First Party And Third Party Insurance

What is the Difference Between First Party and Third Party Insurance?

When it comes to insurance, there are two main types: first party and third party. Knowing the difference between the two is essential for anyone looking to purchase an insurance policy. Here, we explain the difference between first party and third party insurance and how each one works.

What is First Party Insurance?

First party insurance is a type of insurance policy that is used to protect the insured person or entity from any losses or damages caused by their own actions. This type of insurance provides coverage for the policyholder's own losses, such as medical bills, lost wages, or property damage. It is also referred to as “first-person” insurance because it is the insured party who receives the benefit of the policy.

What is Third Party Insurance?

Third party insurance is a type of insurance that is used to protect the policyholder from losses or damages caused by a third party. This type of insurance provides coverage for damages or losses caused by someone other than the insured person or entity. Examples of third party losses include medical bills, lost wages, or property damage resulting from a car accident or other incident caused by someone else.

The Advantages of First Party Insurance

First party insurance provides more comprehensive coverage than third party insurance. This type of insurance allows the policyholder to receive compensation for their own losses and damages, regardless of who caused them. Additionally, first party insurance is often less expensive than third party insurance, and the policyholder is not responsible for any legal costs associated with a claim. Finally, first party insurance policies tend to have more flexible coverage options than third party policies.

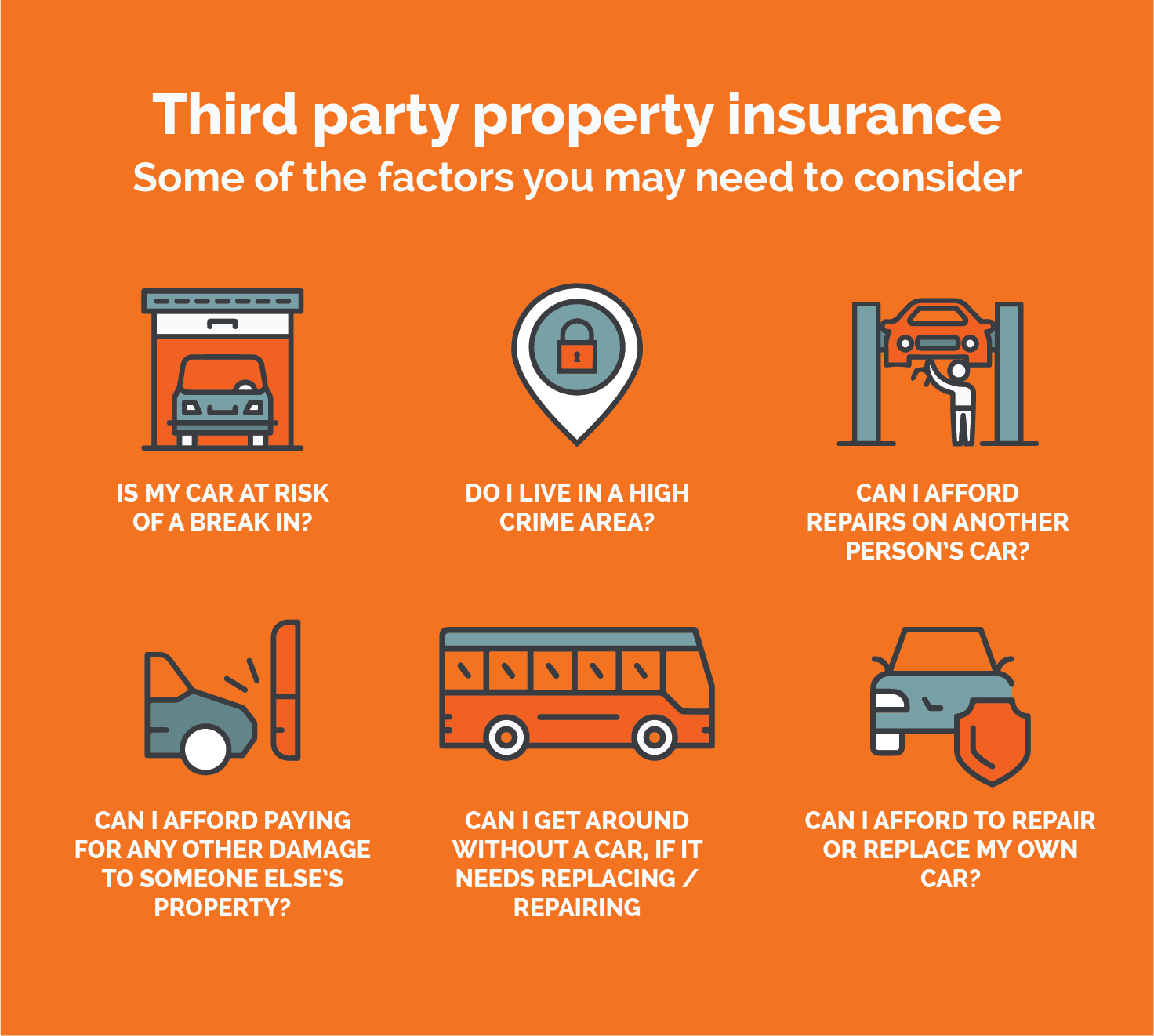

The Advantages of Third Party Insurance

Third party insurance provides coverage for losses or damages caused by someone other than the insured party. This type of insurance is often required by law for certain types of activities, such as driving a vehicle. Additionally, third party insurance can provide coverage for legal costs associated with a claim, and it is typically more affordable than first party insurance. Finally, third party insurance policies have more comprehensive coverage options than first party policies.

Which Type of Insurance Is Right for You?

The type of insurance you choose will depend on your individual needs and circumstances. First party insurance provides more comprehensive coverage and is typically less expensive than third party insurance, but it is important to consider the potential risks associated with a first party policy. On the other hand, third party insurance provides coverage for losses or damages caused by someone other than the insured, which may be beneficial in certain situations. Ultimately, it is important to carefully consider the advantages and disadvantages of both types of insurance before making a decision.

First Party और Third Party insurance क्या होता है, दोनों में अंतर तथा लाभ?

What Is The Difference Between First-Party And Third-Party Insurance?

Difference First Party Third Party Insurance Ppt Powerpoint Pictures

Insurans Third Party / Accident 101 Making A Third Party Insurance

The loss your car incurs is not covered by your insurance provider but