Iowa State Minimum Car Insurance

Understanding Iowa State Minimum Car Insurance Requirements

Iowa state minimum car insurance requirements are set in place to make sure that drivers have the necessary amount of coverage to protect them and other drivers in the event of an accident. The state of Iowa requires drivers to have liability insurance, uninsured motorist coverage, and personal injury protection. While this may sound overwhelming and expensive, it is important to understand the requirements and why they are important for protecting you and other drivers on the road.

Liability Insurance

Liability insurance is one of the most important types of car insurance coverage. This type of insurance is designed to protect you from being legally and financially responsible for the damage or injury that you cause to another person or property. In the state of Iowa, you must carry liability insurance with a minimum coverage of $20,000 for bodily injury per person, $40,000 for bodily injury per accident, and $15,000 for property damage. This coverage pays for any damages that are your fault and helps to ensure that you are not left with a huge bill if you cause an accident.

Uninsured Motorist Coverage

Uninsured motorist coverage is another important type of car insurance coverage. This coverage protects you in the event that you are in an accident with a driver who does not have insurance. Without this coverage, you would have to pay for all of the damages out of pocket. In Iowa, the minimum coverage for uninsured motorist coverage is $20,000 per person and $40,000 per accident. This coverage helps to ensure that you are not left with a huge bill if you are in an accident with an uninsured driver.

Personal Injury Protection

Personal injury protection is a type of car insurance coverage that pays for medical bills, lost wages, and other costs incurred as a result of an accident. In Iowa, the minimum coverage for personal injury protection is $15,000 per person and $30,000 per accident. This coverage helps to make sure that you are not left with a huge bill if you are injured in an accident.

Why Are Car Insurance Requirements Important?

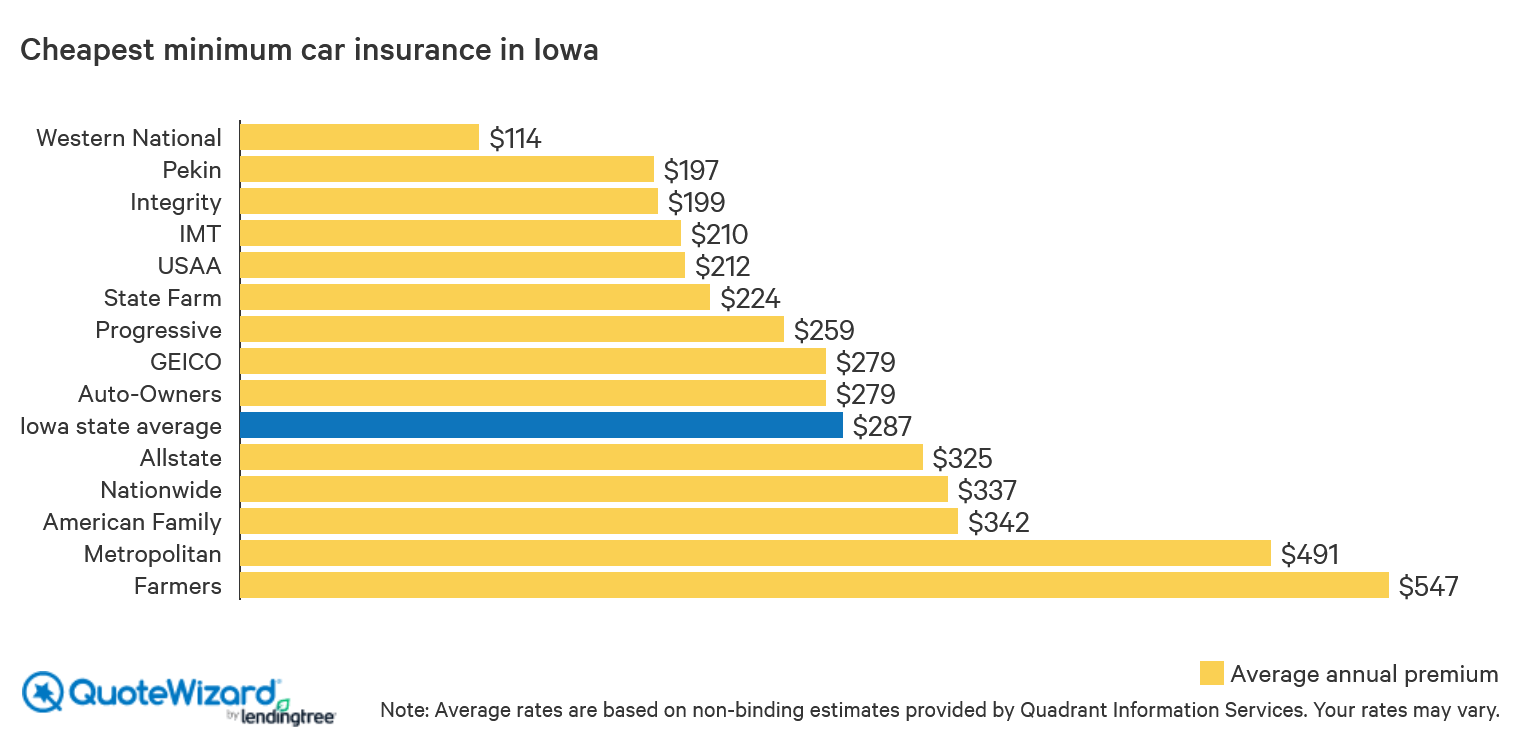

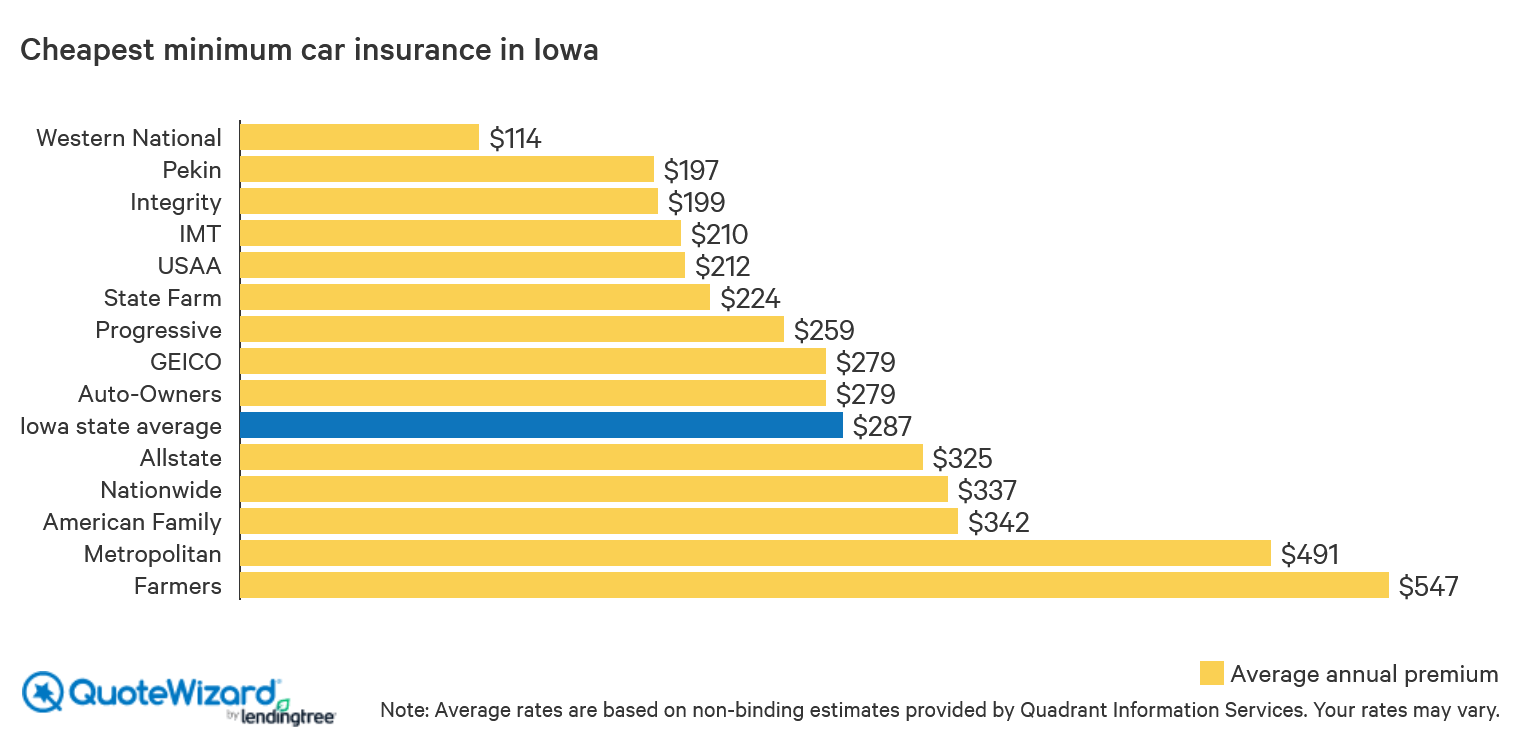

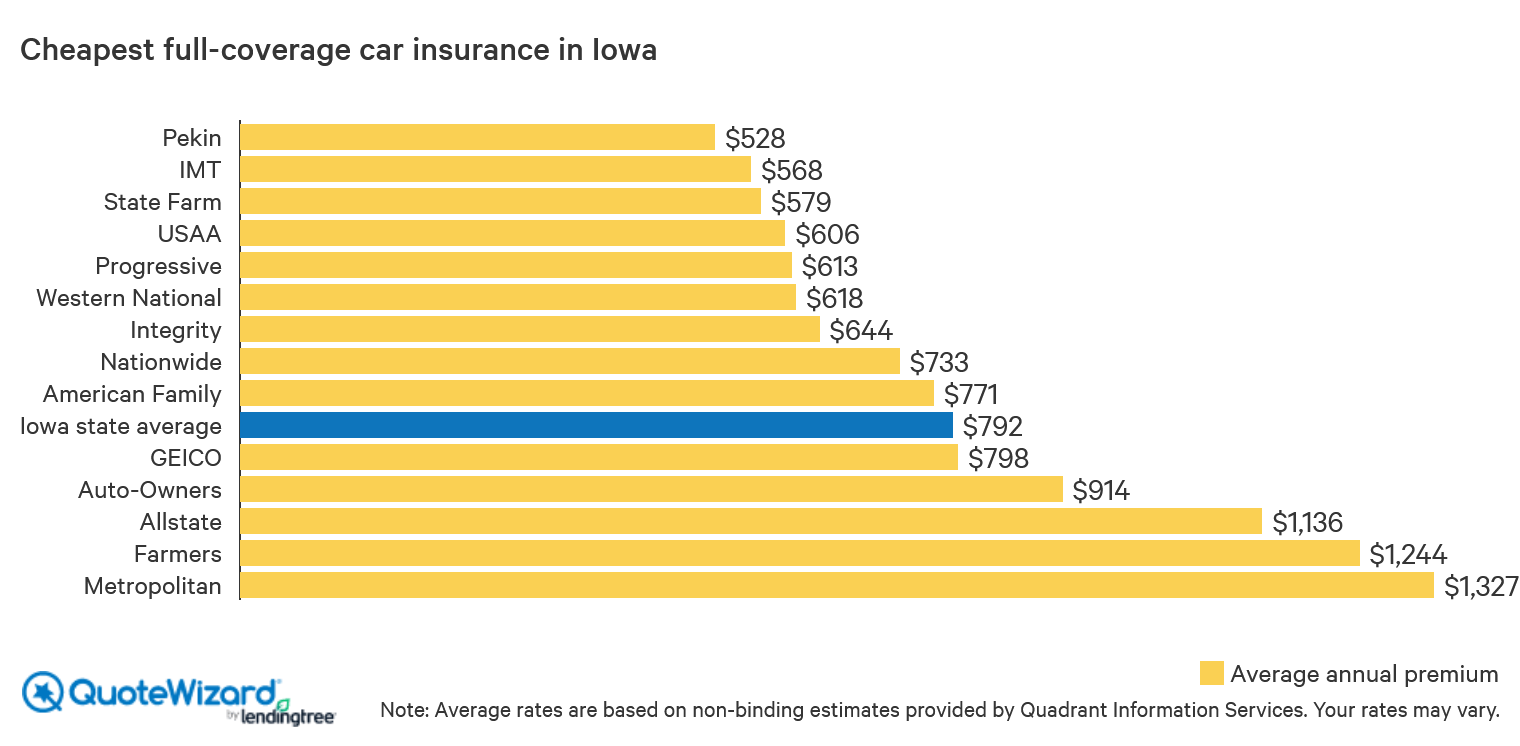

Car insurance requirements are important for protecting you as a driver. Without the necessary coverage, you could be left with a huge bill if you are in an accident. By understanding the state minimum car insurance requirements, you can ensure that you have the necessary coverage to protect you and other drivers on the road. It is also important to shop around for the best car insurance rates so that you can get the coverage that you need at an affordable price.

Conclusion

Iowa state minimum car insurance requirements are important for protecting you and other drivers on the road. It is important to understand the requirements and make sure that you have the necessary coverage. By shopping around for the best car insurance rates, you can make sure that you are getting the coverage that you need at an affordable price. Understanding the state minimum car insurance requirements can help to ensure that you are properly protected in the event of an accident.

Get Cheap Auto Insurance in Iowa | QuoteWizard

Cheap Car Insurance in Iowa 2019

Get Cheap Auto Insurance in Iowa | QuoteWizard

What is state minimum auto insurance in Ohio? - Cowan & Hilgeman Law