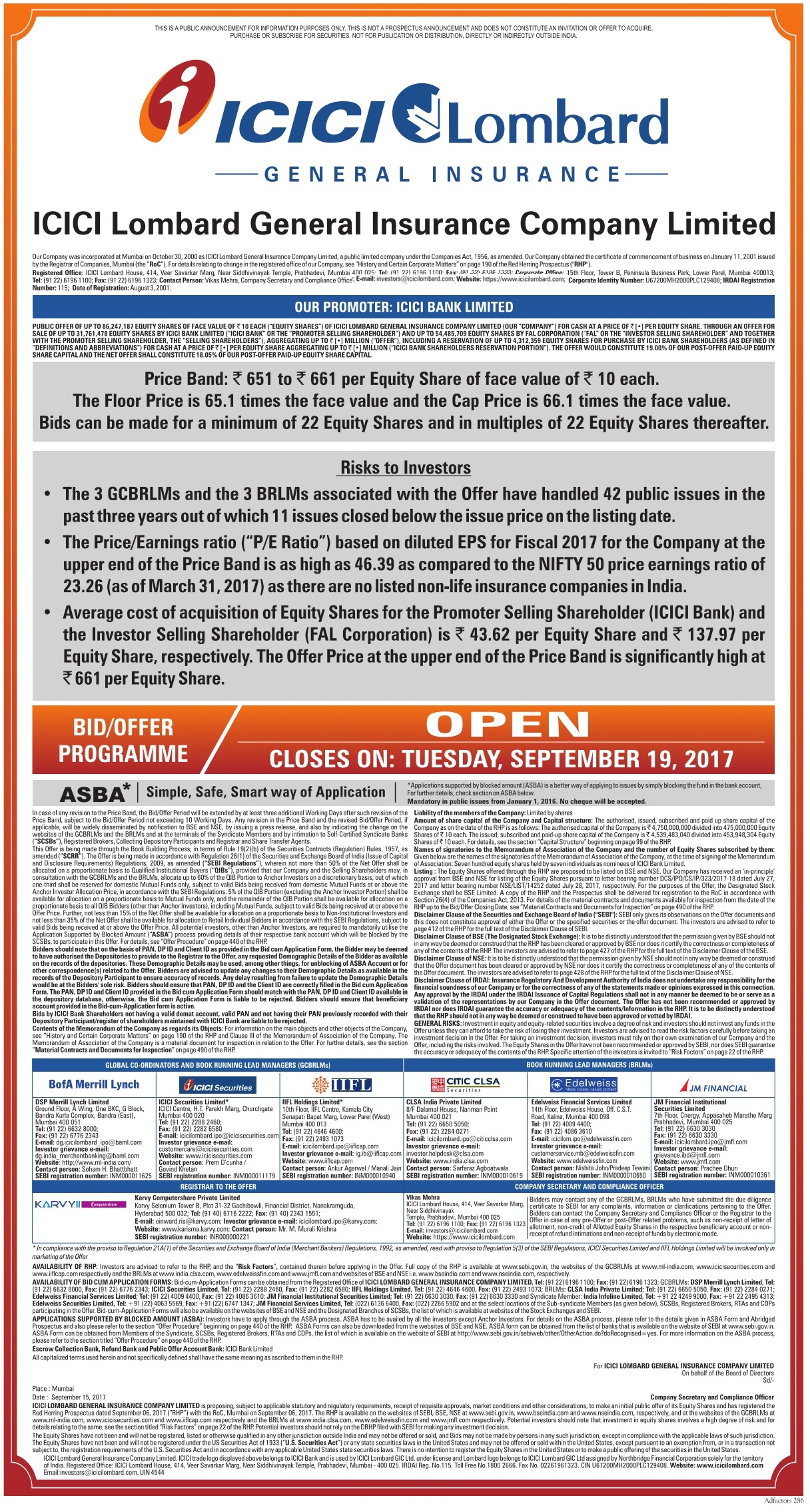

Icici Lombard General Insurance Ad - Advert Gallery