Is Kansas A No Fault Auto Insurance State

Tuesday, January 9, 2024

Edit

Is Kansas A No Fault Auto Insurance State?

What Is No-Fault Car Insurance?

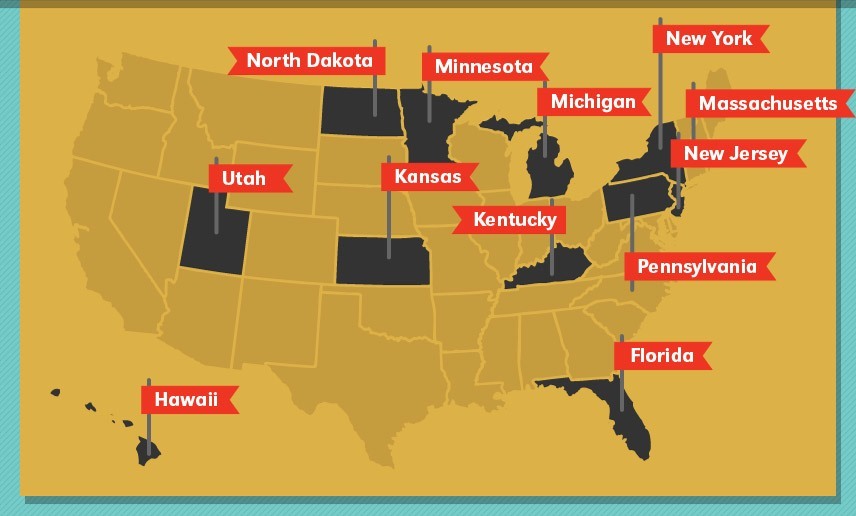

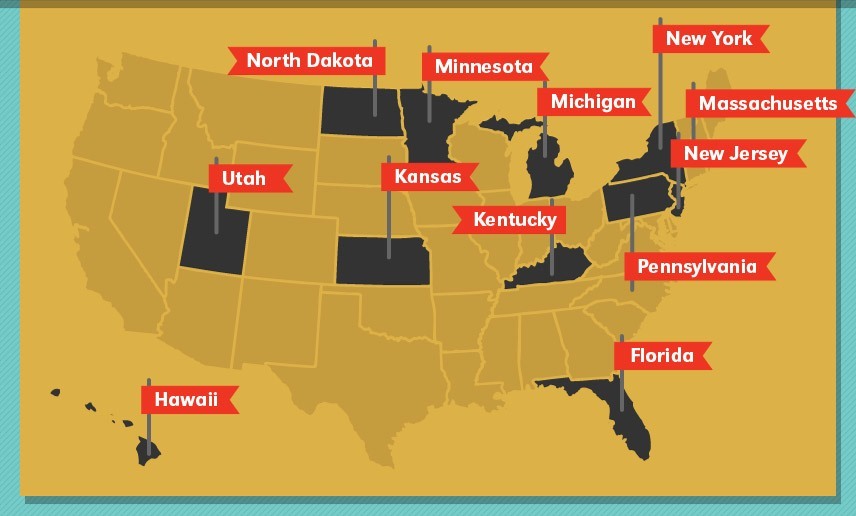

No-fault car insurance is a type of auto insurance coverage that is designed to help cover medical and other costs for those injured in an automobile accident, regardless of who is at fault for the accident. The theory behind no-fault car insurance is that when an accident occurs, the costs associated with medical expenses and other damages should be paid by the individual's own insurance policy, instead of attempting to hold the other driver liable. This type of coverage is mandatory in some states and is optional in others, while there are also some states that do not allow no-fault car insurance at all.

No-Fault Insurance In Kansas

In Kansas, no-fault car insurance is optional. This means that an individual can choose to purchase no-fault insurance coverage, or they can choose not to. If an individual does decide to purchase no-fault insurance, they will be able to take advantage of the benefits that it provides, such as being able to have their medical bills covered if they are injured in an automobile accident, regardless of who is at fault. However, if an individual chooses not to purchase no-fault insurance, they will not be able to take advantage of these benefits.

What Is Covered By No-Fault Insurance?

No-fault insurance in Kansas can provide coverage for a variety of costs associated with automobile accidents. This includes medical expenses, lost wages, and other costs that may be incurred due to the accident. In addition, no-fault insurance can also provide coverage for property damage, such as repairs to the vehicle that was damaged in the accident. No-fault insurance can also provide coverage for funeral expenses in the event that a death occurs as a result of an automobile accident.

Limitations Of No-Fault Insurance

No-fault insurance in Kansas is not without its limitations. For example, no-fault insurance does not provide coverage for any pain and suffering that may be incurred as a result of an accident. Additionally, no-fault insurance does not provide coverage for any punitive damages that may be awarded, such as in the event that a driver is found to be grossly negligent in their driving. Finally, no-fault insurance does not provide coverage for any costs associated with damage to another person's property, such as their vehicle or other personal property.

Conclusion

No-fault car insurance is an optional type of coverage in Kansas, and it can provide a variety of benefits for those who choose to purchase it. No-fault insurance can provide coverage for medical expenses, lost wages, property damage, and funeral expenses in the event of a death. However, it is important to note that no-fault insurance does not provide coverage for any pain and suffering, punitive damages, or damages to another person's property. Ultimately, whether or not no-fault insurance is a good choice depends on an individual's specific needs and situation.

Cheap No Fault Auto Insurance Quotes - Which States and What it Means

Ultimate Guide to No-Fault Auto Insurance

Car Collisions: Top Types & How Insurance Applies - Honest Policy

Is California a No-Fault State? | Glendale, CA - Megeredchian Law

2017 Auto Insurance Facts | Do You Know Massachusetts Is a No Fault