Intact Car Insurance Cancellation Policy

Cancelling Your Intact Car Insurance Policy: What You Need To Know

If you’re considering cancelling your Intact car insurance policy, it’s important to understand all the factors involved before you make a final decision. Intact offers several car insurance plans and some of them may be more suitable for your needs, so it’s important to consider all the options before you make a decision. This article will provide you with the information you need to understand Intact’s cancellation policy, so you can make an informed decision about your insurance needs.

Cancelling Your Intact Car Insurance Policy

When you’re considering cancelling your Intact car insurance policy, it’s important to understand that you may be subject to certain fees or penalties. Intact has a few different cancellation policies depending on the type of coverage you have, so it’s important to read your policy carefully before you make any decisions. Generally, if you cancel your policy before the end of its term, you may be subject to a cancellation fee. This fee can vary depending on the type of coverage you have, so you should call Intact to get an exact amount.

In addition to a cancellation fee, you may also be subject to a penalty if you cancel your policy before the end of its term. Intact may charge a penalty if they believe that you’re cancelling your policy to avoid paying a claim or to avoid paying premiums. The penalty can vary depending on the type of coverage you have, so it’s important to understand the terms of your policy before you make any decisions.

What If I Need To Cancel My Policy?

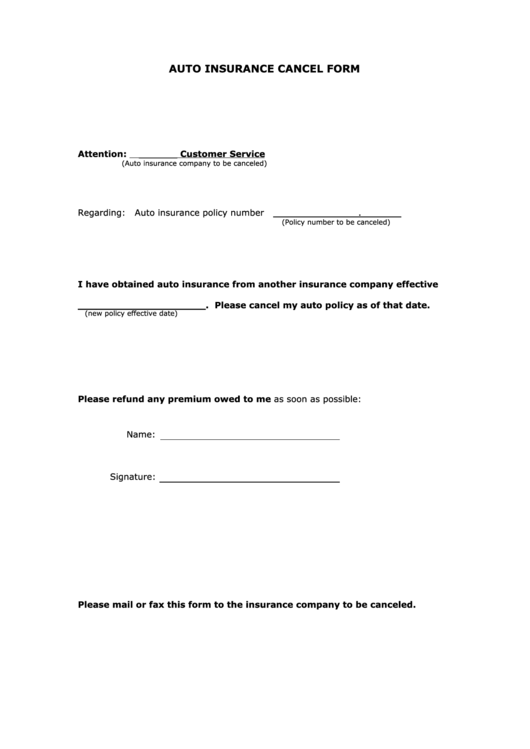

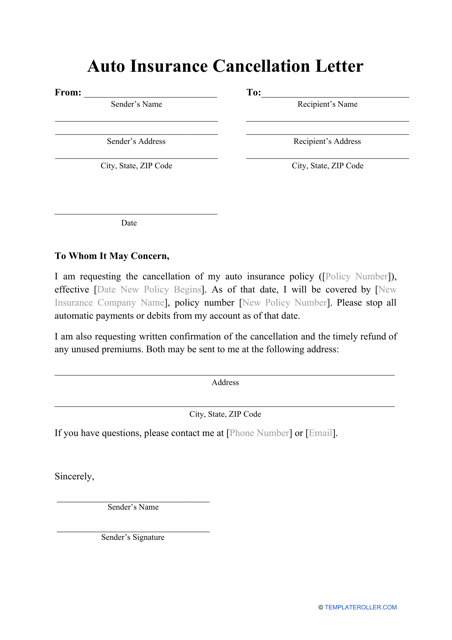

If you need to cancel your Intact car insurance policy, you should contact Intact as soon as possible. Intact requires that you provide written notice of your cancellation, so make sure to include your name, policy number, and the date you want your coverage to end. You may also need to provide proof of insurance from a new provider if you’re switching to a different insurer.

When you cancel your policy, Intact may offer you a refund for any unused premiums. However, this refund will be reduced by any cancellation fees or penalties that you may be subject to. You may also be eligible for a refund if you’ve paid your premiums in advance. Intact will review your policy and provide you with a refund if you’re eligible.

Conclusion

Cancelling your Intact car insurance policy can involve some fees and penalties, so it’s important to understand all the factors involved before you make a final decision. Intact has a few different cancellation policies depending on the type of coverage you have, so make sure to read your policy carefully before you make any decisions. If you need to cancel your policy, make sure to contact Intact as soon as possible and provide written notice of your cancellation.

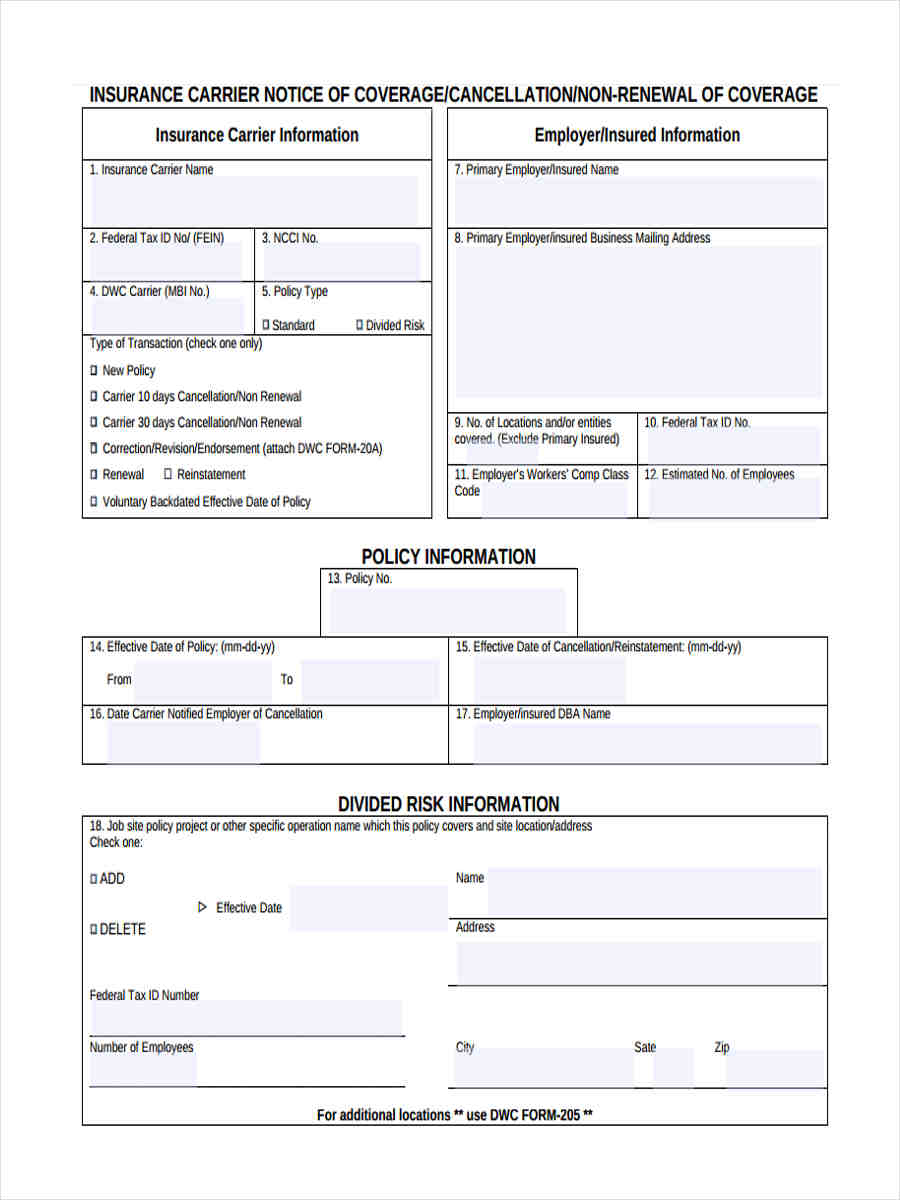

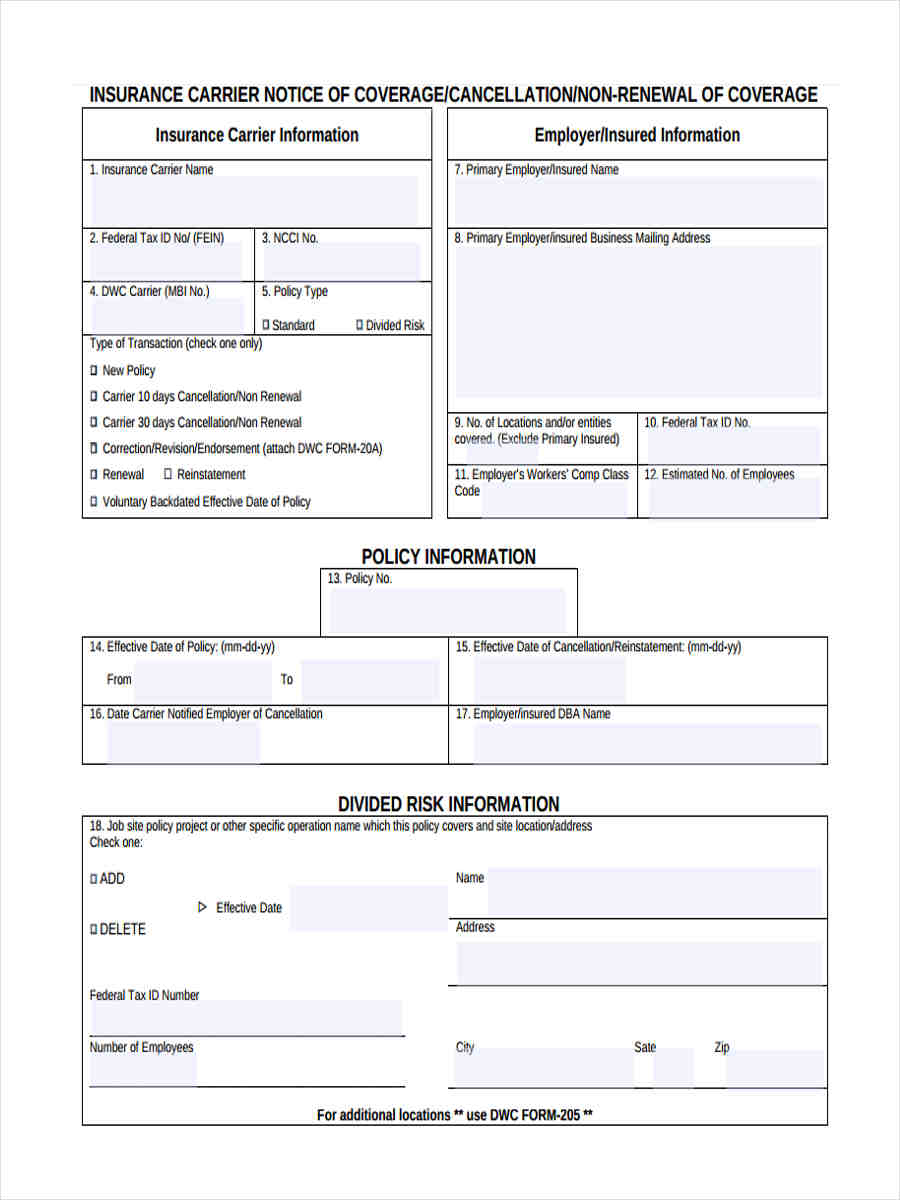

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

Fillable Auto Insurance Cancel Form printable pdf download

Auto Insurance Cancellation Letter Template Download Printable PDF

Intact Insurance - Canada’s Top Provider for Home & Auto | Insurdinary

Application for Cancellation of Insurance Policy - Request for