How To Lower Car Insurance Quotes

How To Lower Car Insurance Quotes

1. Comparison Shopping

Car insurance is one of the most important investments you can make as a car owner. With the right coverage, you can protect yourself and your vehicle from financial loss in the event of an accident. Unfortunately, it can also be one of the most expensive investments, which is why it is so important to shop around and compare car insurance quotes from different providers. Comparison shopping can be a great way to save money on car insurance, as each company may offer different rates and discounts. To get the best deal, it is important to compare quotes from several different companies.

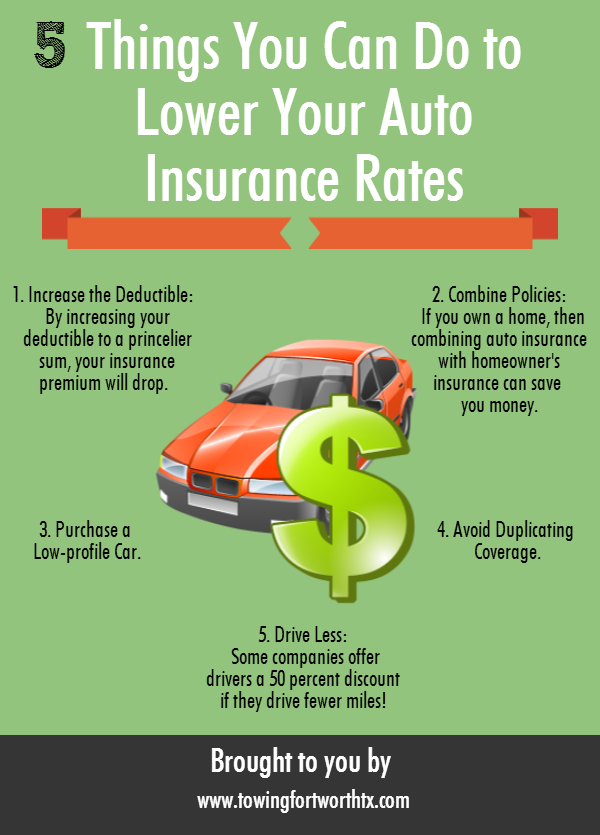

When researching car insurance quotes, be sure to look at the coverage and the cost of premiums. Pay attention to any discounts that may be offered, such as a multi-policy discount if you purchase both auto and homeowners insurance from the same provider. Also, look at the deductible amount, which is the amount of money you must pay out-of-pocket in the event of an accident before your insurance company pays out. A higher deductible can mean lower premiums, so be sure to consider this when comparing quotes.

2. Choose a Safe Car

The type of car you drive can have a significant effect on your car insurance rates. Generally, cars that are considered to be safer will have lower insurance premiums. Insurance companies view certain cars as being more likely to be involved in an accident, and thus will charge higher rates for them. Newer cars with features such as anti-lock brakes, airbags, and other safety features are often seen as less risky and may result in lower rates. Also, cars with higher safety ratings may qualify for discounts, so it pays to do your research before purchasing a car.

3. Increase Your Deductible

Increasing your deductible amount is another way to lower your car insurance premiums. A higher deductible means that you will have to pay more out-of-pocket in the event of an accident before your insurance company pays out. While this can result in higher out-of-pocket costs in the event of an accident, it can also mean lower premiums. Be sure to consider the potential costs before increasing your deductible, as it may not always be the best option for your specific situation.

4. Take Advantage of Discounts

Many car insurance companies offer discounts for certain groups of people or specific types of vehicles. For example, some companies may offer discounts for good students, military personnel, or drivers over the age of 55. Also, some insurers may offer discounts for vehicles with certain safety features, such as airbags or anti-lock brakes. Be sure to ask your insurance provider about any available discounts that may apply to you.

5. Avoid Unnecessary Coverage

When shopping for car insurance, it is important to only purchase the coverage you actually need. While some coverage may be required by law, such as liability coverage, you may not need additional coverage such as rental car reimbursement or gap coverage. Be sure to review your coverage and only purchase the coverage that is necessary for your situation. This can help to keep your insurance costs low.

6. Ask About Payment Plans

Another way to lower your car insurance premiums is to ask about payment plans. Many car insurance companies offer payment plans that allow you to spread the cost of your car insurance premiums over several months or even a full year. This can make it easier to budget for your car insurance and can result in lower overall premiums. Be sure to ask your car insurance provider about any available payment plans.

By taking the time to comparison shop, choose a safe car, increase your deductible, take advantage of discounts, avoid unnecessary coverage, and ask about payment plans, you can save money on car insurance and lower your car insurance quotes. With the right coverage, you can protect yourself and your vehicle from financial loss in the event of an accident, so it pays to take the time to shop around and compare car insurance quotes.

lower-car-insurance-quote-lp-011 | Auto Insurance Landing Page Design

16 Ways To Lower Your Auto Insurance Premium | Car insurance, Best car

Lower Your Auto Insurance Rates with 5 steps

INFOGRAPHIC: 5 Ways to Reduce Car Insurance - rateGenius

Car & Taxi Insurance Quotes - Try Compare in 2020 | Insurance quotes