Cheapest Place To Get Sr22 Car Insurance

Cheapest Place To Get Sr22 Car Insurance

Introduction

SR22 car insurance, also known as "financial responsibility insurance," is required by some states in the United States. It is an insurance policy that provides proof of financial responsibility, typically when a driver has been convicted of driving without insurance or has had their license suspended. In order to keep your license valid and get back on the road, you may be required to get SR22 car insurance. It is important to know that SR22 insurance is usually more expensive than regular car insurance. Therefore, it's important to shop around to get the best price. Here are some tips to help you find the cheapest place to get SR22 car insurance.

Shop Around for SR22 Car Insurance

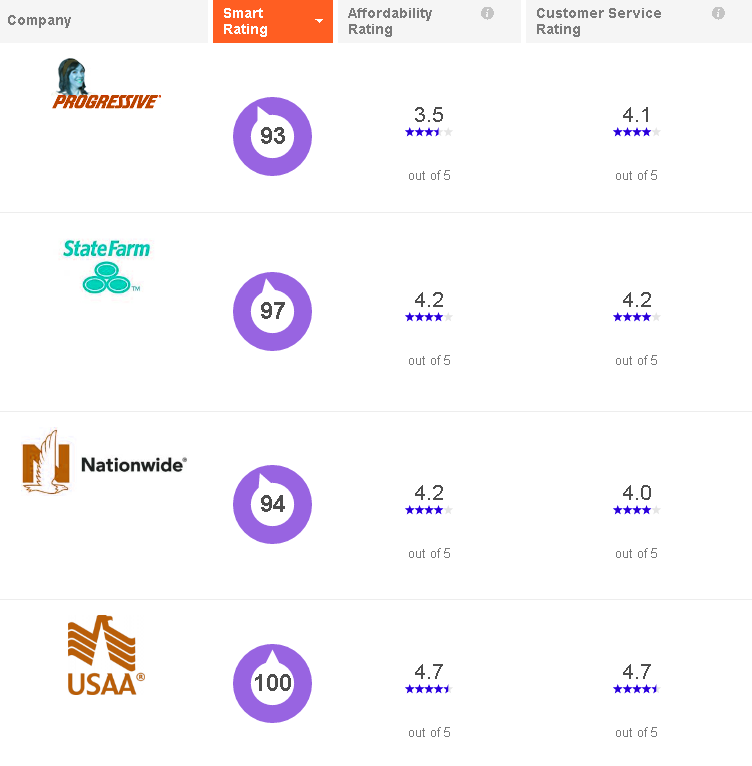

The first step in finding the cheapest place to get SR22 car insurance is to shop around. You should compare prices from different insurance companies to see which one has the best rates. It is also important to compare the coverage and deductible options offered by each company. Different companies may offer different coverage and deductible options, so it is important to compare them to make sure you are getting the best deal.

Look for Discounts

Another way to get the cheapest SR22 car insurance is to look for discounts. Many insurance companies offer discounts for things like having a good driving record, being a student, or taking a defensive driving course. It is important to take advantage of any discounts that you qualify for in order to get the cheapest rate possible. Additionally, some insurance companies offer discounts if you bundle more than one type of insurance with them, such as home and auto insurance. Bundling your insurance can help you save money.

Ask Your Insurance Company About SR22 Requirements

In some cases, your insurance company may have special requirements for SR22 car insurance. For example, some insurance companies may require that you have a certain amount of coverage or that you use a certain type of vehicle. It is important to ask your insurance company about any special requirements that they may have before you purchase SR22 car insurance. This will help you make sure that you are getting the best deal possible.

Check Online Reviews

Finally, it is important to check online reviews about different insurance companies to make sure you are getting the best deal. Reading online reviews can help you find out about any hidden fees or hidden costs that may be associated with a particular company. Additionally, online reviews can help you find out about the customer service of a particular company. Reading online reviews can help you make sure you are getting the best deal when it comes to SR22 car insurance.

Conclusion

Finding the cheapest place to get SR22 car insurance can be a challenge. However, by shopping around, looking for discounts, and checking online reviews, you can make sure you are getting the best deal. Additionally, it is important to ask your insurance company about any special requirements they may have for SR22 car insurance. By following these tips, you can make sure you are getting the best deal when it comes to SR22 car insurance.

Get SR22 Insurance After a DUI through Mid-Columbia Insurance

Cheap Commercial Insurance : A1 Insurance - Affordable Home, Auto and

Car Insurance Quotes California : California Car Insurance California

Florida Car Insurance Quotes Comparison

car insurance - cheap car insurance in ohio - Top 10 best insurance