A List Of Stand Alone Gap Insurance Providers

Friday, December 1, 2023

Edit

A List Of Stand Alone Gap Insurance Providers

What is Gap Insurance?

Gap insurance is an optional coverage that you can purchase for your car. It covers the difference between the amount you owe on your loan and the actual value of your car in the event of an accident. In other words, if your car is totaled in an accident, the insurance company will cover the difference between what you owe on the loan and what your car is actually worth. This coverage can be beneficial for those who have recently purchased a new car and owe more on the loan than the car is worth.

Why Should I Get Gap Insurance?

Gap insurance can be beneficial for anyone who has recently purchased a new car or is financing one. If you find yourself in an accident and your car is totaled, you are still responsible for the loan. This can be a financial burden if the amount you owe is more than the actual value of the car. Gap insurance can help protect you from this burden by paying the difference.

What Are Stand Alone Gap Insurance Providers?

Stand alone gap insurance providers are companies that offer gap insurance coverage as a separate policy from your auto insurance coverage. This type of gap insurance is ideal for those who want to purchase gap coverage but don't want to bundle it with their auto insurance coverage. Stand alone gap insurance providers can also be beneficial for those who have already purchased auto insurance coverage and want to add gap insurance to their existing policy.

A List Of Stand Alone Gap Insurance Providers

There are a number of companies that offer stand alone gap insurance coverage. Here is a list of some of the most popular providers:

- GapGuard: GapGuard is a leading provider of stand alone gap insurance coverage. They offer flexible coverage options and competitive rates.

- GapInsurance123: GapInsurance123 is another popular provider of stand alone gap insurance coverage. They offer a variety of coverage options and competitive rates.

- GapShield: GapShield is a top provider of stand alone gap insurance coverage. They offer excellent customer service and a variety of coverage options.

- GapAssurance: GapAssurance is another popular provider of stand alone gap insurance coverage. They offer a variety of coverage options and competitive rates.

- GapCover: GapCover is a leading provider of stand alone gap insurance coverage. They offer flexible coverage options and competitive rates.

Things To Consider When Purchasing Stand Alone Gap Insurance

When purchasing stand alone gap insurance, there are a few things to consider. First, make sure you understand the coverage options and determine which coverage works best for you. Second, compare rates from different providers to ensure you are getting the best rate. Finally, make sure you understand the terms and conditions of the policy and ensure you are comfortable with them before purchasing the policy.

Conclusion

Gap insurance can be a beneficial coverage for those who have recently purchased a new car or are financing one. Stand alone gap insurance providers offer gap insurance coverage as a separate policy from your auto insurance coverage. There are a number of companies that offer stand alone gap insurance coverage and it is important to compare rates and coverage options before purchasing a policy.

Is GAP insurance worthwhile? - babybmw.net

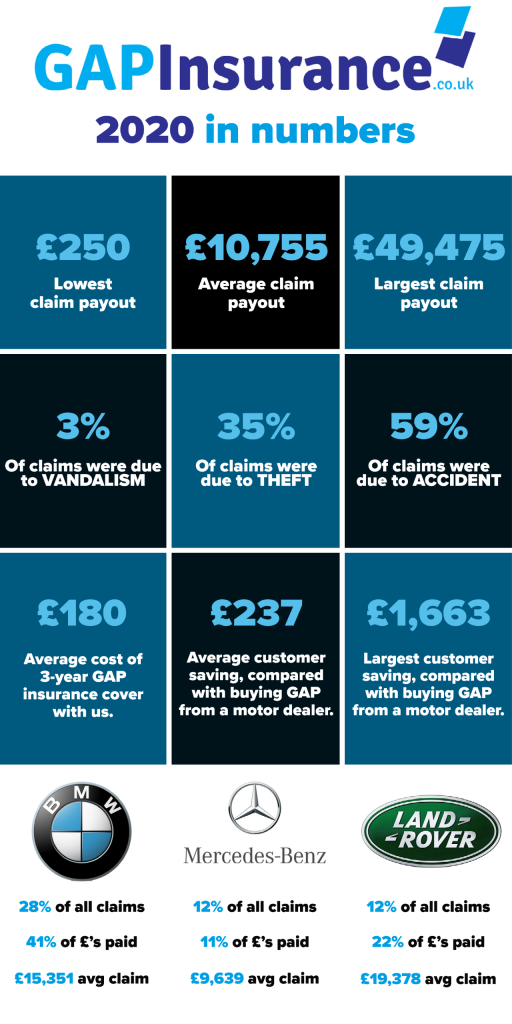

What is Gap Insurance? Infographic

What Is Gap Insurance? - Lexington Law

Health/Gap Insurance For Employees in Montgomery - Will Parsons

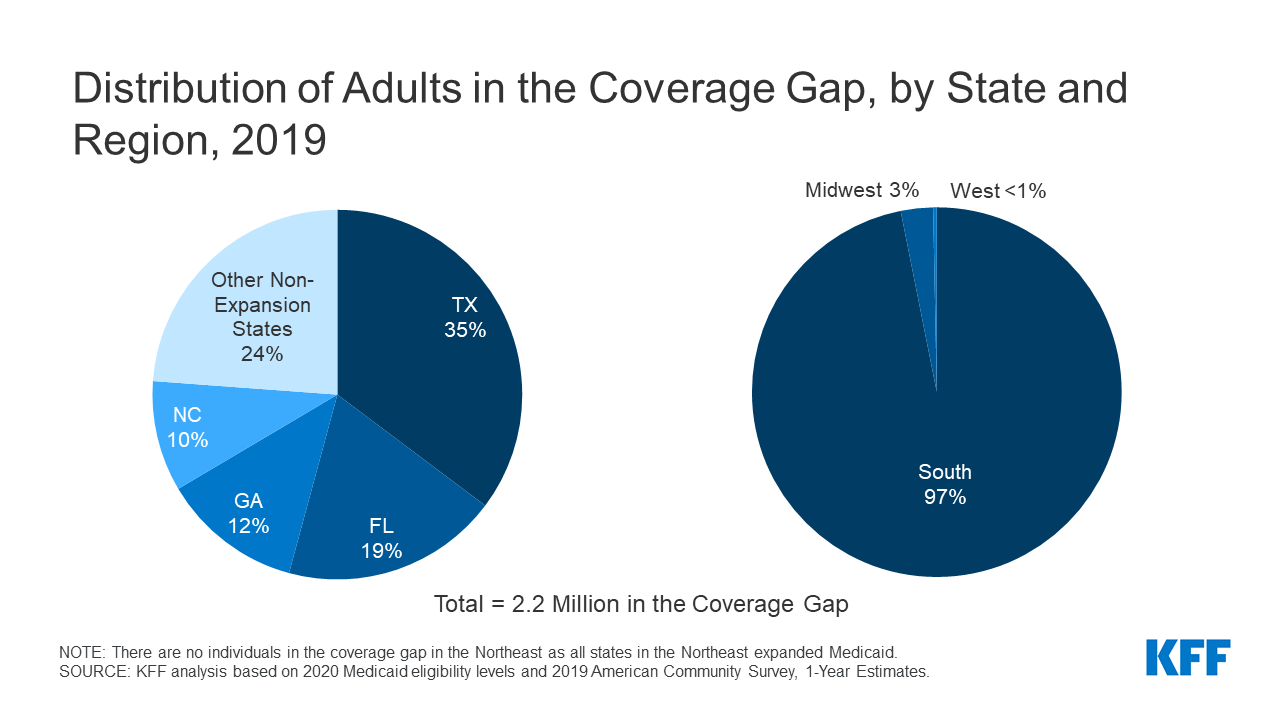

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand