Average Price Of Teenage Car Insurance

Average Price Of Teenage Car Insurance

How Much Does Teenage Car Insurance Cost?

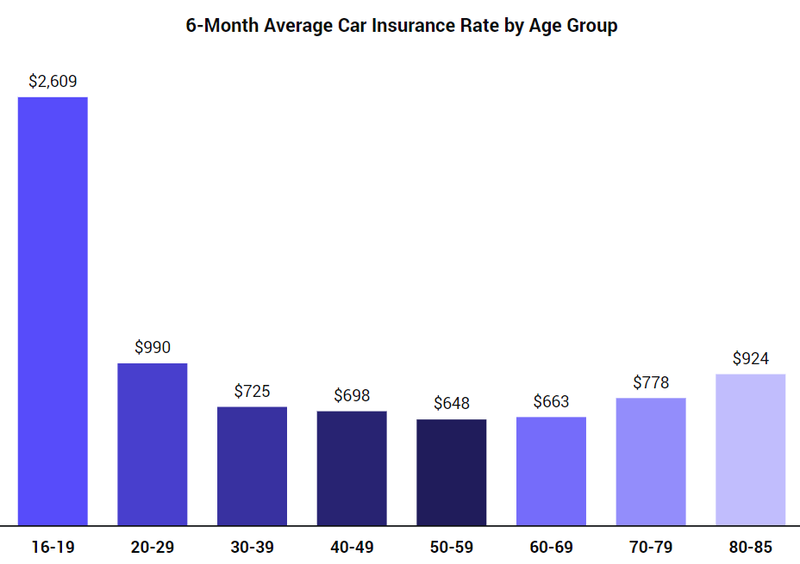

If you’re a teenager, you might be wondering how much teenage car insurance costs. The answer is that it depends on a variety of factors, such as the type of car you drive, your driving record, where you live, and many other factors. Generally speaking, teenage car insurance tends to be more expensive than adult car insurance. That’s because teenagers are considered to be higher risk drivers, which means they’re more likely to get into accidents. However, there are some things you can do to get lower car insurance rates as a teenager.

Factors That Affect Teenage Car Insurance Rates

When it comes to teenage car insurance rates, there are several factors that can affect the cost. For example, the type of car you drive can have a big impact on your rates. Cars that are newer, more expensive, and have more safety features tend to have lower insurance rates than older, cheaper, less safe cars. Additionally, your driving record can also have an effect on your teenage car insurance rates. If you have a clean driving record, you’re likely to get lower rates than someone who has a history of traffic violations or accidents.

Where You Live Matters

Where you live can also have an effect on your teenage car insurance rates. If you live in an area with higher rates of car accidents, you’ll likely pay higher rates than someone who lives in an area with low rates of car accidents. Additionally, if you live in an area with higher rates of car theft, you’ll likely pay more for teenage car insurance than someone who lives in an area with lower rates of car theft. It’s important to keep these factors in mind when comparing car insurance rates.

Discounts For Teenage Drivers

Fortunately, there are some discounts available for teenage drivers. For example, many insurance companies offer discounts for good grades. If you maintain a certain grade point average, you may be eligible for a discount on your car insurance. Additionally, some insurance companies offer discounts for taking a defensive driving course. Taking a defensive driving course can help you become a safer driver, and it can also help you get lower rates.

Shop Around For The Best Rates

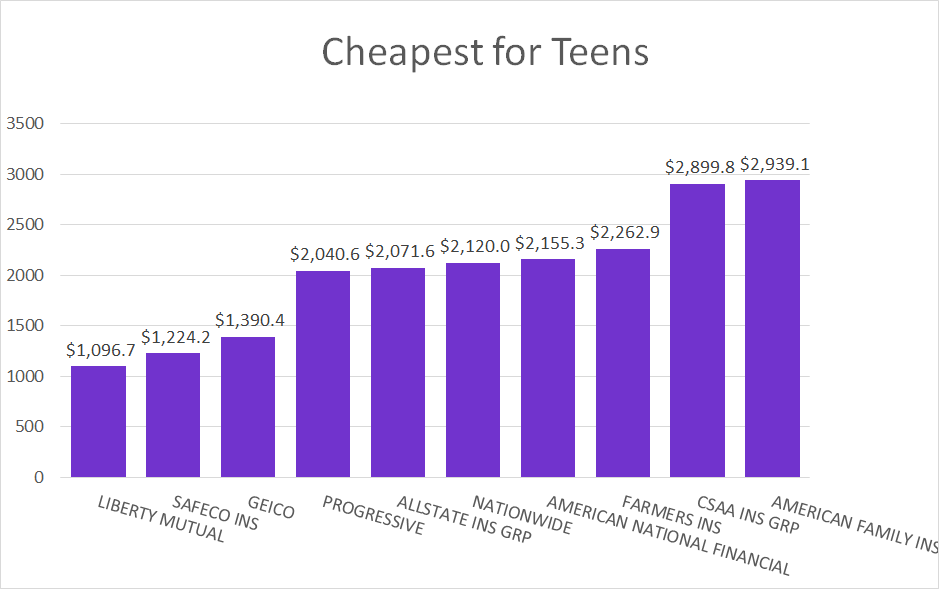

Finally, it’s important to shop around for the best rates when it comes to teenage car insurance. Different insurance companies may offer different rates, so it’s important to compare quotes from multiple companies before you decide on a policy. Additionally, some insurance companies may offer discounts for bundling policies, so it may be worth looking into if you need to purchase multiple policies. By doing your research and comparing rates, you can find the best policy for your needs.

Teenage Car Insurance Average Cost Per Month ~ artfirstdesign

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra

Teenage Car Insurance Average Cost : Best Car Insurance Rates in

Average Car Insurance Rates For 19 Year Old Male - Rating Walls

Teenage Car Insurance Average Cost : Best Car Insurance Rates in