What Is Appraisal Gap Coverage

What Is Appraisal Gap Coverage?

Appraisal gap coverage is a type of insurance policy that provides extra coverage in the event of a total loss. It is also known as Guaranteed Asset Protection (GAP) insurance. This type of coverage is most often offered by car dealerships as an additional product to car buyers. It covers the “gap” between the actual cash value of a car (the amount the car is worth at the time of the total loss) and the amount the buyer borrowed to purchase the car.

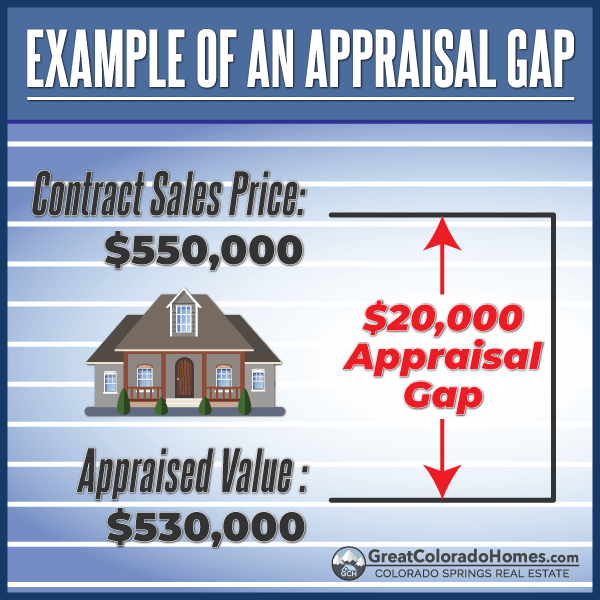

For example, if a buyer purchased a car for $25,000 but the car was only worth $20,000 at the time of a total loss, the appraisal gap coverage would pay the difference of $5,000. This coverage is especially important for buyers who put a small down payment on their car or who finance the entire amount of the purchase. Without this type of coverage, the buyer would be stuck with the remaining balance of the loan, even though the car is no longer around.

How Does Appraisal Gap Coverage Work?

When a buyer purchases appraisal gap coverage, they are essentially buying a form of protection. The buyer pays a one-time premium, which is usually a percentage of the total cost of the car, in exchange for the coverage. In the event of a total loss, the insurer pays the difference between the actual cash value of the car and the amount the buyer borrowed to purchase the car. The coverage is only valid if the buyer has a valid policy with the insurer at the time of the total loss.

Who Needs Appraisal Gap Coverage?

Appraisal gap coverage is an important type of insurance for anyone who puts a small down payment on a car or who finances the entire amount of the purchase. This type of coverage can also be beneficial for buyers who have an extended loan term, as the car can depreciate significantly over a longer period of time. Without appraisal gap coverage, the buyer could end up stuck with the remaining balance of the loan, even though the car is no longer around.

What Is the Cost of Appraisal Gap Coverage?

The cost of appraisal gap coverage is typically determined by the total cost of the car and the amount of the down payment or loan. Most car dealerships charge a one-time premium, which is usually a percentage of the total cost of the car. The cost of the coverage can vary widely depending on the insurer, so it’s important to shop around to get the best rate.

Conclusion

Appraisal gap coverage is an important type of insurance for anyone who puts a small down payment on a car or who finances the entire amount of the purchase. This type of coverage will pay the difference between the actual cash value of the car and the amount the buyer borrowed to purchase the car, in the event of a total loss. The cost of appraisal gap coverage is typically determined by the total cost of the car and the amount of the down payment or loan. It’s important to shop around to get the best rate.

What is Appraisal Gap Coverage? - NFM Lending

Appraisal Gap Coverage - Make Your Offer More Competitive - YouTube

What is an Appraisal Gap Clause and How Does It Work? | LaptrinhX / News

Appraisal Gap- Get Your Dream Home Under Contract!

One Mortgage at a Time: Solving the Appraisal Gap