What Is Policy Excess In Motor Insurance

What Is Policy Excess In Motor Insurance

What Is Excess?

Excess in motor insurance is an amount you must pay if you make a claim. This amount is deducted from the total amount awarded to you by the insurer. The amount of excess you must pay varies depending on the type of policy you have, but it is typically between €100 and €500. It is important to be aware of the excess amount when you are purchasing a policy as this can affect the cost of your premium.

What Are the Different Types of Excess?

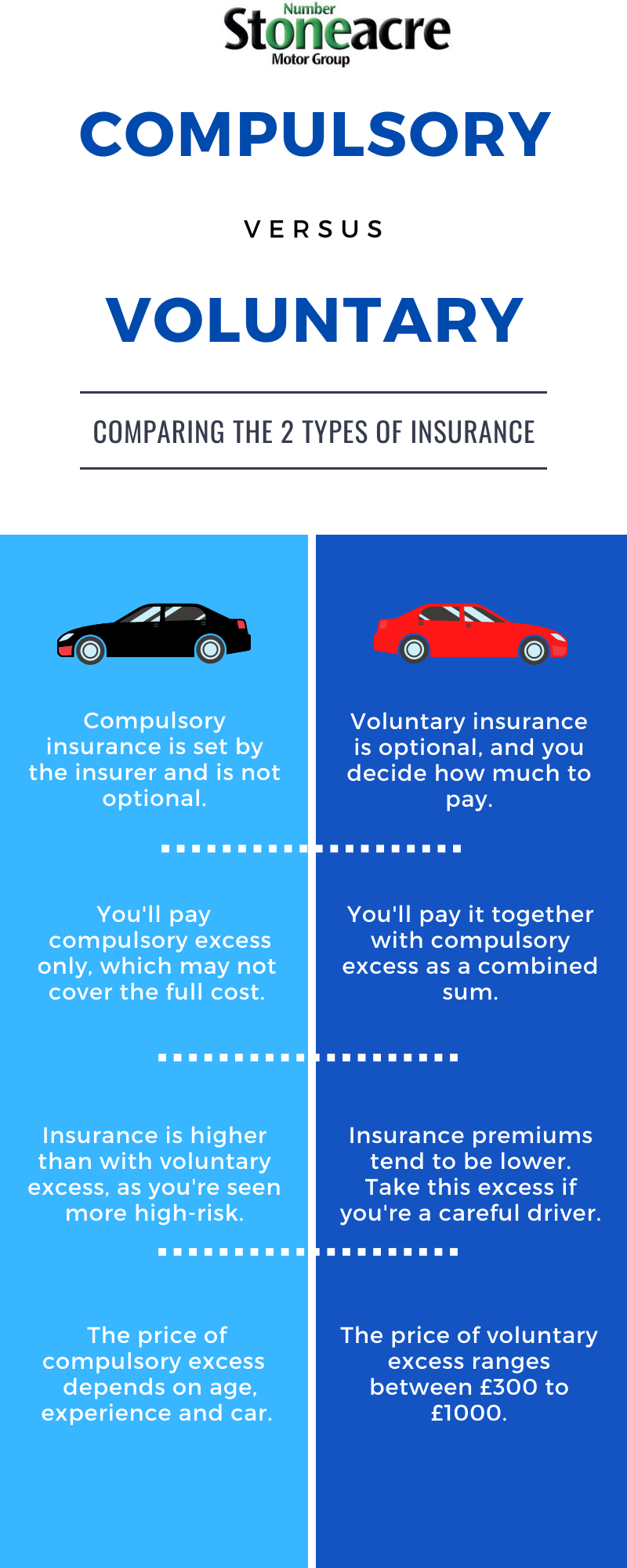

There are two main types of excess: voluntary and compulsory. Voluntary excess is an amount you agree to pay when you take out the policy. It is usually higher than the compulsory excess, but it can reduce your premium. Compulsory excess is the amount that is set by the insurer and it is usually lower than the voluntary excess.

What Are Some Examples of Excess?

The amount of excess you must pay can vary depending on the type of incident that has occurred. For example, if you have an accident and it is deemed to be your fault, you may be required to pay a higher excess than if it was the fault of the other driver. You may also be required to pay a higher excess if you have made a series of claims in a short period of time. Other examples of excess include: windscreen damage, third party property damage, and medical expenses.

What Are the Benefits of Excess?

Excess can be beneficial as it can help to reduce the cost of your premium. This can be beneficial if you are on a budget and are looking for ways to save money on your car insurance policy. Additionally, it can also help to reduce the amount of time it takes for you to receive payment for a claim as the insurer will not have to pay out the full amount.

What Should I Consider Before Agreeing to an Excess?

Before you agree to an excess, it is important to consider how much you can afford to pay. If you are on a tight budget, you may want to opt for a lower excess as this can help to reduce your premium. Additionally, you should also consider the type of incidents that are covered by the excess, as some may not be applicable to your situation. It is also important to read the terms and conditions of your policy carefully to ensure that you understand what is covered by the excess.

Conclusion

Excess in motor insurance can be beneficial as it can help to reduce the cost of your premium. However, it is important to consider the amount of excess you can afford to pay, as well as the type of incidents that are covered by the excess. By understanding these factors, you can make an informed decision about the level of excess you should agree to.

Motor Insurance excess – Compulsory and Voluntary excess | CoverNest Blog

How does car insurance excess work? - Stoneacre Motor Group

Voluntary & Compulsory Excess In Motor Insurance | Finserv MARKETS

Articles Junction: Types of Fire Insurance Polices - Meaning and

Understanding Insurance: Motor Insurance, Types and Coverage - iBanding