3rd Party Claim Car Insurance

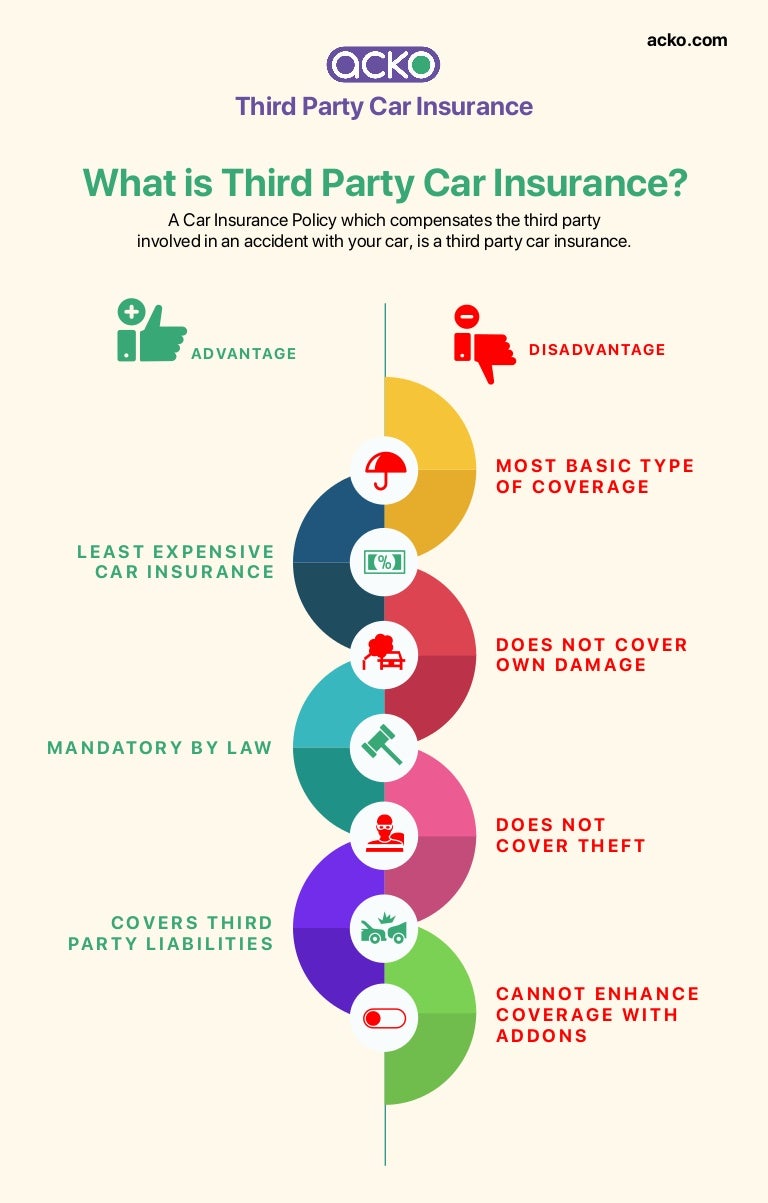

What is Third-Party Claim Car Insurance?

Third-party claim car insurance is a type of insurance policy that provides coverage to the insured party in the event of a third-party claim being made against them. This type of insurance is usually taken out by individuals or businesses who are at risk of being sued by a third-party due to an accident or other incident. The policy will cover the cost of any legal fees, court costs and damages which may be awarded to the third-party claimant.

How Does Third-Party Claim Car Insurance Work?

Third-party claim car insurance is designed to provide financial protection for the policyholder in the event of a claim being made against them. If a third-party makes a claim against the policyholder, the insurance company will cover the legal costs and any damages which may be awarded to the claimant. In some cases, the insurance company will also cover the cost of any repairs to the vehicle in question.

What Are the Benefits of Taking Out Third-Party Claim Car Insurance?

Taking out third-party claim car insurance provides peace of mind for the policyholder. If a claim is made against them, the insurance company will cover the costs of any legal fees and any damages which may be awarded to the third-party claimant. This could save the policyholder a great deal of money, as legal fees and court costs can be extremely expensive. Furthermore, the policyholder will not have to worry about having to pay for any repairs to the vehicle in question.

What Types of Claims Does Third-Party Claim Car Insurance Cover?

Third-party claim car insurance typically covers claims made by the third-party due to an accident or other incident involving the policyholder's vehicle. This includes claims for damages, medical expenses and legal costs associated with the incident. In some cases, the insurance company may also cover the cost of any repairs required to the vehicle in question.

What Are the Limitations of Third-Party Claim Car Insurance?

Third-party claim car insurance does not cover any damage caused to the policyholder's own vehicle. Therefore, if the policyholder is involved in an accident and their vehicle is damaged, they will have to pay for the repairs themselves. It is also important to note that third-party claim car insurance does not provide coverage for any personal injury or death which may occur as a result of the incident.

What Should I Consider When Taking Out Third-Party Claim Car Insurance?

When taking out third-party claim car insurance, it is important to consider the coverage limits of the policy. It is also important to check the terms and conditions of the policy, as well as the exclusions, to ensure that the policy provides the necessary coverage for the policyholder's requirements. It is also a good idea to shop around and compare different policies, as different insurers may offer different levels of coverage at different prices.

Third Party Property Car Insurance | iSelect

What is Third Party Insurance in 2020 | Third party, Insurance, Aadhar card

What is third party insurance | Online insurance, Compare insurance

Third Party Insurance For Car - Insurance

Third Party Car Insurance