Average Cost Of Sr22 Insurance In Nebraska

Average Cost Of SR22 Insurance In Nebraska

Nebraska residents are required to obtain SR22 insurance if they have been convicted of certain driving-related offenses like DUI or DWI. SR22 insurance is a special type of car insurance that provides coverage for drivers who have been deemed high-risk. It is important to understand the cost of SR22 insurance in Nebraska before purchasing a policy. In this article, we discuss the average cost of SR22 insurance in Nebraska, as well as some tips for finding the best rates.

What is SR22 Insurance?

SR22 insurance is a type of car insurance that is required for drivers who have been convicted of certain driving-related offenses, such as DUI, DWI, reckless driving, or driving without insurance. SR22 insurance is also required for drivers who have had multiple traffic violations or accidents in a short period of time. SR22 insurance is more expensive than regular car insurance because it is seen as a higher risk. Most states require drivers to maintain SR22 insurance for at least three years.

Average Cost of SR22 Insurance in Nebraska

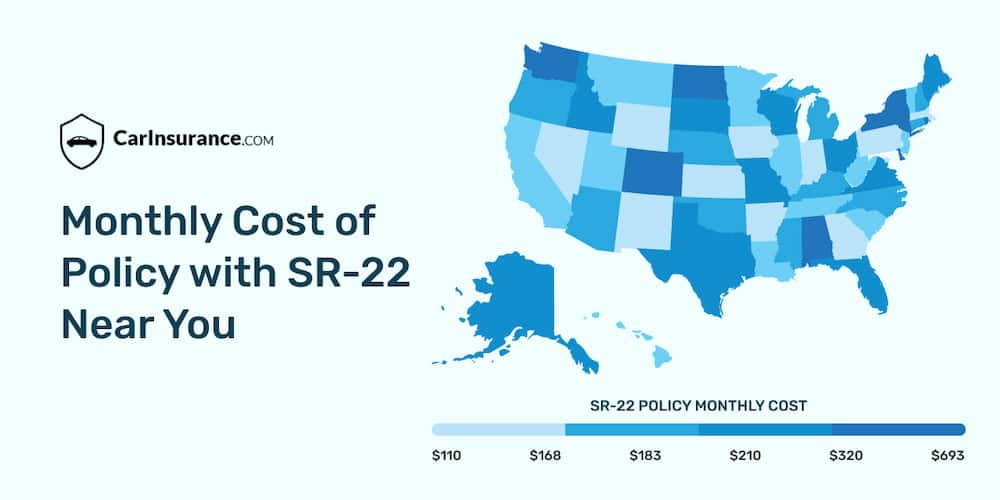

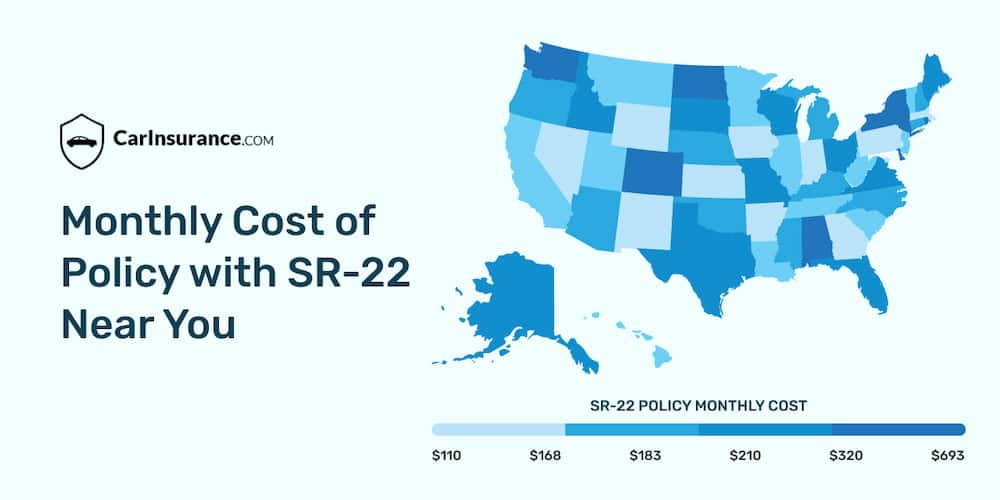

The average cost of SR22 insurance in Nebraska is around $1,000 per year. However, the cost can vary significantly depending on the type of coverage, the insurance company, the driver's driving record, and other factors. It is important to shop around and compare rates from different insurance companies in order to find the best rate.

Factors That Affect the Cost of SR22 Insurance in Nebraska

The cost of SR22 insurance in Nebraska is affected by a variety of factors. The primary factor is the driver's driving record. Drivers with a history of traffic violations or accidents will pay more for SR22 insurance than those with a clean driving record. Other factors that can affect the cost include the type of coverage, the insurance company, the driver's age, and the type of vehicle. It is important to compare rates from different insurance companies in order to find the best rate.

Tips for Finding the Best Rates

There are several steps you can take to find the best rates on SR22 insurance in Nebraska. First, it is important to shop around and compare rates from different insurance companies. It is also important to look for discounts, such as multi-policy discounts, good driver discounts, and student discounts. Additionally, it is important to make sure the coverage is adequate for your needs. Finally, it is important to review the policy carefully and make sure you understand the coverage.

Conclusion

The cost of SR22 insurance in Nebraska can vary significantly depending on the type of coverage, the insurance company, the driver's driving record, and other factors. It is important to shop around and compare rates from different insurance companies in order to find the best rate. Additionally, it is important to look for discounts, such as multi-policy discounts, good driver discounts, and student discounts. Finally, it is important to review the policy carefully and make sure you understand the coverage.

Getting The Best Sr-22 Insurance Options For 2022 - Benzinga To Work

Sr22 insurance - insurance

SR22 Insurance: What Does It Cover? | EINSURANCE

What Is SR22 Insurance and How Do You Get it? – Car News

Cheap Car Insurance in Nebraska 2019