Cheap Full Coverage Auto Insurance Ky

Thursday, November 23, 2023

Edit

Full Coverage Auto Insurance in Kentucky

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a type of insurance that provides policyholders with a wide range of coverage options to protect them from financial losses due to car accidents. The coverage typically includes bodily injury liability, property damage liability, medical payments or personal injury protection, uninsured/underinsured motorist coverage and comprehensive coverage. This type of insurance is designed to provide protection for drivers who want to be fully protected in the event of an accident or other incident.

Benefits of Full Coverage Auto Insurance in Kentucky

When it comes to auto insurance, Kentucky drivers have the option of purchasing full coverage auto insurance. By doing so, they enjoy a range of benefits, including protection from liability, medical expenses, and repairs.

Full coverage auto insurance in Kentucky can provide the following benefits:

• Liability protection: Liability coverage pays for the other driver's medical bills, lost wages, and property damage if you are responsible for an accident.

• Medical expenses: Your policy will cover medical expenses for yourself and any passengers in your car if you are injured in an accident.

• Repair costs: If your car is damaged in an accident, your policy will cover the cost of repairs.

• Uninsured/underinsured motorist coverage: This coverage pays for your medical expenses if you are injured in an accident with an uninsured or underinsured driver.

• Comprehensive coverage: This coverage pays for damage caused by events other than a collision, such as theft, vandalism, or natural disasters.

How to Find Cheap Full Coverage Auto Insurance in Kentucky

Finding a cheap full coverage auto insurance policy in Kentucky can be a challenge. In order to get the best rate, it is important to shop around and compare rates from different companies. It is also a good idea to review your current policy and make sure that you are getting the coverage that you need.

Here are a few tips to help you find a cheap full coverage auto insurance policy in Kentucky:

• Compare rates: It is important to compare rates from different companies and make sure that you are getting the coverage that you need at the best rate.

• Ask for discounts: Many insurance companies offer discounts for things like having a clean driving record, being a good student, or bundling multiple policies.

• Increase your deductible: Increasing your deductible is one of the easiest ways to lower your premium.

• Review your policy: Make sure that you are getting the coverage that you need at a price that you can afford.

How to Choose the Best Full Coverage Auto Insurance in Kentucky

When it comes to choosing the best full coverage auto insurance in Kentucky, there are a few factors to consider. It is important to research different companies and compare their rates and coverage options. You should also consider the company's financial strength and customer service record.

Here are a few tips to help you choose the best full coverage auto insurance in Kentucky:

• Compare rates: Compare rates from different companies to make sure that you are getting the coverage that you need at the best rate.

• Review coverage options: Make sure that you are getting the coverage that you need to protect you and your vehicle.

• Consider the company's financial strength: Make sure that the company you choose has the financial strength to pay out claims in the event of an accident.

• Read customer reviews: Read customer reviews to get an idea of the company's customer service record.

By following these tips, you can find the best full coverage auto insurance in Kentucky that fits your needs and budget.

Conclusion

Full coverage auto insurance in Kentucky can provide a range of benefits, including liability protection, medical expenses, and repair costs. In order to get the best rate, it is important to shop around and compare rates from different companies. It is also a good idea to review your policy and make sure that you are getting the coverage that you need. When it comes to choosing the best full coverage auto insurance in Kentucky, it is important to compare rates, review coverage options, consider the company's financial strength, and read customer reviews.

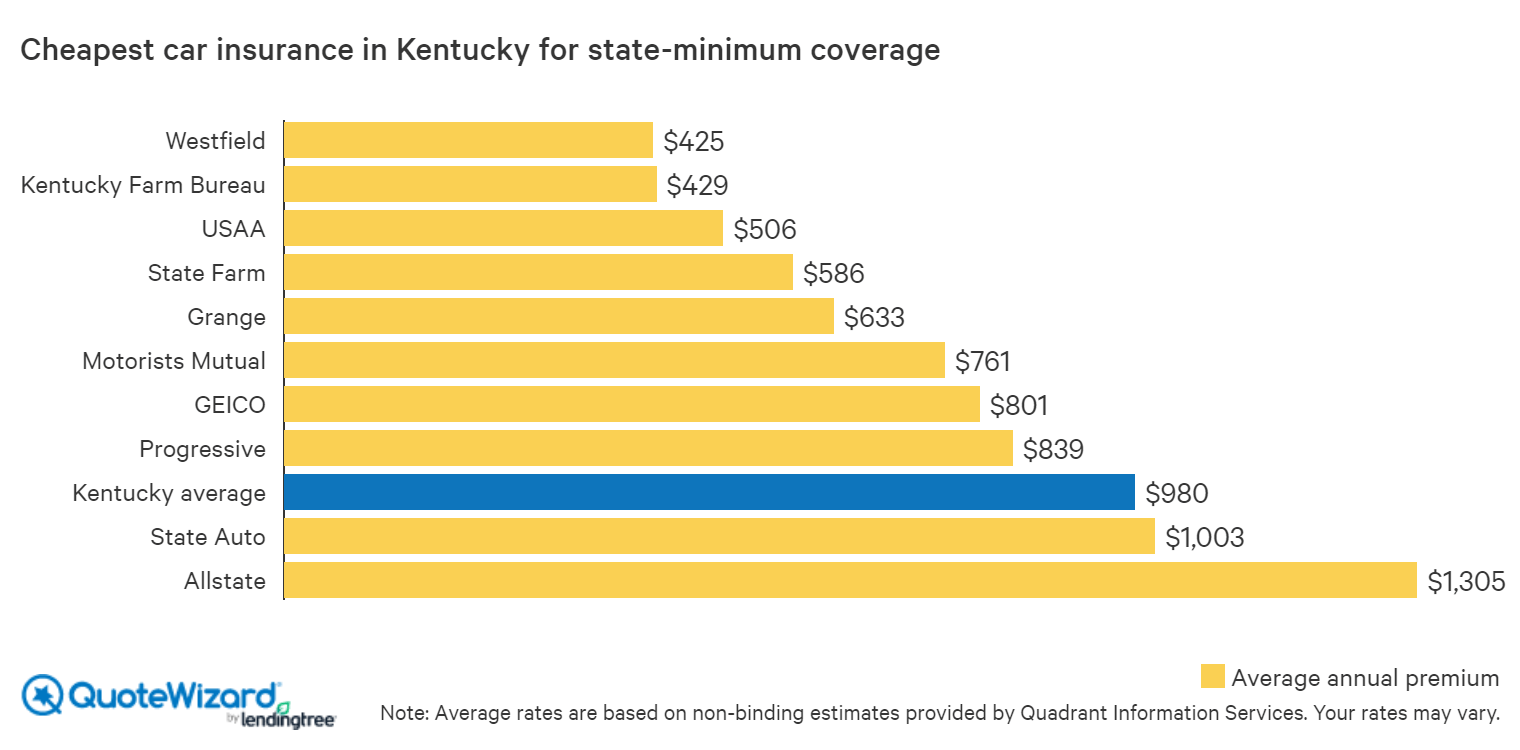

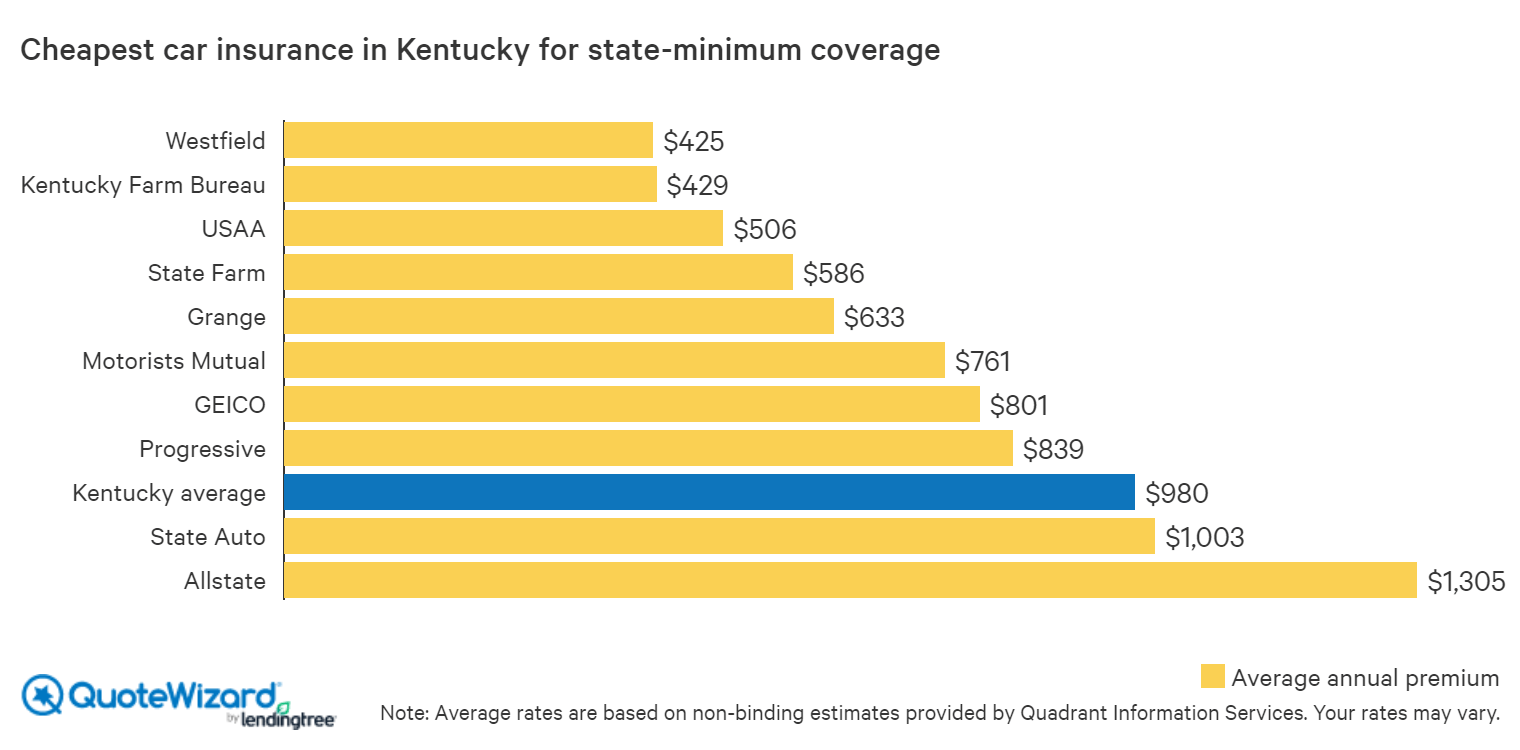

Find Cheap Car Insurance in Kentucky | QuoteWizard

Cheap full coverage auto insurance

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

Cheap Full Coverage Auto Insurance In Texas - blog.pricespin.net

Get Car Insurance with Suspended Driver Licenses – Save Upto 70%