More Than Home Insurance Claims

Monday, March 11, 2024

Edit

Home Insurance Claims - More Than Just Fire and Theft

Home insurance is a necessity for homeowners and renters alike. The last thing anyone wants is to suffer a loss and not have the right coverage in place. We’ve all heard of the basic home insurance coverages like fire, theft, and liability, but there’s a lot more to home insurance than that.

What Else Can Home Insurance Cover?

Home insurance can provide protection from more than just fire and theft. It can also cover events like windstorms, hail, and lightning, as well as other natural disasters like floods, earthquakes, and volcanic eruptions. Depending on your policy, it can also cover things like sewer backups, pet damage, and even identity theft.

What Kinds of Claims Can I Make?

The types of claims you can make on your home insurance policy will depend on the type of coverage you have and the cause of the damage. For example, if your home is damaged or destroyed by a fire, you can make a claim for the damage and the cost of replacing any destroyed items. If your home is damaged or destroyed by a flood, you’ll need to have flood insurance coverage in order to make a claim.

How to File a Claim?

When filing a home insurance claim, it’s important to have all of the necessary information ready. This includes a detailed description of the damage, photographs of the damage, and receipts or estimates of the cost of repair or replacement. In some cases, you may also need to provide proof of ownership for the damaged items. Once you’ve collected all of the necessary information, you can contact your insurance company to start the claims process.

What Happens After I File a Claim?

Once you’ve filed a home insurance claim, your insurance company will begin the claims process. This usually involves an adjuster coming to assess the damage and determine the extent of the coverage. Depending on the type of claim and the cause of the damage, your insurance company may cover the cost of repairing or replacing the damaged items, or they may offer you a settlement.

What If I Don’t Agree With the Settlement?

If you don’t agree with the settlement offered by your insurance company, you can always appeal the decision. This involves submitting additional evidence and information to the insurance company in support of your claim. If your appeal is successful, the insurance company may agree to increase the settlement amount. If the insurance company denies your appeal, you may have the option to take the issue to court.

Home insurance is an important part of protecting your home and possessions. It can provide protection from more than just fire and theft and can cover things like windstorms, hail, floods, and even identity theft. Knowing what home insurance can cover and how to file a claim can help you make sure you’re prepared in case of an emergency.

More Than Home Insurance Claims / How To Speed Up An Insurance Claim

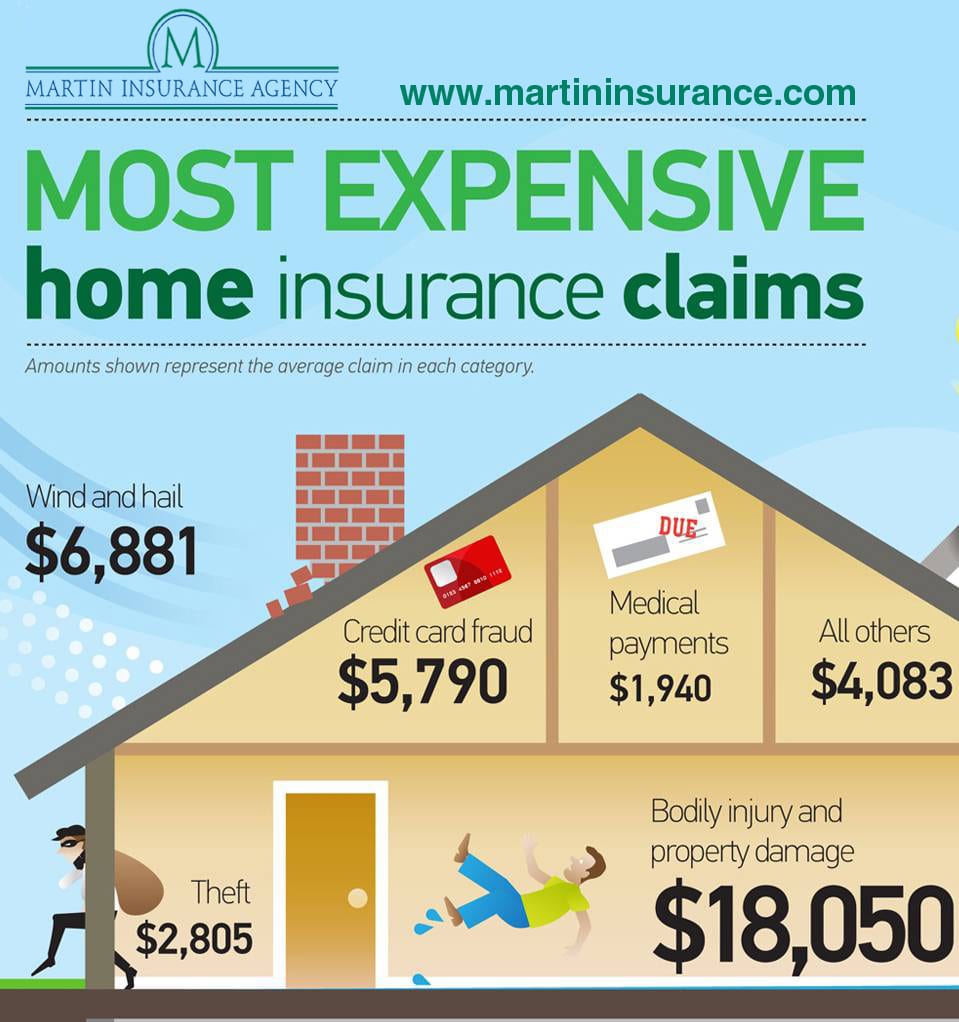

Most Expensive Home Insurance Claims | Martin Insurance

Most Expensive Home Insurance Claims [Infographic] | Insurance Center

![More Than Home Insurance Claims Most Expensive Home Insurance Claims [Infographic] | Insurance Center](https://www.answerfinancial.com/insurance-center/wp-content/uploads/2011/09/Most-Expensive-Homeowners-Insurance-Claims.jpg)

The Worst Could Happen: Common Home Insurance Claims to Know

Homeowners Insurance: Reasons why homeowners claims get denied