Auto Insurance No Fault States

What Are No-Fault States for Auto Insurance?

No-fault auto insurance refers to a system of insurance in which drivers are responsible for their own losses, regardless of who was at fault for an accident. This system is used in some states in the United States, and is designed to make the process of settling claims easier and more efficient. In no-fault states, drivers must purchase personal injury protection (PIP) insurance, which pays for medical expenses, lost wages, and other costs related to an accident, regardless of who is at fault.

No-fault auto insurance has been around since the 1970s, when it was introduced as a way to reduce insurance costs, decrease the number of lawsuits, and speed up the process of settling claims. While there are currently only 12 states that have adopted some form of no-fault insurance, it has become increasingly popular in recent years as a way to reduce insurance premiums.

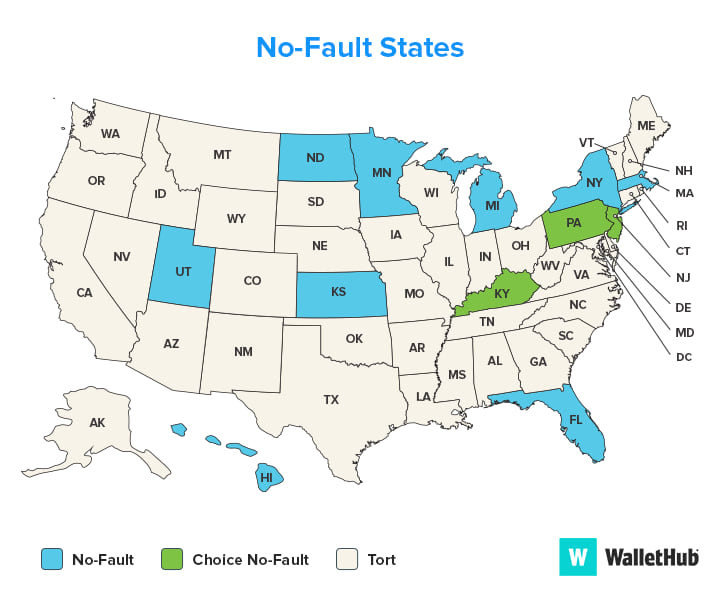

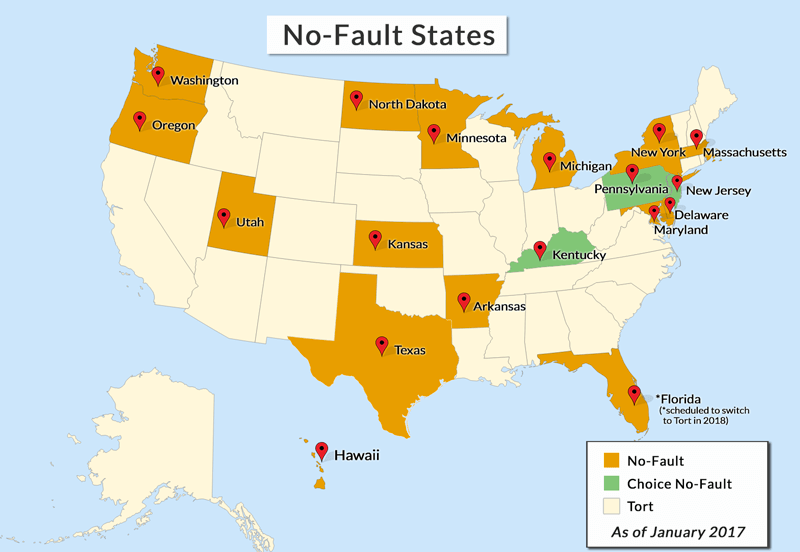

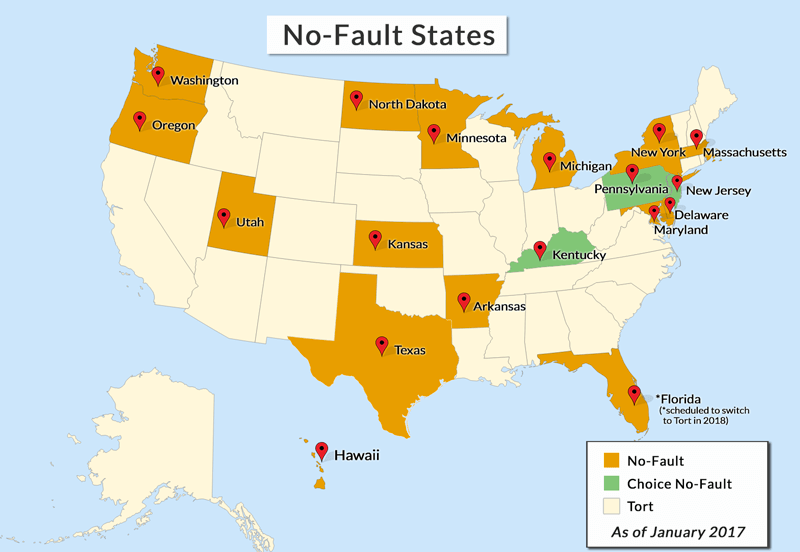

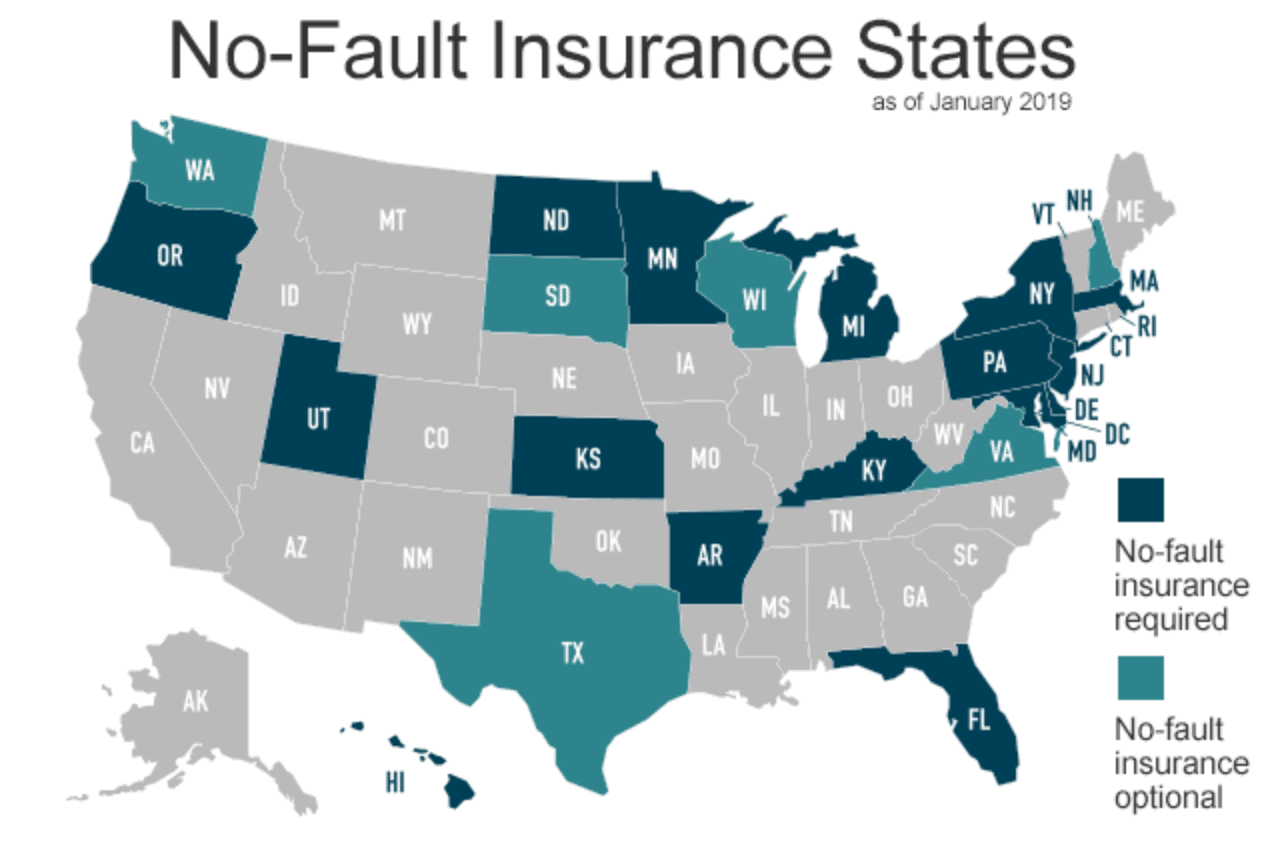

What States Are No-Fault States?

The 12 states currently using no-fault insurance are: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Each of these states has its own unique system of no-fault insurance, and the coverage requirements and limits vary from state to state.

No-fault auto insurance works differently in each of these states, but the general premise is the same. All drivers are required to purchase personal injury protection (PIP) insurance, which covers medical expenses, lost wages, and other costs related to an accident, regardless of who is at fault. This type of insurance is designed to make the process of settling claims easier and more efficient.

How Does No-Fault Insurance Work?

No-fault auto insurance works on the premise that each driver is responsible for their own losses, regardless of who was at fault for an accident. This means that if you are in an accident, you will only be able to recover from your own insurance company, rather than sue the other driver. This system is designed to make the process of settling claims faster and easier, as both drivers can recover without having to go through the long and expensive process of suing each other.

In no-fault states, drivers must purchase personal injury protection (PIP) insurance, which pays for medical expenses, lost wages, and other costs related to an accident, regardless of who is at fault. The coverage limits vary from state to state, but generally they are quite generous. In addition, some states have enacted "thresholds" that limit the ability of drivers to sue each other in certain circumstances.

Are There Any Advantages to No-Fault Insurance?

The primary advantage of no-fault insurance is that it makes the process of settling claims faster and easier. Since each driver is responsible for their own losses, they don't have to go through the long and expensive process of suing each other. In addition, no-fault insurance can also help to reduce insurance premiums, since drivers are not as likely to file frivolous claims.

Another advantage is that, since each driver is responsible for their own losses, it reduces the risk of fraud. Since drivers are not able to sue each other, they are less likely to file false claims in order to recover more money from the other driver's insurance company.

Are There Any Disadvantages to No-Fault Insurance?

The primary disadvantage of no-fault insurance is that it can limit the amount of compensation that a driver can receive in the event of an accident. Since each driver is responsible for their own losses, they may not be able to receive compensation for certain types of damages, such as pain and suffering or emotional distress.

In addition, since drivers are not able to sue each other, they may not be able to recover the full amount of their losses. This is especially true in cases where the other driver is found to be at fault, but their insurance limits are not enough to cover all of the damages.

Conclusion

No-fault auto insurance is a system of insurance in which drivers are responsible for their own losses, regardless of who is at fault for an accident. This system is used in some states in the United States, and is designed to make the process of settling claims easier and more efficient. No-fault insurance can help to reduce insurance premiums, and makes the process of settling claims faster and easier. However, it can also limit the amount of compensation that a driver can receive in the event of an accident.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

States With No-Fault Auto Insurance | Reviews.com - Infogram

What Does No-Fault State Mean? | Lerner and Rowe Injury Attorneys

How Does Car Insurance Work When You Are At Fault – Epsilonbed