Aid For Car Insurance Teens And Drivers Education

Friday, February 23, 2024

Edit

Aid For Car Insurance Teens And Drivers Education

Why is Car Insurance Expensive For Teenagers?

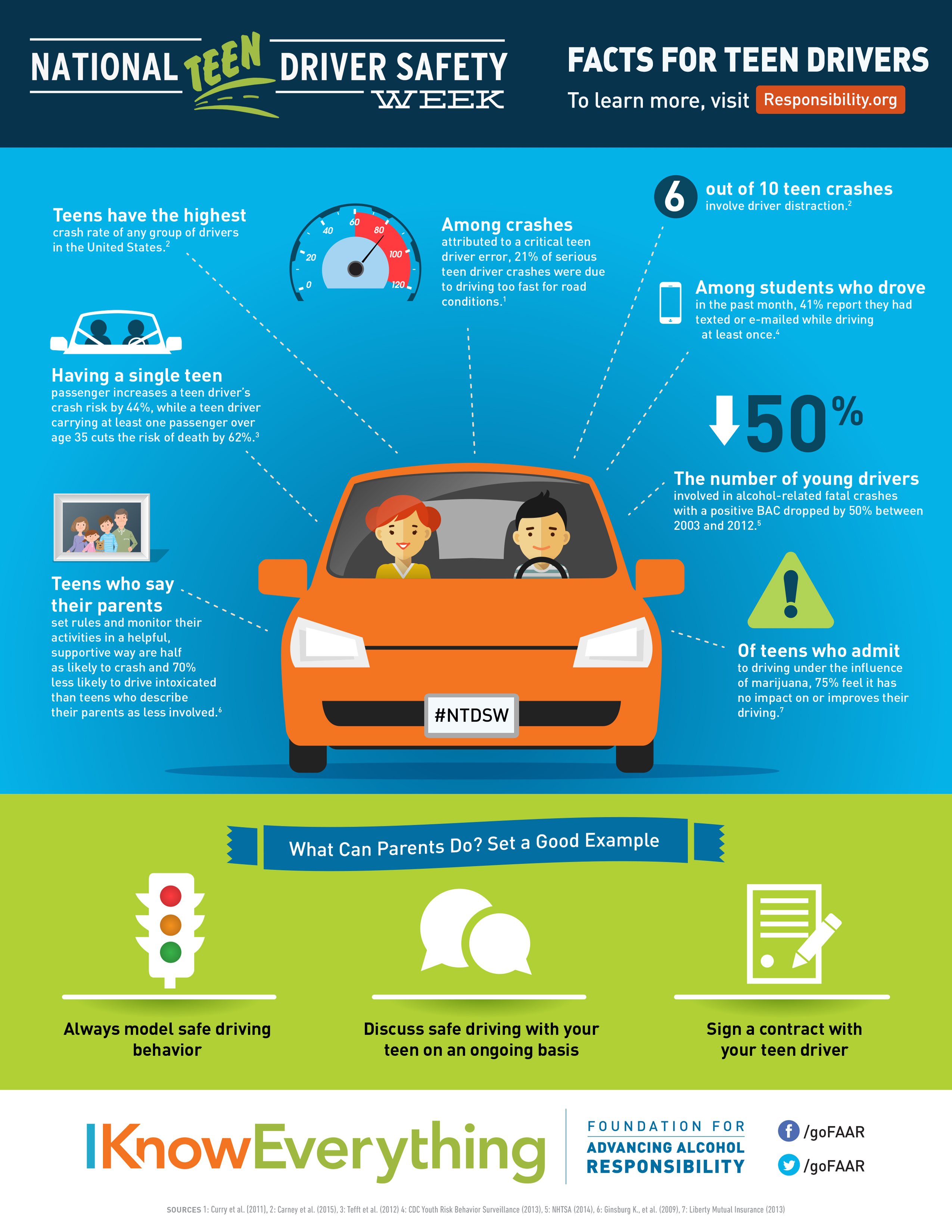

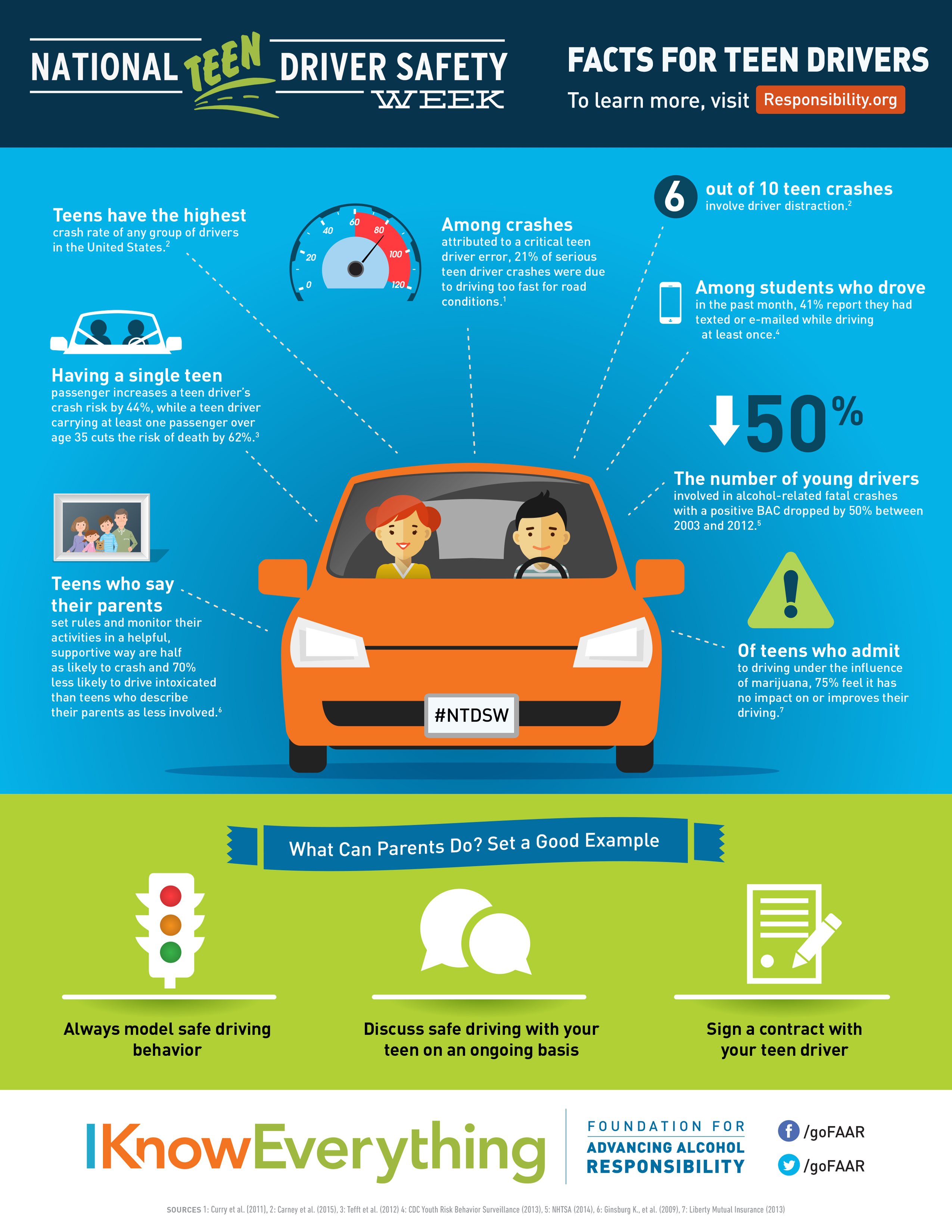

Teenage drivers are one of the riskiest groups to insure. This is due to the fact that they are inexperienced and statistically more likely to be involved in an accident. As such, car insurance companies must charge them more for coverage. Teenagers who are just beginning to drive may find that the cost of car insurance is too expensive. This can be a difficult hurdle for many young drivers and their families.

What Can Be Done To Help Lower Insurance Costs?

The good news is that there are a few things that can be done to help lower the cost of car insurance for teenagers. One of the most popular options is to take a drivers education course. Most car insurance companies offer discounts to drivers who complete an approved drivers education course. This is because drivers education courses teach young drivers the skills and knowledge they need to be safer on the road.

Another option is to get a car that is considered to be “safe”. Cars that are considered to be “safe” are usually those that are newer and have safety features such as airbags, anti-lock brakes and other safety features. Insurance companies often offer discounts to drivers who have these types of cars as they are less likely to be involved in an accident.

Other Ways To Help Reduce Insurance Costs

There are also other ways to help reduce insurance costs for teenagers. One of the most popular is to get good grades in school. Most car insurance companies offer discounts to students who maintain good grades. This is because good students are seen as being more responsible and less likely to be involved in an accident.

It is also important to maintain a clean driving record. Insurance companies look at a driver’s driving record when calculating rates. Drivers who have been in an accident or have received a ticket for a moving violation are seen as higher risk and will be charged more for coverage. It is important to avoid risky behavior such as speeding or driving recklessly in order to keep insurance rates low.

Additional Resources For Lowering Insurance Costs

There are also a few additional resources that can help lower insurance costs for teenagers. Many states offer special programs and discounts for young drivers. These programs may offer discounts on car insurance for teens who complete a driver’s education course or maintain good grades in school. It is important to research these programs and determine if they are available in your state.

It is also important to shop around for car insurance. Different insurance companies may offer different rates for the same coverage. By shopping around and comparing rates, you may be able to find a better deal on car insurance for your teenager.

Conclusion

Car insurance for teenagers can be expensive but there are a few things that can be done to help lower the cost. Taking a drivers education course and maintaining good grades in school are two of the best ways to get a discount on car insurance. Additionally, shopping around for car insurance and taking advantage of any special programs available in your state can also help lower rates.

National Teen Driver Safety Week - Responsibility.org

Auto Insurance | Teen Drivers - YouTube

Trends in teen driver safety | Safe Driving Infographs | Pinterest

Pin on Teen Driver Safety