Business Car Insurance Policy Uk

Monday, March 11, 2024

Edit

Business Car Insurance Policy UK

What Is Business Car Insurance?

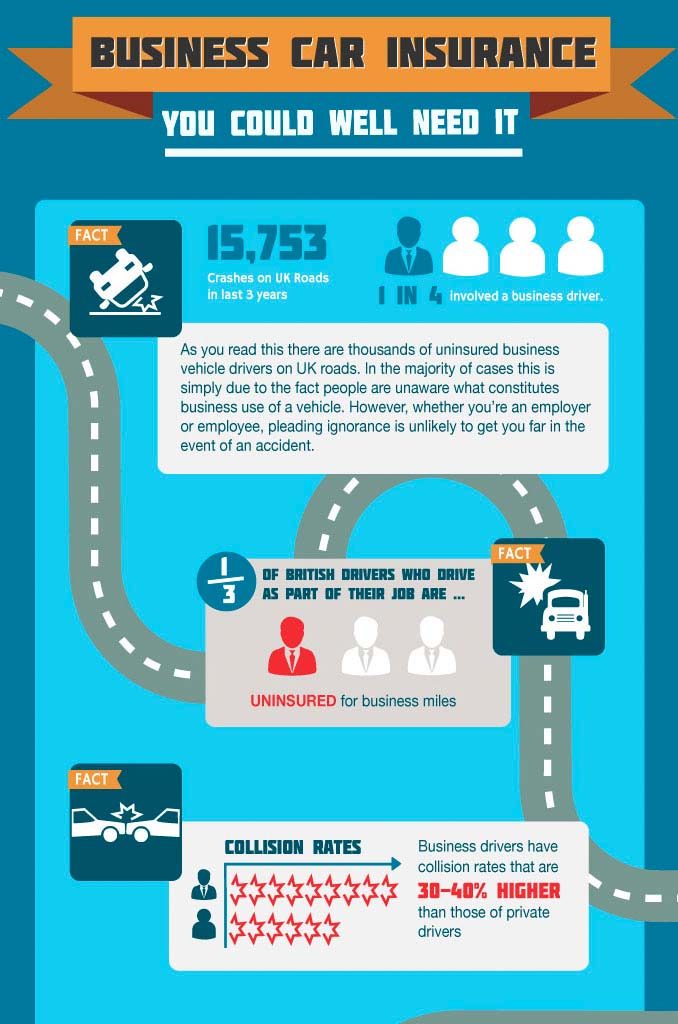

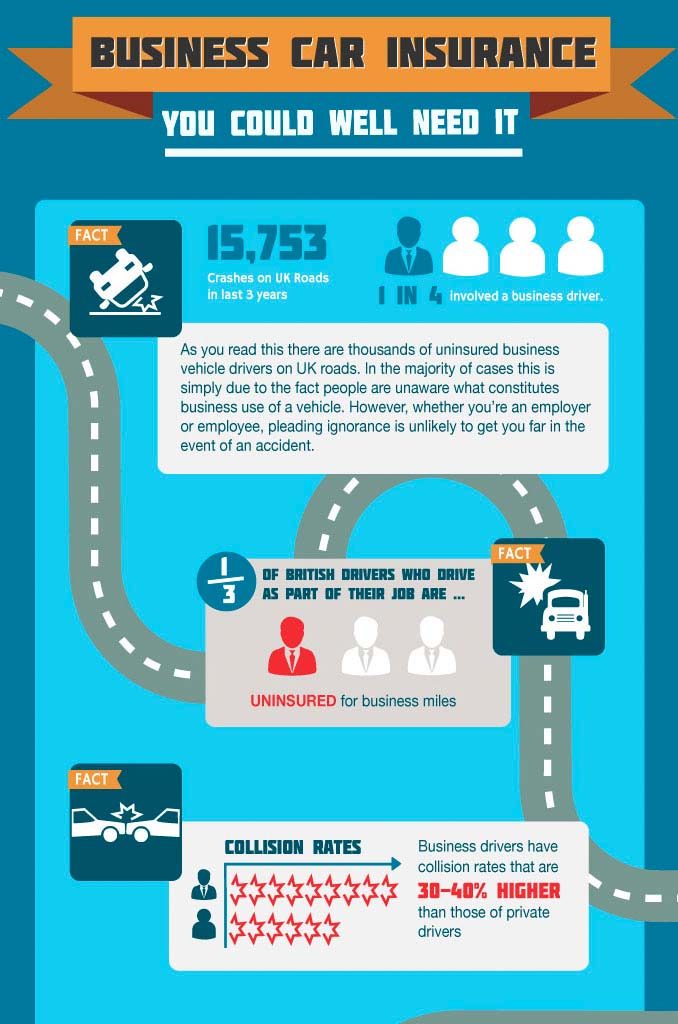

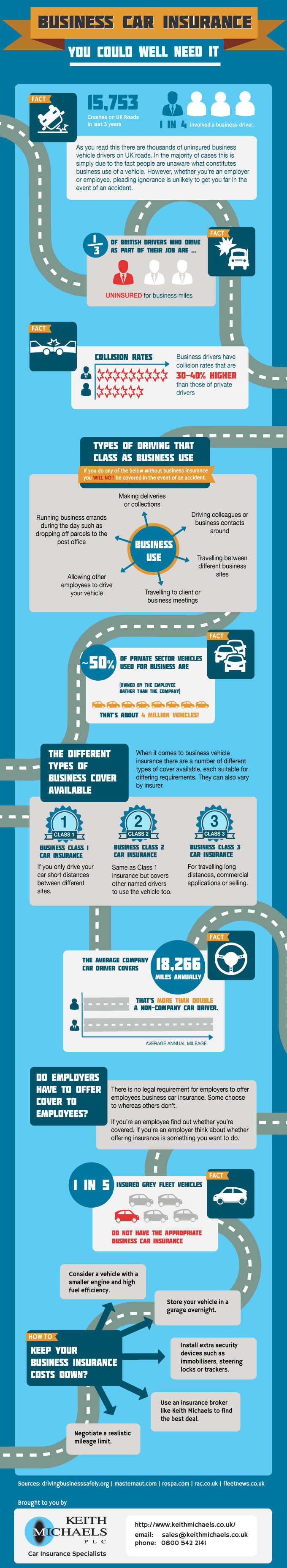

Business car insurance is a type of cover that is specifically designed to protect people who use their car for business purposes. This could include people who use their car to transport goods, as well as those who use their car for business trips. Business car insurance is usually more expensive than standard car insurance, as it offers a higher level of protection to the policyholder. It is important to note that business car insurance does not cover any damage caused to the vehicle itself, such as a collision.

What Does Business Car Insurance Cover?

Business car insurance typically covers the cost of damage to other people's property, such as another car or a building, if you cause an accident while driving your car for business purposes. It also covers the cost of medical expenses for any passengers in your car, as well as the cost of any medical treatment you may need if you are injured in an accident. Business car insurance may also cover the cost of repairs to your car, or even the cost of a replacement car if your vehicle is written off.

What Types Of Business Car Insurance Are Available?

There are several different types of business car insurance available in the UK. The most common type is third party only, which covers the cost of any damage that you cause to other people's property. This type of cover is usually the cheapest option, but it does not cover the cost of damage to your own car. Another type of cover is comprehensive, which covers the cost of damage to other people's property, as well as damage to your own car. It also covers the cost of medical expenses and other losses.

What Factors Can Affect The Cost Of Business Car Insurance?

The cost of business car insurance can be affected by a range of factors, including the type of cover that you choose and the type of car that you drive. Other factors that can influence the cost of business car insurance include your age, your driving history and the number of years that you have been driving.

Are There Any Additional Benefits To Business Car Insurance?

Yes, there are a number of additional benefits that you can get with business car insurance. Some policies will cover the cost of a replacement car if your vehicle is stolen or written off, as well as the cost of a replacement key if your car key is lost or stolen. Many policies also offer legal protection, which can cover the cost of legal fees if you are taken to court as a result of an accident that was caused by you.

How Can I Get The Best Deal On Business Car Insurance?

It is important to shop around when looking for business car insurance, as different insurers will offer different levels of cover and different prices. It can also be a good idea to use a price comparison website to compare the cost of cover from different insurers. It is also important to make sure that you read the policy documents carefully, as this will help to ensure that you are getting the right level of cover for your needs.

What is Business Car Insurance? | Business Insurance

What is Business Car Insurance? | Business Insurance | Keith Michaels

Vehicle Insurance Policy Format | Vehicle Insurance | Liability Insurance

Business Car Insurance | Compare Commercial Car Insurance Quotes at

car-insurance-policy