What Is An Sr22 Insurance

What Is An Sr22 Insurance?

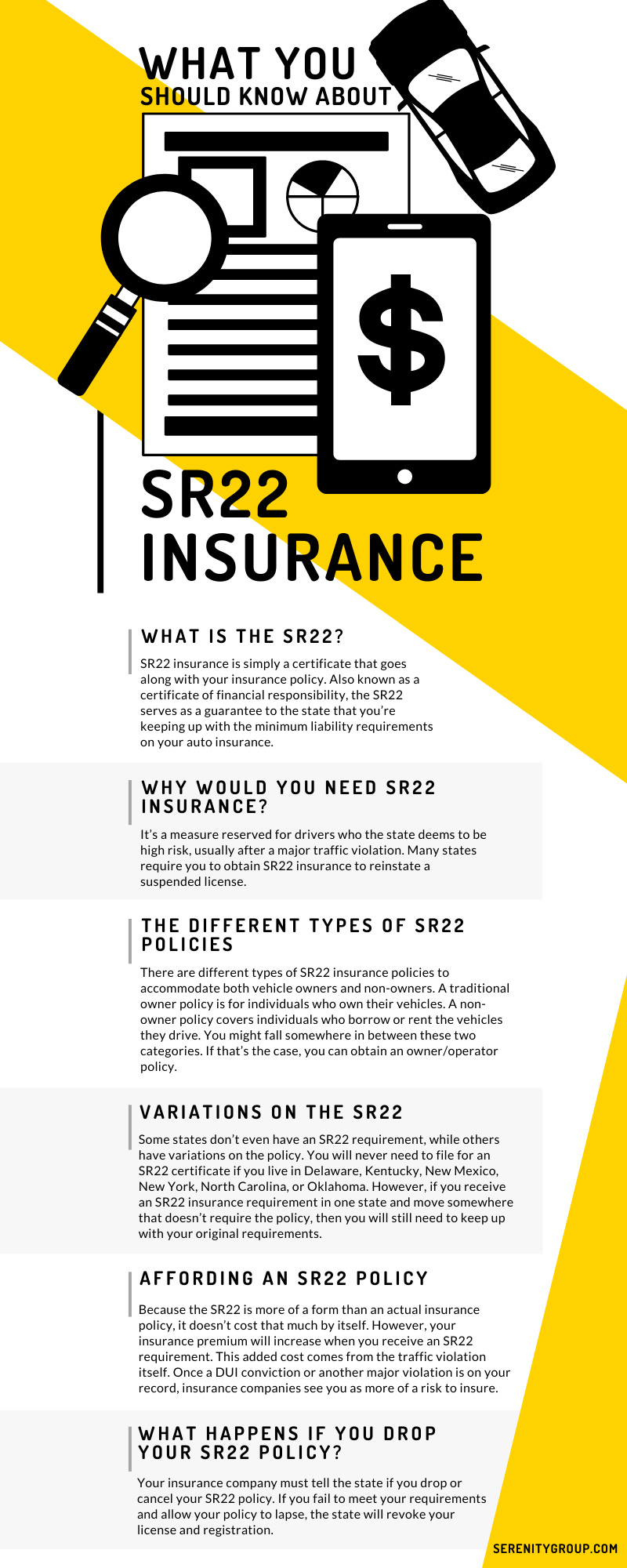

Are you in the market for car insurance or heard about SR22 insurance? You may be wondering, what is an SR22 insurance and do you need one? The purpose of this blog is to help explain what an SR22 insurance is and when you may need it.

What Is SR22 Insurance?

SR22 insurance is a type of liability insurance that is typically required by the Department of Motor Vehicles (DMV) in order to have your driver’s license reinstated. It is not a type of insurance coverage; rather it is a form that is filed by your insurance company with the DMV to prove that you are carrying the minimum amount of liability insurance coverage required by your state.

The SR22 form is also known as a Certificate of Financial Responsibility (CFR). It’s not a type of auto insurance coverage, but rather a certificate that is issued by your auto insurance company which verifies that you have the minimum liability coverage required by your state.

When Do You Need SR22 Insurance?

You may need SR22 insurance if you’ve been convicted of certain driving offenses such as driving under the influence (DUI), driving without insurance, or reckless driving. Depending on the offense, the DMV may require you to file an SR22 form with the DMV to prove that you have the required minimum liability insurance coverage.

In addition, if you have had your license suspended due to a lack of insurance or another offense, the DMV may require you to obtain an SR22 from your insurance company to have your license reinstated.

How Much Does SR22 Insurance Cost?

The cost of SR22 insurance varies depending on the type of offense you committed and your driving record. Generally, if you’ve had multiple violations or accidents, you will be charged a higher rate. In addition, the cost of SR22 insurance varies from company to company, so it pays to shop around to find the best rate.

It’s important to note that SR22 insurance is not required in all states. If you’re required to obtain SR22 insurance in your state, the DMV will provide you with instructions on how to do so.

Conclusion

In summary, SR22 insurance is a type of liability insurance that is required by the Department of Motor Vehicles in order to reinstate your driver’s license. It is not a type of insurance coverage, but rather a form that is filed by your insurance company with the DMV to prove that you have the required minimum liability insurance coverage. The cost of SR22 insurance varies depending on the type of offense you committed and your driving record. It’s important to note that SR22 insurance is not required in all states.

What Is SR22 Insurance and How Do You Get it? – Car News

SR22 Insurance: What Does It Cover? | EINSURANCE

SR22 California Insurance, SR 22 Forms & Requirements - Raisinsurance

SR22 Insurance - YouTube

What You Should Know About SR22 Insurance