Met Life Insurance Auto Clain

Friday, December 1, 2023

Edit

MetLife Auto Insurance Claims

MetLife Auto Insurance provides customers with the security and assurance of knowing that they are covered in the event of an accident. With MetLife Auto Insurance, customers can enjoy peace of mind knowing that they will be taken care of in the event of an auto-related incident. MetLife Auto Insurance makes it easy for customers to submit a claim when they need to.

How to File a Claim with MetLife Auto Insurance

When filing a claim with MetLife Auto Insurance, customers have several options. The first step is to contact MetLife Auto Insurance directly to report the incident. Customers can do this by calling the toll-free number or by submitting an online claim form.

Once the claim has been reported, MetLife Auto Insurance will provide customers with a claims adjuster who will review the incident and process the claim. The claims adjuster will review the incident and any related documentation, such as police reports or photos, and will contact the customer to discuss the details of the incident.

The claims adjuster will also discuss the customer’s coverage and will help them to determine the best course of action. The adjuster will also review any claims that the customer may have submitted in the past and will work with the customer to ensure that they receive the best possible outcome.

What to Do After Filing a Claim with MetLife Auto Insurance

After filing a claim with MetLife Auto Insurance, customers will need to take a few steps to ensure that their claim is processed quickly and efficiently. Customers should keep all documentation related to the incident, such as photos, police reports, and repair estimates, and should be prepared to provide this information to the claims adjuster. Customers should also keep track of all correspondence with the adjuster, including any emails or phone calls, and should keep records of any payments they receive from MetLife Auto Insurance.

Customers should also be aware of any deadlines related to the claim and should contact the adjuster if they have any questions or concerns. The adjuster will be able to provide further guidance and assistance throughout the process.

The Benefits of Filing a Claim with MetLife Auto Insurance

Filing a claim with MetLife Auto Insurance provides customers with a number of benefits. In addition to providing customers with peace of mind knowing that they are covered in the event of an auto-related incident, MetLife Auto Insurance also offers a number of other services.

For example, MetLife Auto Insurance offers a number of discounts to customers who have multiple policies with the company. Customers may also be eligible for reimbursement for rental car expenses if they are unable to drive their vehicle while it is being repaired. Additionally, MetLife Auto Insurance also provides roadside assistance and towing services for customers who need help getting their vehicle to a repair shop.

Conclusion

MetLife Auto Insurance provides customers with the security and assurance of knowing that they are covered in the event of an auto-related incident. With MetLife Auto Insurance, customers can enjoy peace of mind knowing that their claim will be processed quickly and efficiently. Customers should be aware of their coverage and should keep all documentation related to the incident in order to ensure that their claim is processed properly. Additionally, customers may be eligible for a number of discounts and services, such as rental car reimbursement and roadside assistance. By filing a claim with MetLife Auto Insurance, customers can enjoy the peace of mind that comes from knowing that they are covered.

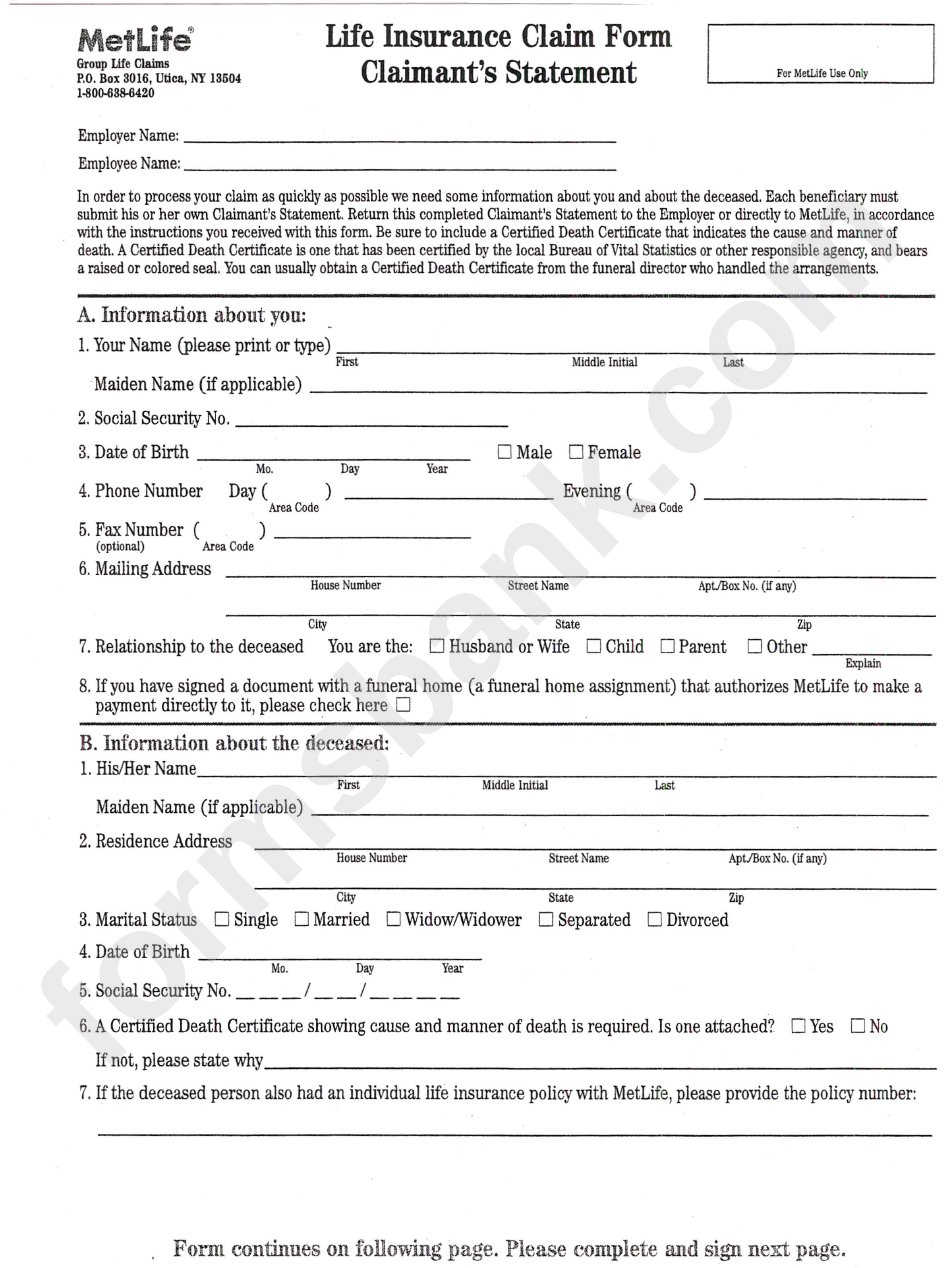

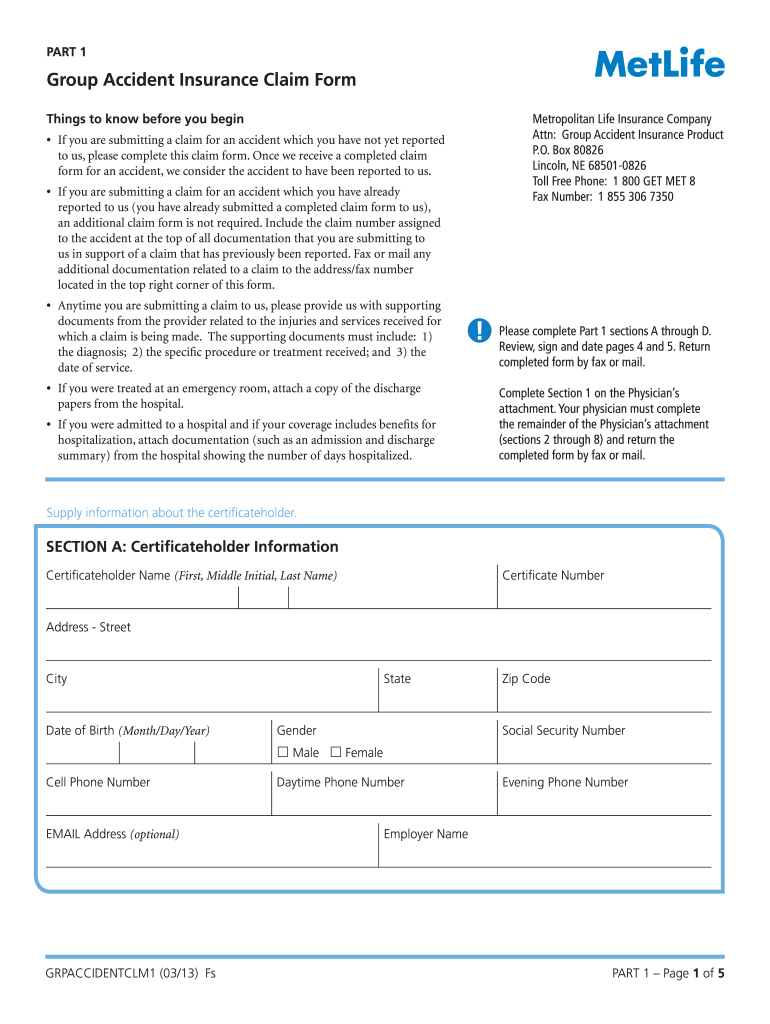

Metlife Accident Claim Form - Fill Out and Sign Printable PDF Template

Metlife Auto Insurance Quote : Step By Step Guide Filing A Flooded Car

Metlife Car Insurance – Haibae Insurance Class

Accidental Death and Dismemberment | MetLife

Metlife Life Insurance Claims Phone Number - Fillable Online Metlife