Generally The Higher The Deductible On An Insurance Policy The

Sunday, February 18, 2024

Edit

The Higher The Deductible On An Insurance Policy The

What Is A Deductible?

A deductible is a set amount of money that you must pay towards a claim before your insurance provider will pay the rest. The deductible can vary depending on the type of insurance you are getting, but for most insurance policies, it is a flat fee that you must pay before any claims are made. Generally, the higher the deductible, the lower the premium rate.

What Are The Benefits Of A High Deductible?

The main benefit of a high deductible is that it typically results in a lower premium rate. By opting for a higher deductible, you can reduce your monthly payments, saving you money in the long run. Additionally, by having a higher deductible, you will be less likely to make a claim, as it would require you to pay a significant amount of money out of pocket. This can be beneficial if you are not likely to make many claims, as it can save you money in the long run.

What Are The Disadvantages Of A High Deductible?

One of the main drawbacks of a high deductible is that you may be required to pay a large amount of money out of pocket if you do make a claim. This could be difficult for some people to afford, especially if the claim is for a large amount. Additionally, if you choose a higher deductible, it could take longer for the insurance company to pay the claim, as they may need to verify the full amount of the claim before they can pay out the deductible.

When Should You Choose A High Deductible?

Choosing a high deductible can be beneficial if you are not likely to make many claims, as it can save you money in the long run. Additionally, if you are in a financial situation where you can afford to pay a high deductible if you do make a claim, then it may be a good option for you. It is important to consider your individual circumstances when deciding whether or not a high deductible is right for you.

What Is The Maximum Deductible I Can Choose?

The maximum deductible you can choose will vary depending on your insurer and the type of policy you are getting. Generally, most insurers will allow you to choose a deductible up to a certain amount. It is important to speak to your insurer to find out the exact maximum deductible you can choose for your policy.

Conclusion

Choosing a higher deductible on your insurance policy can be beneficial if you are not likely to make many claims, as it can save you money in the long run. However, it is important to consider your individual circumstances before deciding whether or not a high deductible is right for you. It is also important to speak to your insurer to find out the exact maximum deductible you can choose for your policy.

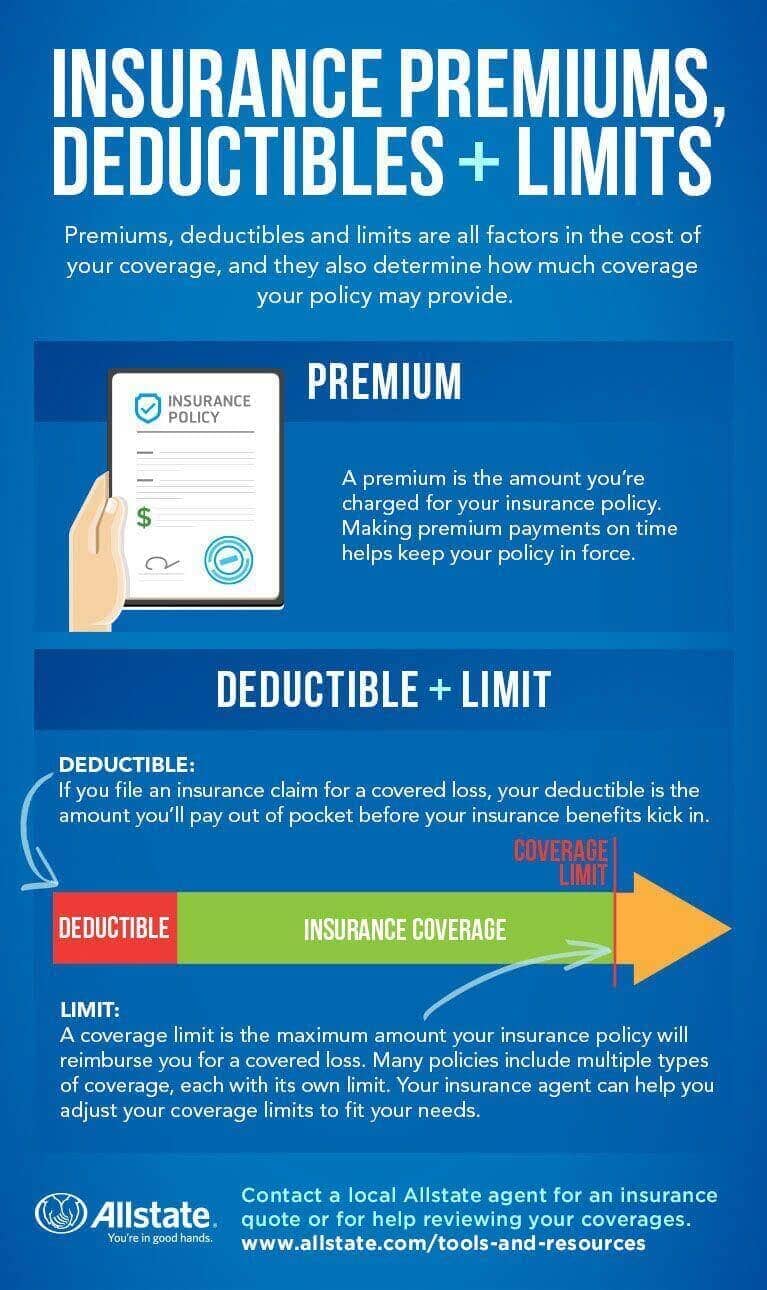

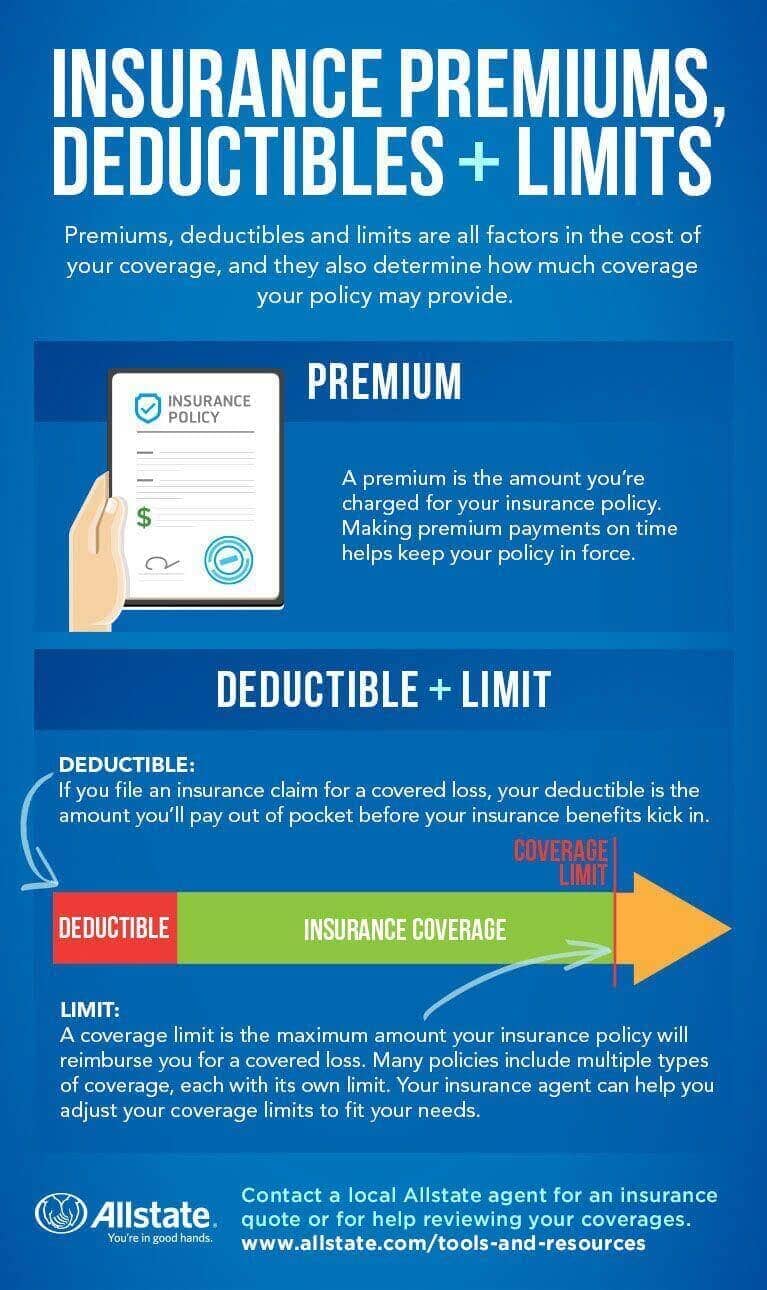

Insurance Premiums, Limits and Deductibles Defined | Allstate

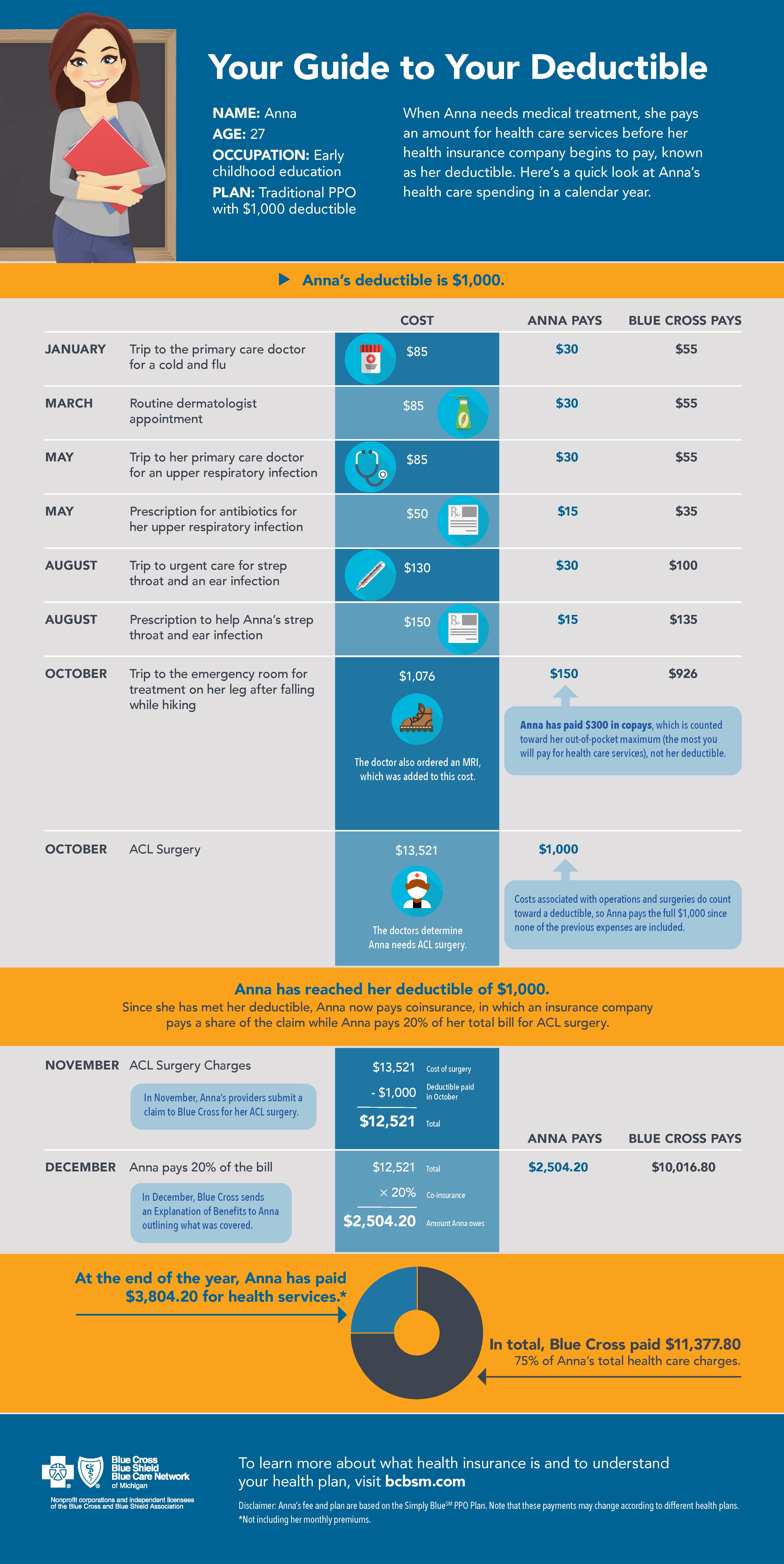

Decoding Doctor’s Office Deductibles - Blue Cross and Blue Shield of Texas

Is It Better To Have A High or Low Deductible For Health Insurance

Your Guide to Understanding Your Deductible | MIBluesPerspectives

canonprintermx410: 25 New What Does 20 Coinsurance After Deductible Mean