Kentucky State Minimum Car Insurance

Minimum Car Insurance Requirements in Kentucky

For drivers in Kentucky, having auto insurance is a must. The minimum auto insurance requirements set by the state of Kentucky are there to ensure that all drivers are able to pay for any damages they may cause while they are driving. It is important to understand the minimum requirements, as well as the implications of not meeting them.

What are the Minimum Requirements for Car Insurance in Kentucky?

The state of Kentucky requires all drivers to carry a minimum amount of auto insurance. This includes liability coverage for bodily injury and property damage. Bodily injury liability coverage pays for medical expenses and other costs associated with injuries sustained by other parties in an accident that is determined to be your fault. Property damage liability coverage pays for damage to property, such as another vehicle, caused by you in an accident.

The minimum amount of liability coverage required in Kentucky is $25,000 for bodily injury to one person, $50,000 for bodily injury to two or more persons, and $10,000 for property damage. These are known as 25/50/10 coverage limits.

What is Uninsured/Underinsured Motorist Coverage?

The state of Kentucky also requires all drivers to carry uninsured/underinsured motorist (UM/UIM) coverage. This coverage pays for medical expenses and other costs associated with injuries sustained by you and your passengers in an accident caused by another driver who does not have insurance or does not have enough insurance to cover the costs of the accident. The minimum amount of UM/UIM coverage required in Kentucky is $25,000 per person and $50,000 per accident.

What are the Penalties for Not Having Auto Insurance in Kentucky?

Drivers in Kentucky who do not have auto insurance can face severe penalties. If you are caught driving without insurance, you can be fined up to $500 and face one year in jail. Additionally, your license and registration can be suspended for up to 6 months, and you will be required to pay a reinstatement fee of $50. Furthermore, you may be required to show proof of insurance going forward, and you may be required to pay an SR-22 filing fee.

What Other Types of Insurance are Available?

In addition to the minimum requirements, there are other types of insurance that you may want to consider. Collision and comprehensive coverage pays for damage to your vehicle, no matter who is at fault. Personal injury protection (PIP) pays for medical expenses and other costs associated with injuries sustained by you and your passengers in an accident. Lastly, uninsured motorist property damage (UMPD) coverage pays for damage to your vehicle caused by an uninsured driver.

Having the minimum amount of auto insurance required by the state of Kentucky is important, but it may not be enough to cover all of your needs. It is important to talk to your insurance provider about the types and amounts of coverage that are right for you.

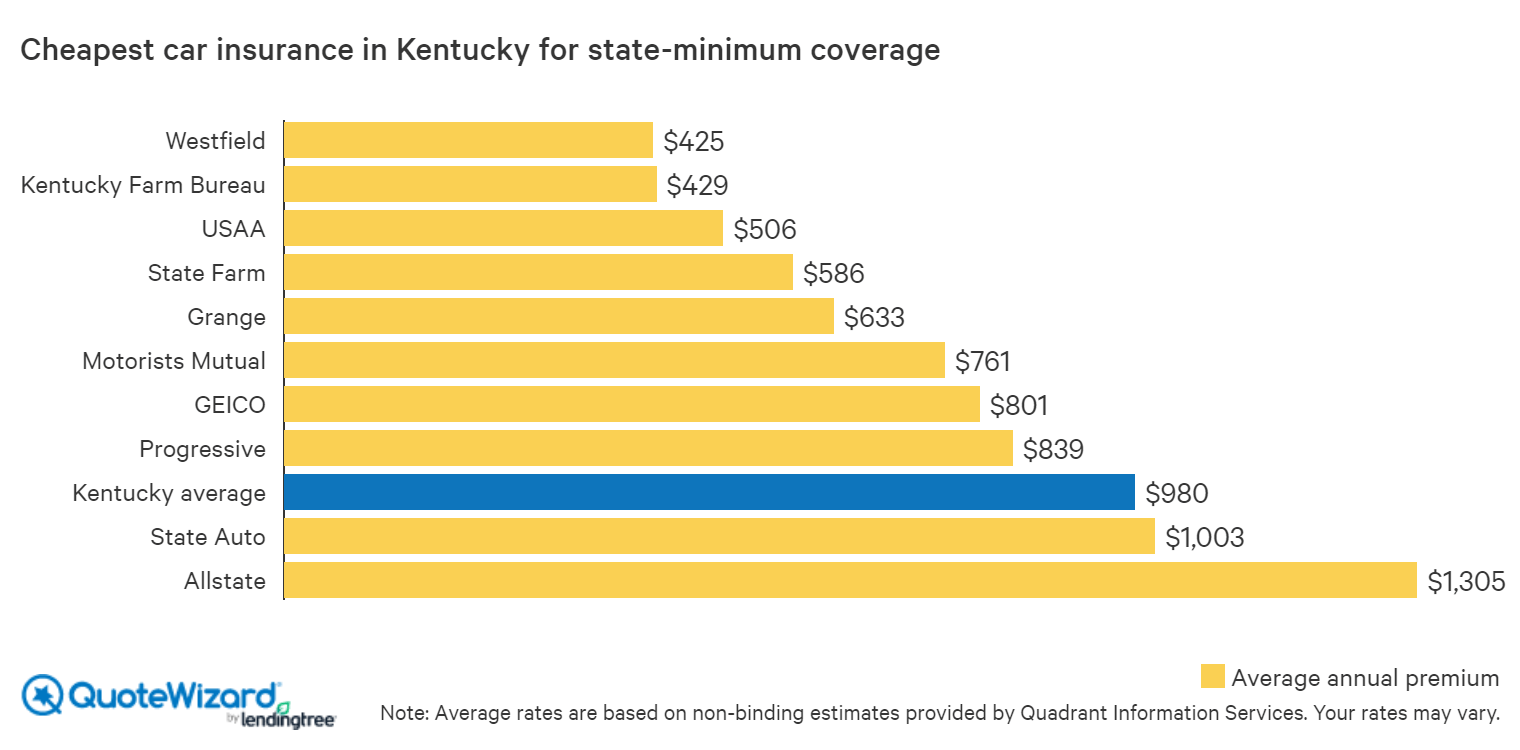

Find Cheap Car Insurance in Kentucky | QuoteWizard

Kentucky Car Insurance Requirements

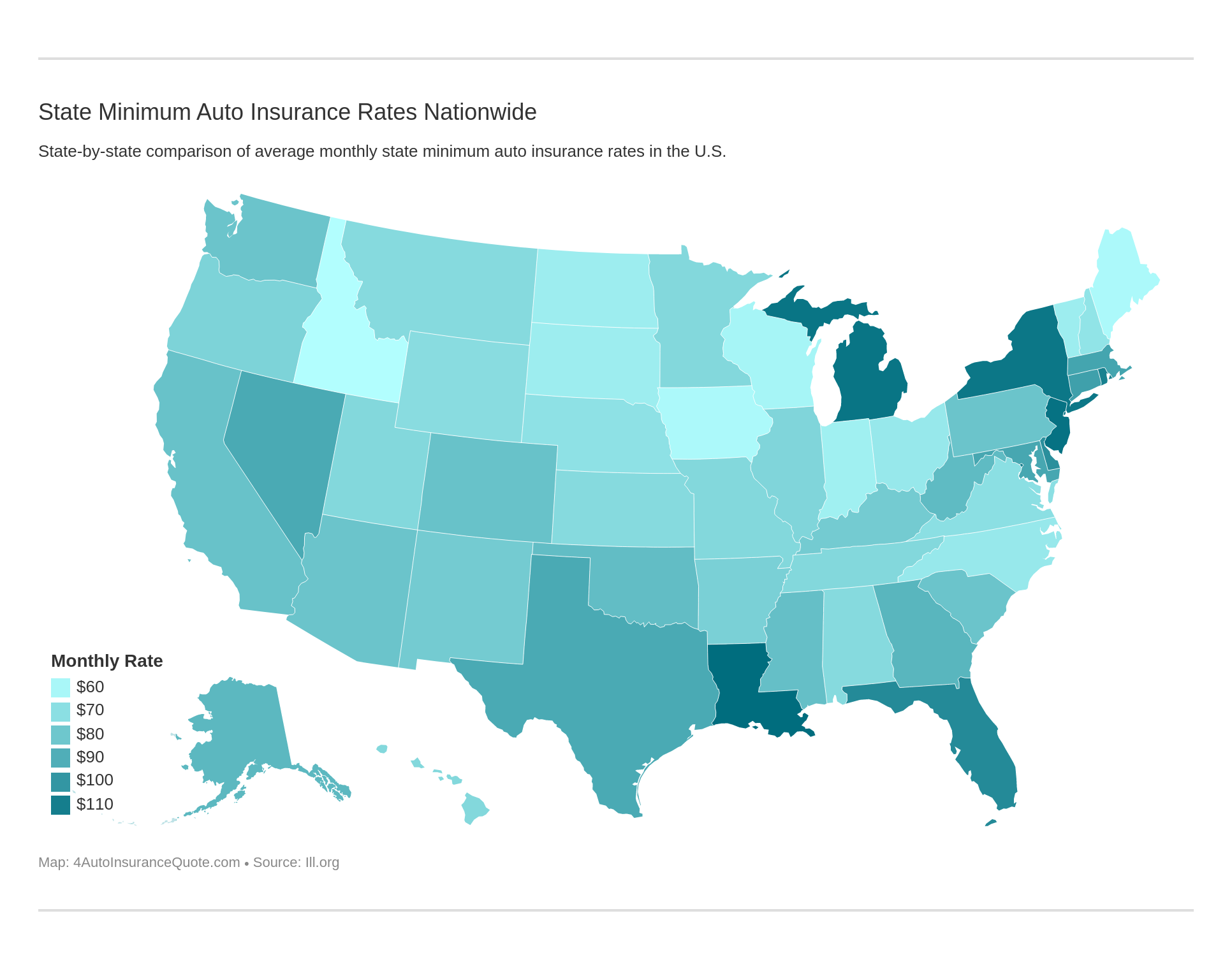

What's the Cost of State Minimum Car Insurance? | Car Insurancee

Insurance Basics | Vehicle Insurance | Katherman Briggs & Greenberg

Cheap Kentucky Auto Insurance for 2021