Typical Car Insurance Cost In Nc

Wednesday, January 10, 2024

Edit

Typical Car Insurance Cost In NC

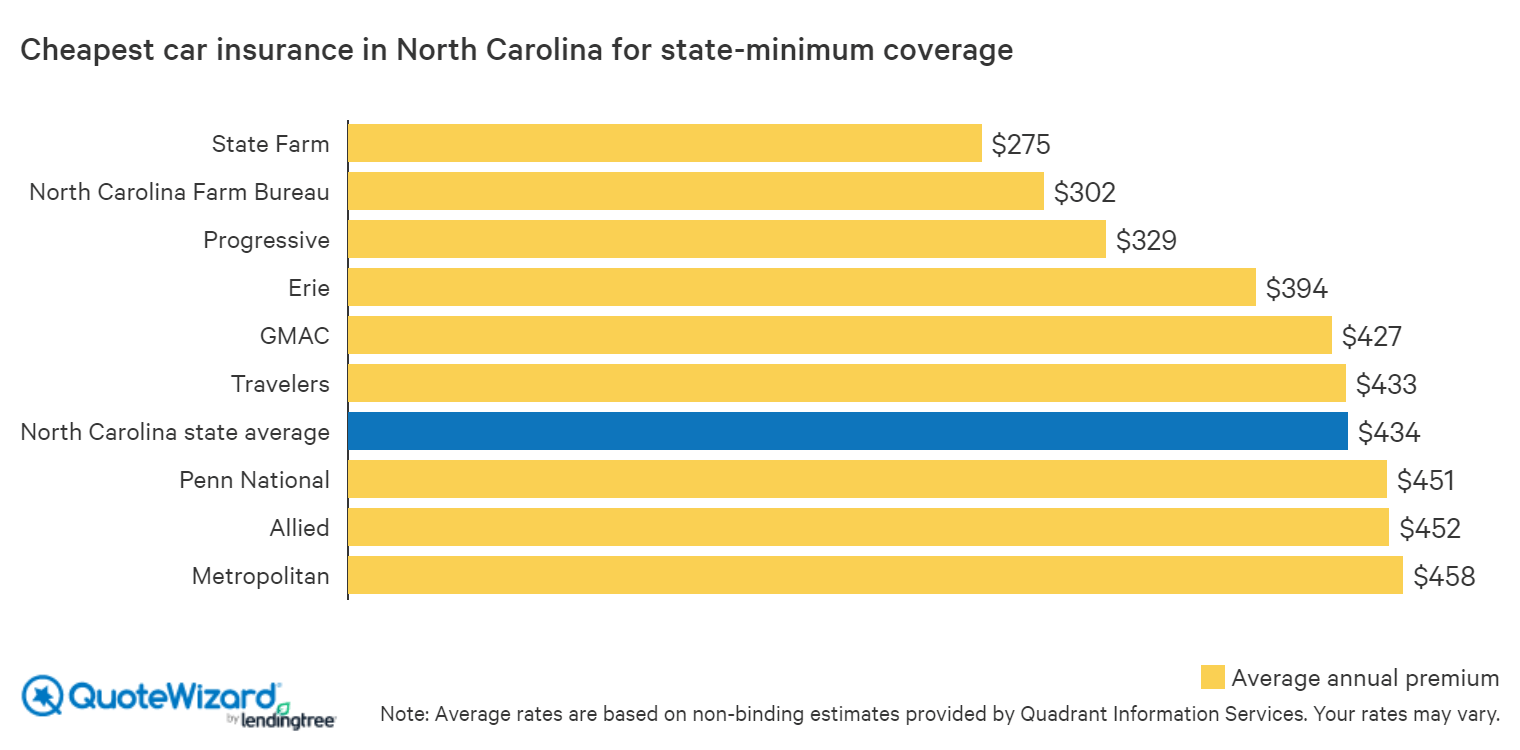

What Factors Impact The Cost of Car Insurance in NC?

When you're shopping for car insurance in North Carolina, there are a variety of factors that can impact the cost of your policy. Some of these factors include your age, driving record, the make and model of your vehicle, and the type of coverage you choose. Additionally, the area where you live may also affect the cost of your car insurance.

How Much Does Car Insurance Cost On Average In NC?

According to recent data, the average cost of car insurance in North Carolina is around $1,000 per year. However, this figure varies depending on the factors mentioned above. For instance, younger drivers tend to pay higher rates than older drivers, and those with a clean driving record can usually get lower rates than those with a history of accidents or tickets.

What Are The Minimum Car Insurance Requirements In NC?

In North Carolina, all drivers must carry liability insurance. This type of coverage helps to protect you financially in the event of an accident in which you are at fault. The minimum liability insurance requirements in NC are $30,000 for bodily injury for each person involved in the accident, $60,000 for total bodily injury for all persons involved, and $25,000 for property damage.

What Other Types Of Coverage Are Available In NC?

In addition to liability coverage, you can also purchase optional coverage such as collision, comprehensive, and uninsured or underinsured motorist coverage. Collision coverage helps to pay for the repairs to your vehicle in the event of an accident, while comprehensive coverage helps to cover damages caused by non-accident related events such as theft or vandalism. Uninsured or underinsured motorist coverage helps to protect you financially in the event that you are in an accident with an individual who does not have adequate insurance coverage.

Can I Get Discounts On My Car Insurance In NC?

Yes, there are several ways to get discounts on your car insurance in North Carolina. For instance, if you have a clean driving record, you may be eligible for a good driver discount. Additionally, if you have multiple vehicles on the same policy, you may be eligible for a multi-car discount. Lastly, some insurance companies offer discounts for being a student or a member of certain organizations or clubs.

Where Can I Find The Best Car Insurance Rates In NC?

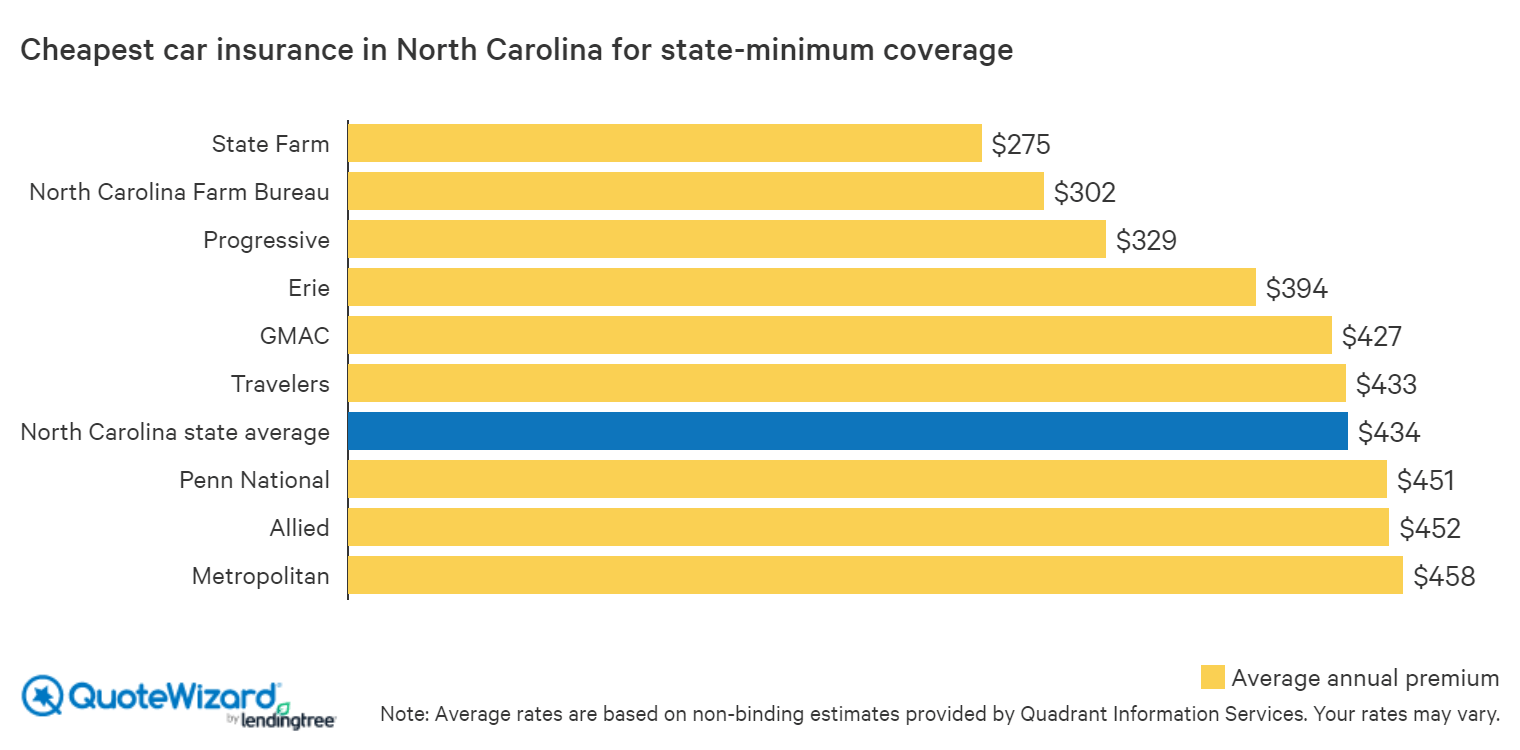

The best way to find the best car insurance rates in North Carolina is to shop around and compare quotes. Start by getting quotes from several different insurance companies and then compare the coverage and the price. You should also make sure to look at factors such as the company's customer service ratings and financial stability. By doing your research and comparing quotes, you can find the best car insurance policy for your needs at the best possible rate.

Cheap Car Insurance in North Carolina | QuoteWizard

What Is The Minimum Auto Insurance Coverage In North Carolina in 2021

North Carolina Car Insurance Rates - North Carolina Auto Insurance

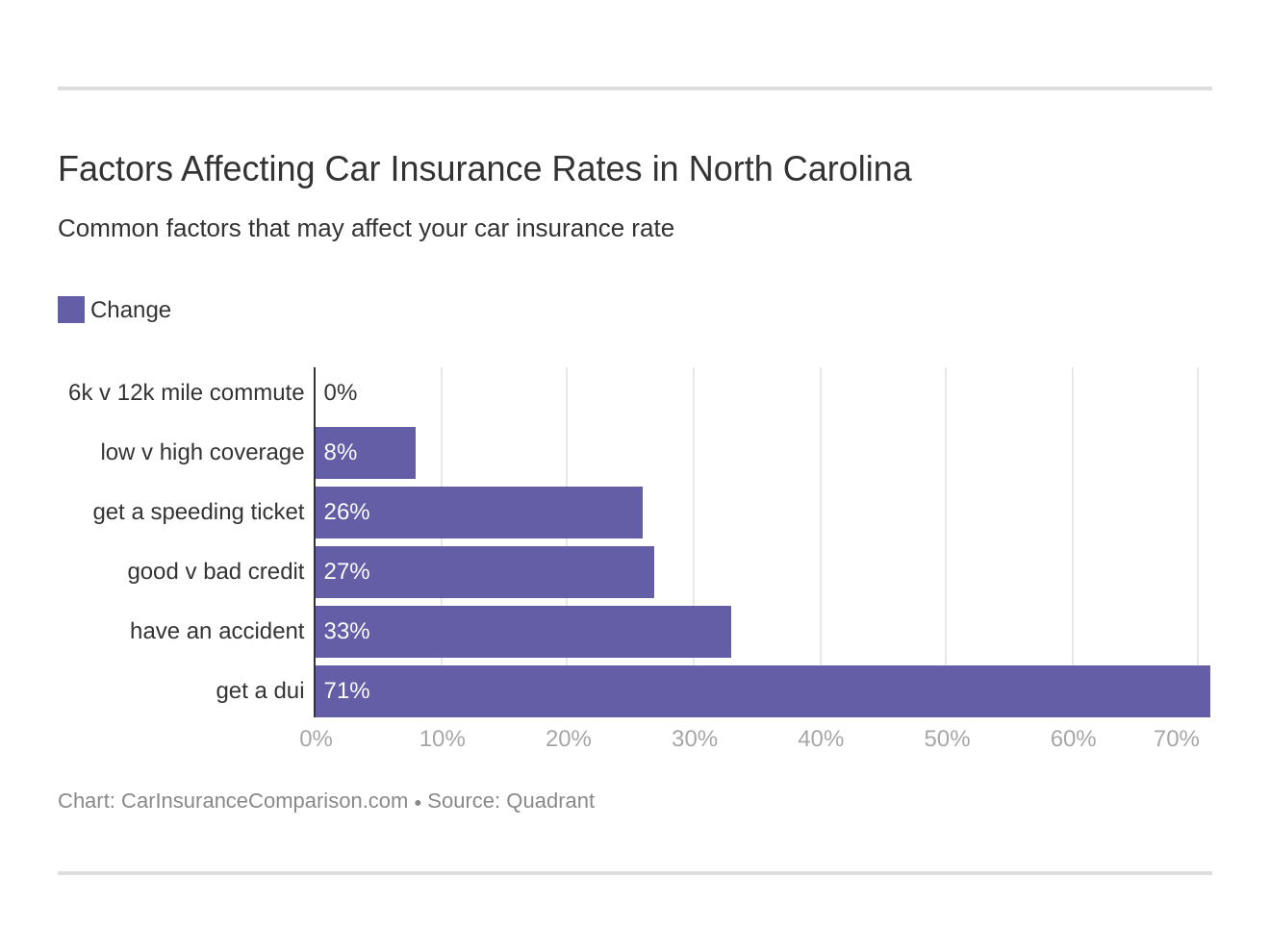

Hidden Costs of Canceling Car Insurance by State

The average cost of car insurance in the US, from coast to coast