Is Florida A No Fault Auto Insurance State

Is Florida A No Fault Auto Insurance State?

No-fault auto insurance laws in the United States are meant to provide a way for drivers to receive compensation for damages to their cars and other property as a result of an auto accident. In essence, no-fault auto insurance means that the insurance company of the driver who is responsible for the accident will pay for the damages, regardless of who is at fault. The no-fault system is meant to speed up the process of compensation and reduce the amount of litigation that would otherwise be necessary in order to determine who is at fault in an accident.

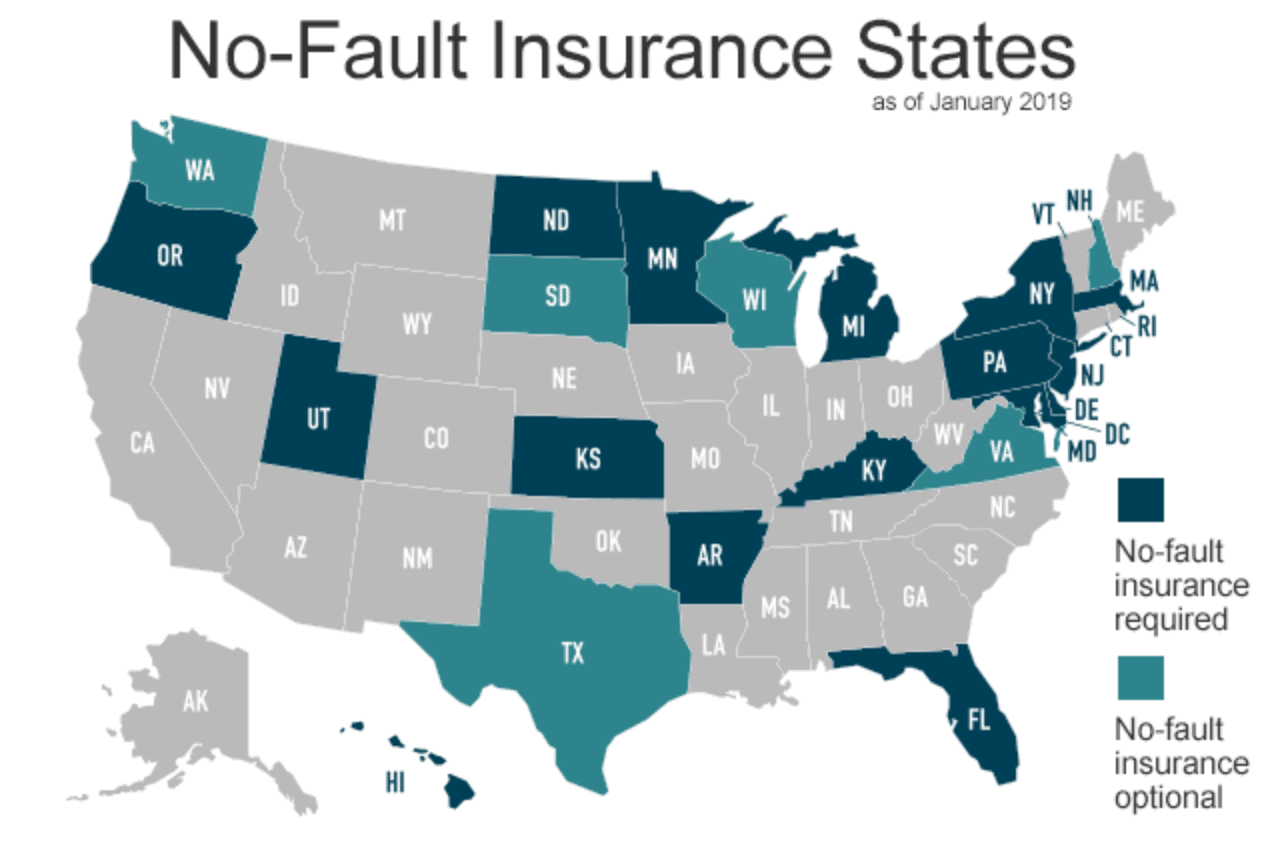

Florida is one of the states that has adopted a no-fault system of auto insurance. Florida operates under a “pure” no-fault system, which means that all drivers must carry a minimum amount of no-fault auto insurance in order to legally drive in the state. This type of insurance is known as Personal Injury Protection (PIP) and it covers medical expenses and lost wages associated with an auto accident, regardless of who is at fault. This is in contrast to a “modified” no-fault system, which allows drivers to sue for damages in certain situations.

The Benefits of No-Fault Auto Insurance in Florida

The primary benefit of no-fault auto insurance in Florida is that it speeds up the process of obtaining compensation for damages and medical expenses after an accident. Under a no-fault system, the insurance company of the driver who is responsible for the accident is responsible for paying for the damages, regardless of who is at fault. This eliminates the need to go through a lengthy legal process in order to determine who is at fault in an accident, which can be a time-consuming and costly process.

No-fault auto insurance in Florida also helps to reduce the number of lawsuits that are filed as a result of auto accidents. If a driver is injured in an accident, he or she may be eligible to receive compensation from the responsible driver’s insurance company. This eliminates the need to file a lawsuit in order to obtain compensation. In addition, the no-fault system helps to reduce the premiums for auto insurance in Florida, as the insurance companies are not required to pay out large settlements as a result of lawsuits.

Limitations of No-Fault Auto Insurance in Florida

One of the primary limitations of no-fault auto insurance in Florida is that it only applies to certain types of damages and expenses. Personal Injury Protection (PIP) insurance covers medical expenses and lost wages, but it does not cover property damage or other expenses that may be incurred as a result of an accident. In addition, PIP coverage has a limit, which means that it will only pay up to a certain amount for any given incident. If the damages or expenses exceed this limit, the driver who is responsible for the accident will be responsible for paying any additional costs.

Another limitation of no-fault auto insurance in Florida is that it does not provide any compensation for pain and suffering. This means that if a driver is injured in an accident, he or she will not be able to recover any compensation for the emotional or physical pain and suffering that was caused by the accident. In addition, no-fault auto insurance in Florida does not provide coverage for property damage that is caused by an accident.

No-fault auto insurance in Florida is meant to provide a way for drivers to receive compensation for damages and medical expenses after an accident. While it is an effective way to speed up the process of obtaining compensation, it does have some limitations. Drivers should be aware of these limitations in order to make sure that they are adequately covered in the event of an accident.

Florida No-Fault Auto Insurance Under Annual Review | Terrell • Hogan

What No Fault Car Insurance Is?

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

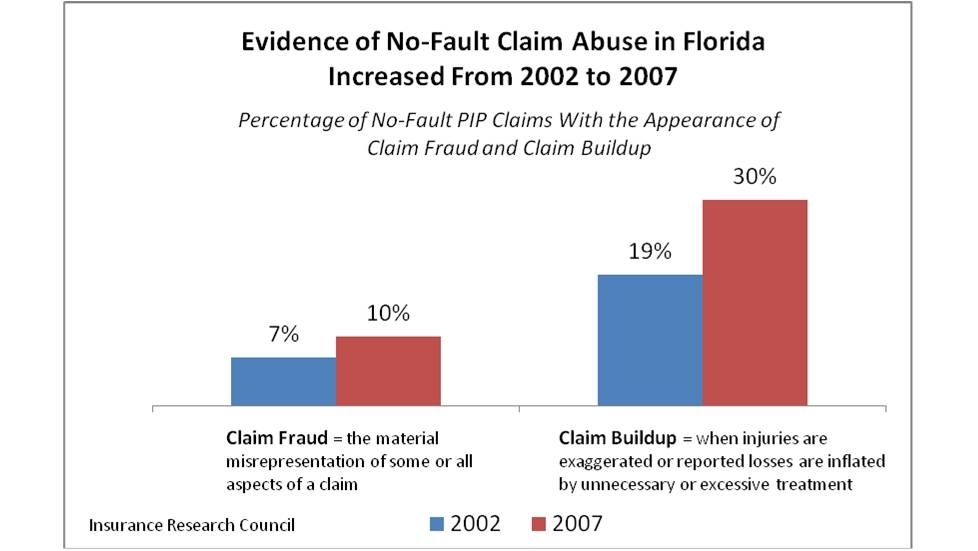

PIP Claiming Behavior and Claim Outcomes in Florida’s No-Fault

Who Pays In A Florida No-Fault? |Boca Law