How Much Does A Sr22 Insurance Cost

How Much Does A SR22 Insurance Cost?

SR22 insurance is a type of auto insurance coverage that is required for certain drivers. If you have been involved in a lot of traffic violations, been convicted of a DUI or DWI, or have had your license suspended, you may be required to carry SR22 insurance. SR22 insurance is a certificate of financial responsibility that proves that you are carrying the minimum required liability insurance coverage.

What Does SR22 Insurance Cover?

SR22 insurance provides the same coverage as a standard auto insurance policy. This includes liability protection for bodily injury, property damage, medical payments, and uninsured motorist coverage. SR22 insurance is usually more expensive than a standard auto insurance policy because of the additional risk associated with the driver. If you are required to have SR22 insurance, you will also have to pay a filing fee.

How Much Does SR22 Insurance Cost?

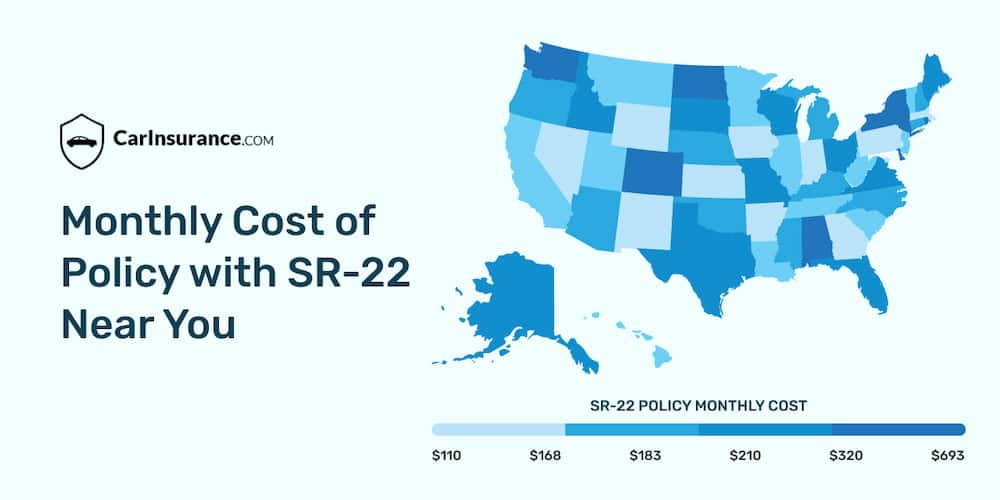

The cost of SR22 insurance can vary depending on several factors, such as the state you live in, your driving record, the type of vehicle you own, and the amount of coverage you require. Generally, SR22 insurance is more expensive than a standard auto insurance policy. The average cost of SR22 insurance is usually between $15 and $30 per month. However, if you have a poor driving record, or if you have been convicted of a DUI or DWI, the cost of SR22 insurance can be significantly higher.

How Do I Get SR22 Insurance?

If you are required to have SR22 insurance, you will need to purchase it from an auto insurance company. Most auto insurance companies offer SR22 insurance, but you may need to shop around to find the best rate. You will also need to provide the insurance company with proof that you have been convicted of a DUI or DWI, or that your license has been suspended. After you have purchased the SR22 insurance, you will need to provide the insurance company with a copy of your driver’s license.

Do I Need SR22 Insurance?

If you have been convicted of a DUI or DWI, or your license has been suspended, you will likely be required to carry SR22 insurance. If you are unsure if you need SR22 insurance, contact your local Department of Motor Vehicles. They will be able to provide you with more information about whether or not you need SR22 insurance.

Conclusion

SR22 insurance is an important type of auto insurance coverage for certain drivers. It is more expensive than a standard auto insurance policy, but it is necessary for drivers who have been involved in a lot of traffic violations, been convicted of a DUI or DWI, or have had their license suspended. The cost of SR22 insurance can vary depending on several factors, such as the state you live in, your driving record, the type of vehicle you own, and the amount of coverage you require. If you are unsure if you need SR22 insurance, contact your local Department of Motor Vehicles.

What is SR22 Insurance - Detailed Guide | CarInsurance.com

How Much Does SR22 Cost in Illinois

What is SR22 Insurance - Detailed Guide | CarInsurance.com

How Much Does Sr22 Insurance Cost A Month : Sr22 Insurance Cost The

How Much Will An Sr22 Increase My Insurance - How Much Does Sr22