How To Lower Car Insurance

How To Lower Car Insurance

Make Sure Your Credit Score Is Accurate

Your credit score is a powerful tool used by insurers to determine your car insurance rates. Before shopping around for car insurance, make sure that your credit score is accurate. Check your credit report for errors, and make sure that all of your credit accounts are up-to-date. If there are discrepancies on your credit report, resolve them immediately. Your credit score can be an important factor in determining the rates you are offered.

Compare Multiple Car Insurance Quotes

Once you have ensured that your credit score is accurate, it's time to shop around for car insurance quotes. Compare multiple quotes from different insurance providers to make sure you are getting the best rate. Make sure to include multiple types of coverage in your quote comparison. This will help you to determine which insurance company offers the most comprehensive coverage at the lowest cost. Don't be afraid to leverage your research to negotiate the best rate with your insurance provider.

Raise Your Deductible

One of the easiest ways to lower your car insurance rates is to raise your deductible. A deductible is the amount of money that you must pay out of pocket before your insurance company will cover the remainder of the cost. The higher the deductible, the lower the monthly premium. However, you should make sure that you can afford to pay the deductible before raising it.

Drive Safely and Avoid Speeding Tickets

Your driving record is one of the most important factors in determining your car insurance rates. Make sure to drive safely and obey all traffic laws. Avoid speeding tickets and other traffic violations, as they will lead to higher car insurance rates. If you have had a few tickets, consider taking a defensive driving course to reduce the impact on your insurance rates.

Pay Your Premiums On Time

It is important to pay your car insurance premiums on time. Late payments may result in a penalty or increase in your rates. Set up automatic payments for your insurance premiums to ensure that they are paid on time. If you are having trouble affording your premiums, talk to your insurance provider about payment plans or discounts.

Choose the Right Vehicle

The type of vehicle you choose can have a big impact on your car insurance rates. Generally, vehicles with high safety ratings and low theft rates will have lower insurance premiums. If you are in the market for a new car, make sure to do your research before making a purchase. Ask your insurance provider for a list of vehicles that qualify for discounts. By choosing the right vehicle, you can significantly reduce your car insurance rates.

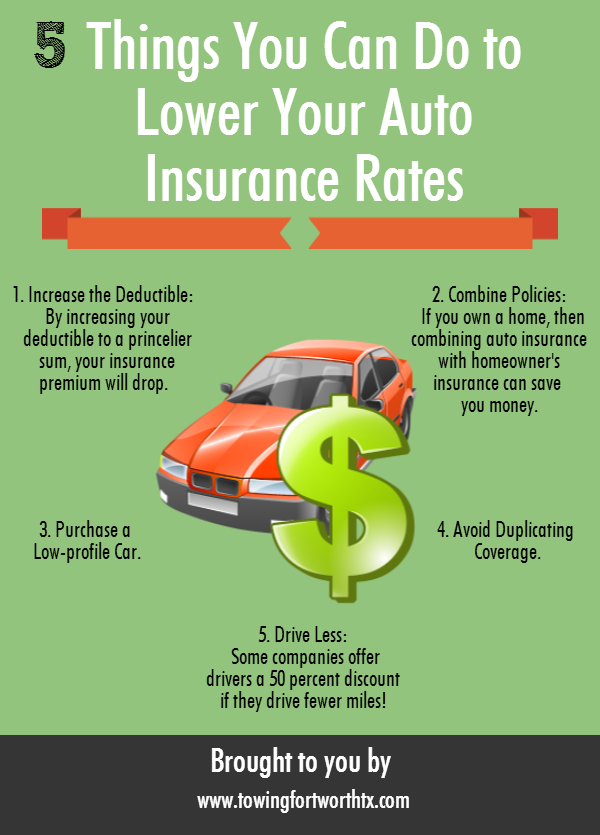

INFOGRAPHIC: 5 Ways to Reduce Car Insurance - rateGenius

Lower Your Auto Insurance Rates with 5 steps

Six Tricks To Help Lower Your Car Insurance Rate

Lower Car Insurance: 11 Ways to Avoid Overpaying Your Insurer | Car

How to lower car insurance: 7 tips to help you save now