Home Health Care Liability Insurance Coverage

Home Health Care Liability Insurance Coverage: What You Need to Know

Home health care liability insurance is a must-have for anyone providing health care services in the home. It protects the provider from potential legal action and financial losses due to errors in providing care. It is important to understand the scope of coverage and responsibilities when selecting an insurance policy. Here are some things you need to know about home health care liability insurance coverage.

What Does Home Health Care Liability Insurance Cover?

Home health care liability insurance covers the provider from liability due to negligence or mistakes made while providing care. It is important to understand that this insurance does not cover intentional misconduct or criminal acts. It also does not cover medical malpractice or product liability claims. The coverage is limited to the actual services provided and does not cover damages caused by the use of defective products or equipment.

Who Is Covered?

Home health care liability insurance covers the provider, as well as any employees or volunteers who provide services in the home. This is important because it ensures that everyone involved in providing care is protected from potential legal action. It is also important to note that the insurance policy should cover any third parties involved in providing care, such as suppliers and contractors.

What Does the Policy Cover?

The policy should cover all aspects of providing home health care, including liability for errors made while caring for the patient. This includes any errors made in providing services, such as administering medications or providing medical advice. It should also cover any equipment or products used in providing care, such as medical supplies. The policy should also provide coverage for any claims arising from the use of the equipment or products.

What Is Not Covered?

The policy typically does not cover any intentional misconduct or criminal acts. It also does not cover medical malpractice claims or product liability claims. Additionally, it does not cover any damages caused by the use of defective products or equipment. The policy may also not cover any claims arising from the use of the equipment or products.

Conclusion

Home health care liability insurance is an essential component of providing home health care services. It is important to understand the scope of coverage and responsibilities when selecting an insurance policy. This will ensure that the provider is adequately protected from potential legal action and financial losses due to errors in providing care. With the right policy in place, providers can have peace of mind when providing care in the home.

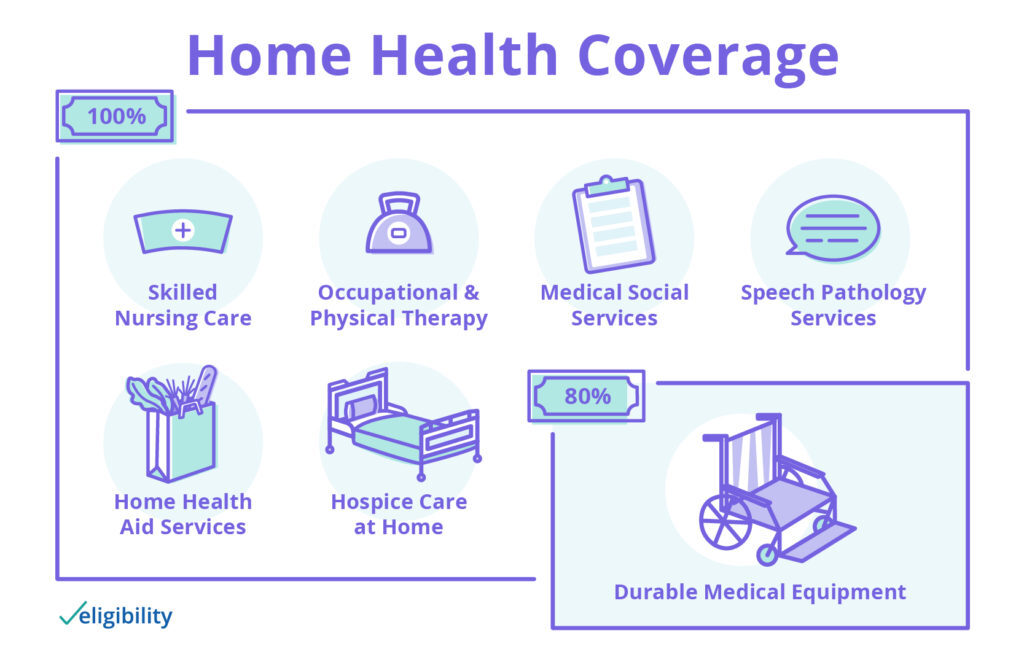

Medicare Coverage of Home Health Care | Eligibility

Five Things You Need to Know About Home Insurance Liability Coverage

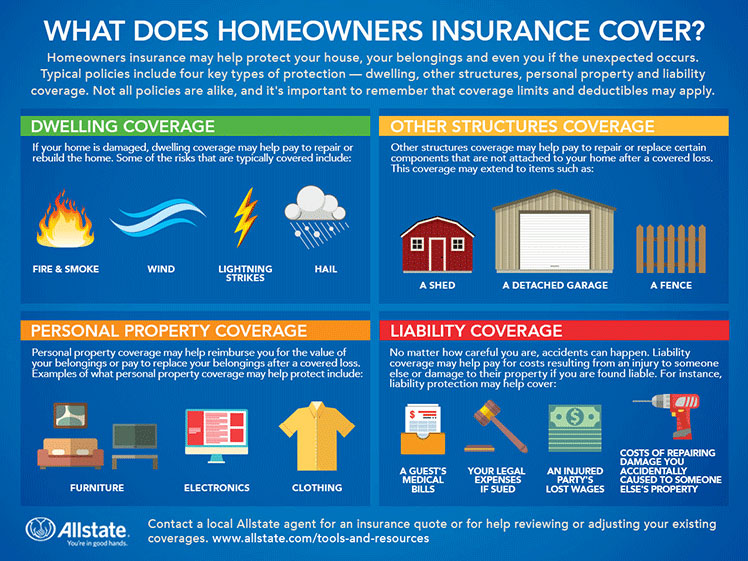

Homeowners Insurance 101 | Allstate

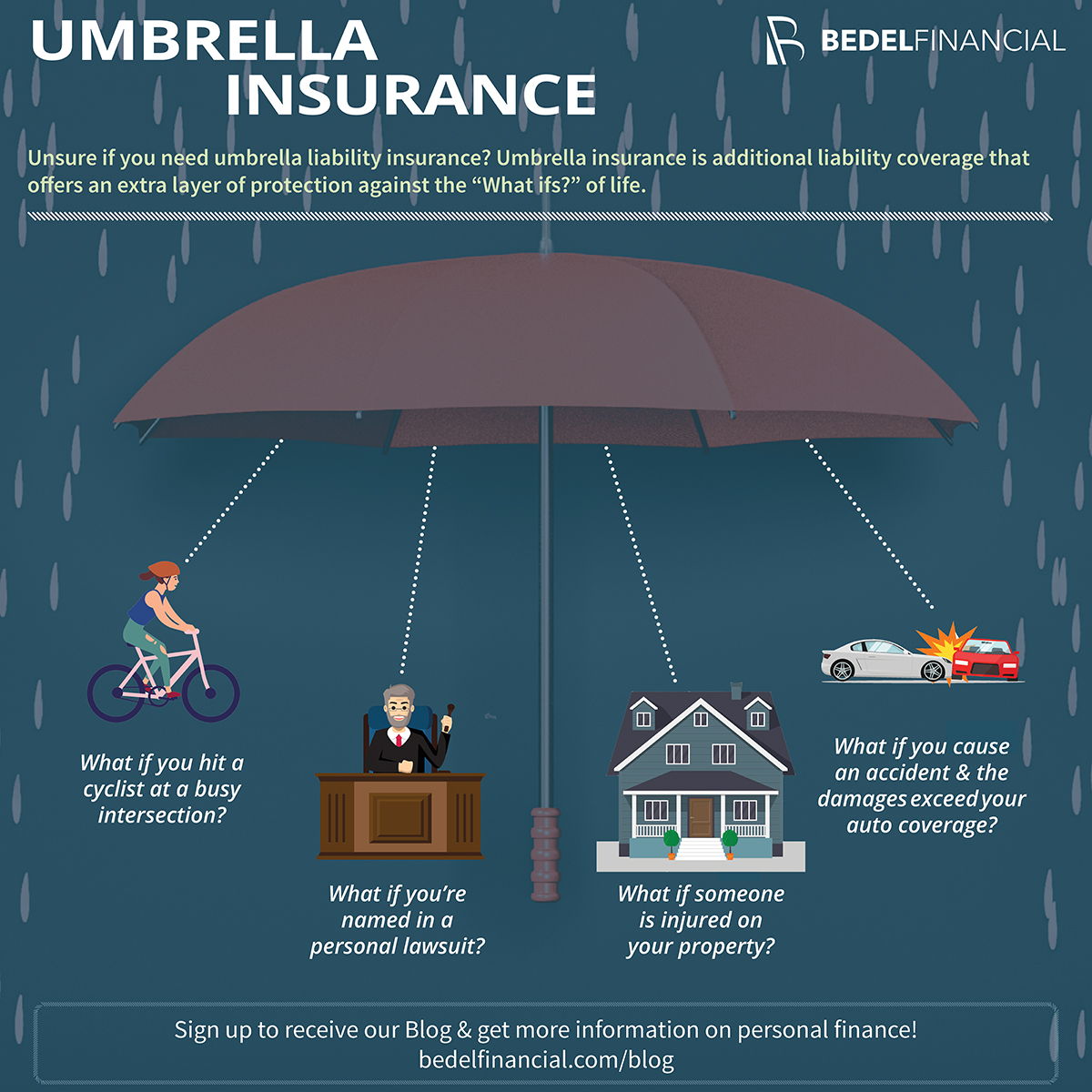

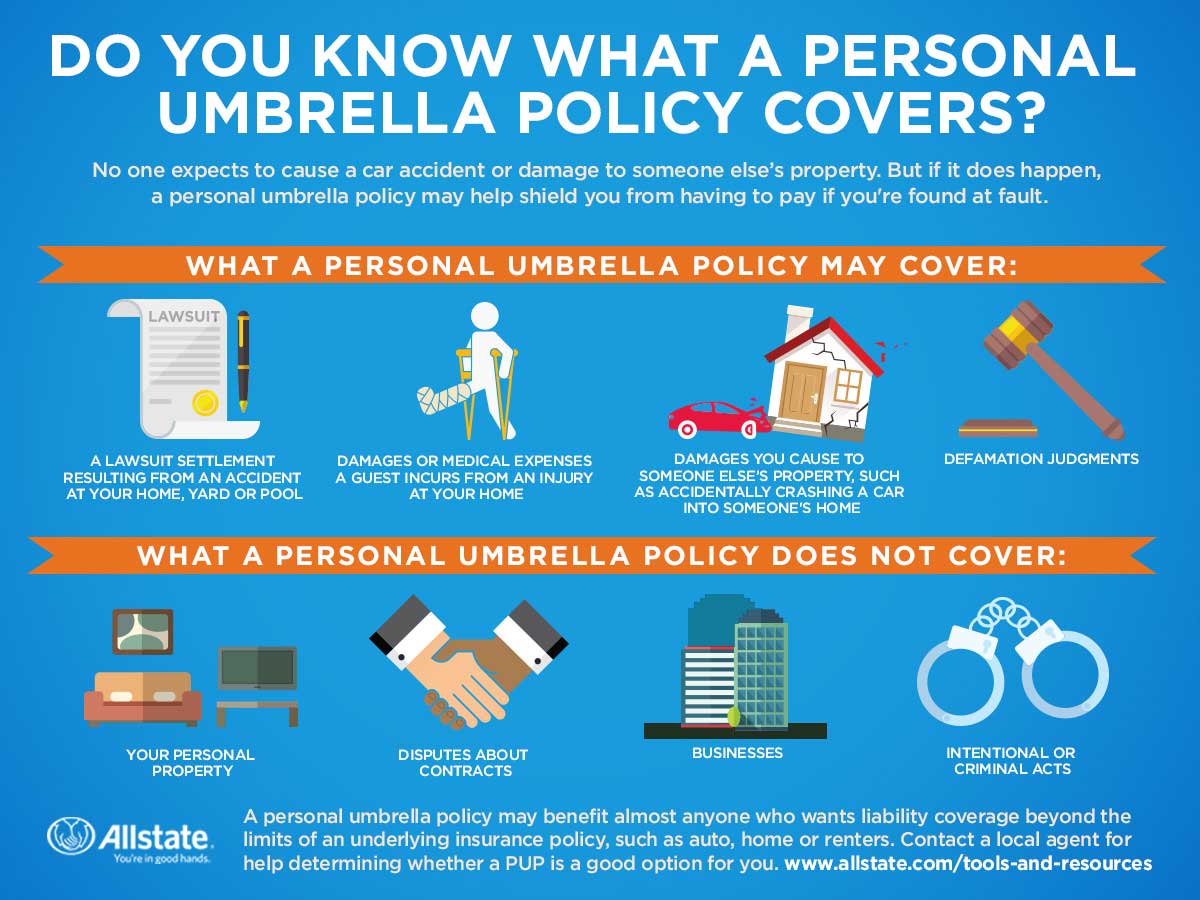

What Does a Personal Umbrella Policy Cover? | Allstate

What is Umbrella Liability Insurance and Do You Need It?