Gap Insurance Cost Per Month

Do You Need Gap Insurance? What is the Cost Per Month?

If you have recently purchased a new car, you are likely considering gap insurance. This type of insurance provides coverage in the event that your car is stolen or damaged beyond repair. Gap insurance can be especially important if you are financing your car, as it can help you avoid owing more money than the car is worth. But what is the cost of gap insurance per month? Read on to find out more.

What is Gap Insurance?

Gap insurance, also known as "guaranteed asset protection" or "loan/lease gap coverage," is an optional insurance coverage that helps cover the difference between the amount owed on a vehicle and the amount that an insurance company pays out if the vehicle is totaled or stolen. This type of coverage can be especially important if you are financing your car, as the insurance company only pays out what the car is worth, not what you owe for it. Gap insurance can help you avoid owing more money than the car is worth.

How Much Does Gap Insurance Cost Per Month?

The cost of gap insurance per month will depend on the amount of coverage you choose, as well as the insurance company you choose. Generally speaking, gap insurance can cost anywhere from $20 to $40 per month, depending on the amount of coverage you choose. It is important to note that the cost of gap insurance may also be included in your overall car insurance premium, so it is worth asking your insurance provider if this is the case.

Is Gap Insurance Worth the Cost?

Whether or not gap insurance is worth the cost is ultimately up to you. If you are financing your car and the amount you owe is significantly more than the car's worth, gap insurance could help protect you from owing more money than the car is worth. However, if you are paying for your car in cash, gap insurance may not be necessary. Ultimately, it is important to weigh the cost of the coverage against the potential cost of not having it.

What Other Types of Insurance Might I Need?

In addition to gap insurance, you may want to consider other types of insurance coverage for your car. This can include collision and comprehensive coverage, as well as liability coverage. Collision and comprehensive coverage help cover the costs of repairs or replacement of your car if it is damaged or destroyed in an accident. Liability coverage helps cover the costs of damages or injuries that you may cause to another person or property. It is important to speak with your insurance provider to determine which types of coverage are right for you.

Conclusion

Gap insurance can be a valuable form of coverage if you are financing your car, as it can help protect you from owing more money than the car is worth. The cost of gap insurance per month will depend on the amount of coverage you choose, as well as the insurance company you choose. It is important to speak with your insurance provider to determine the right type and amount of coverage for your needs.

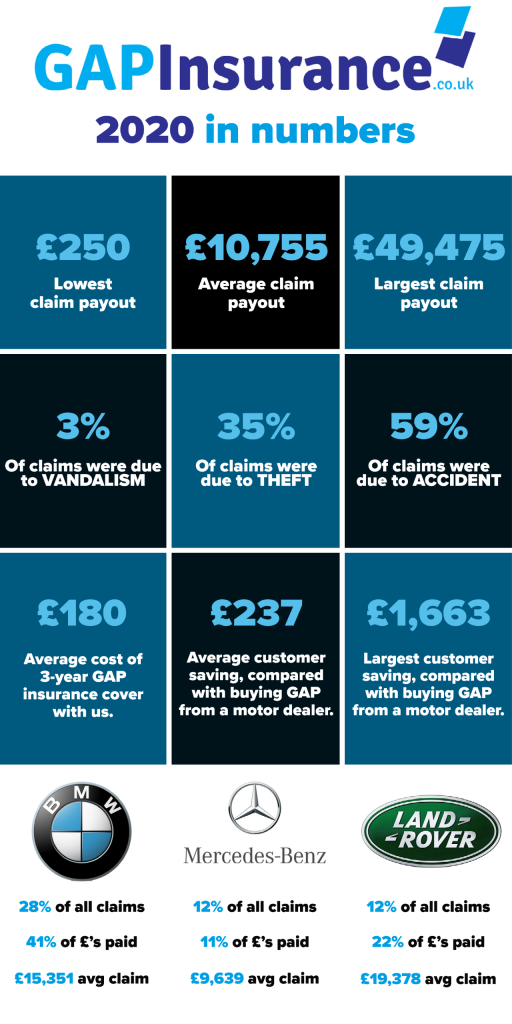

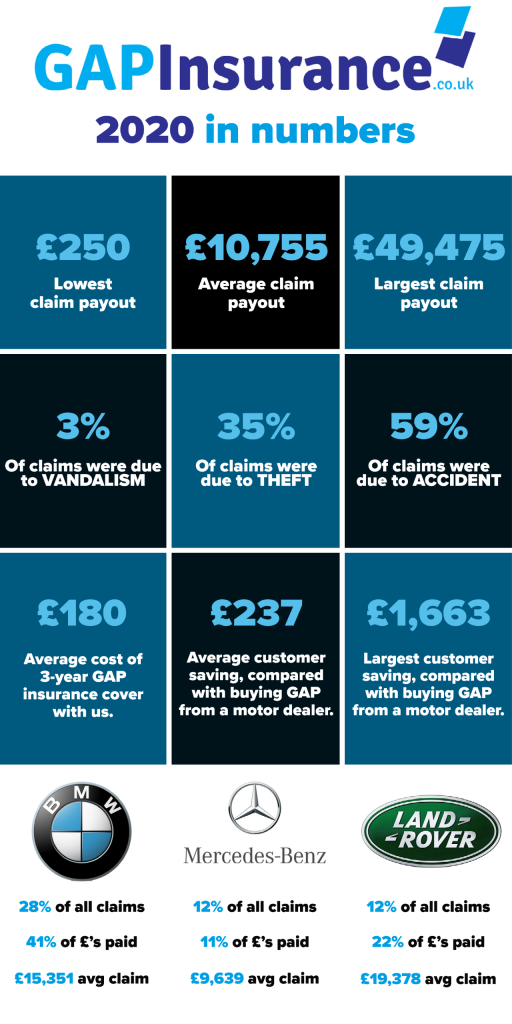

Is GAP insurance worthwhile? - babybmw.net

What Is Gap Insurance? - Lexington Law

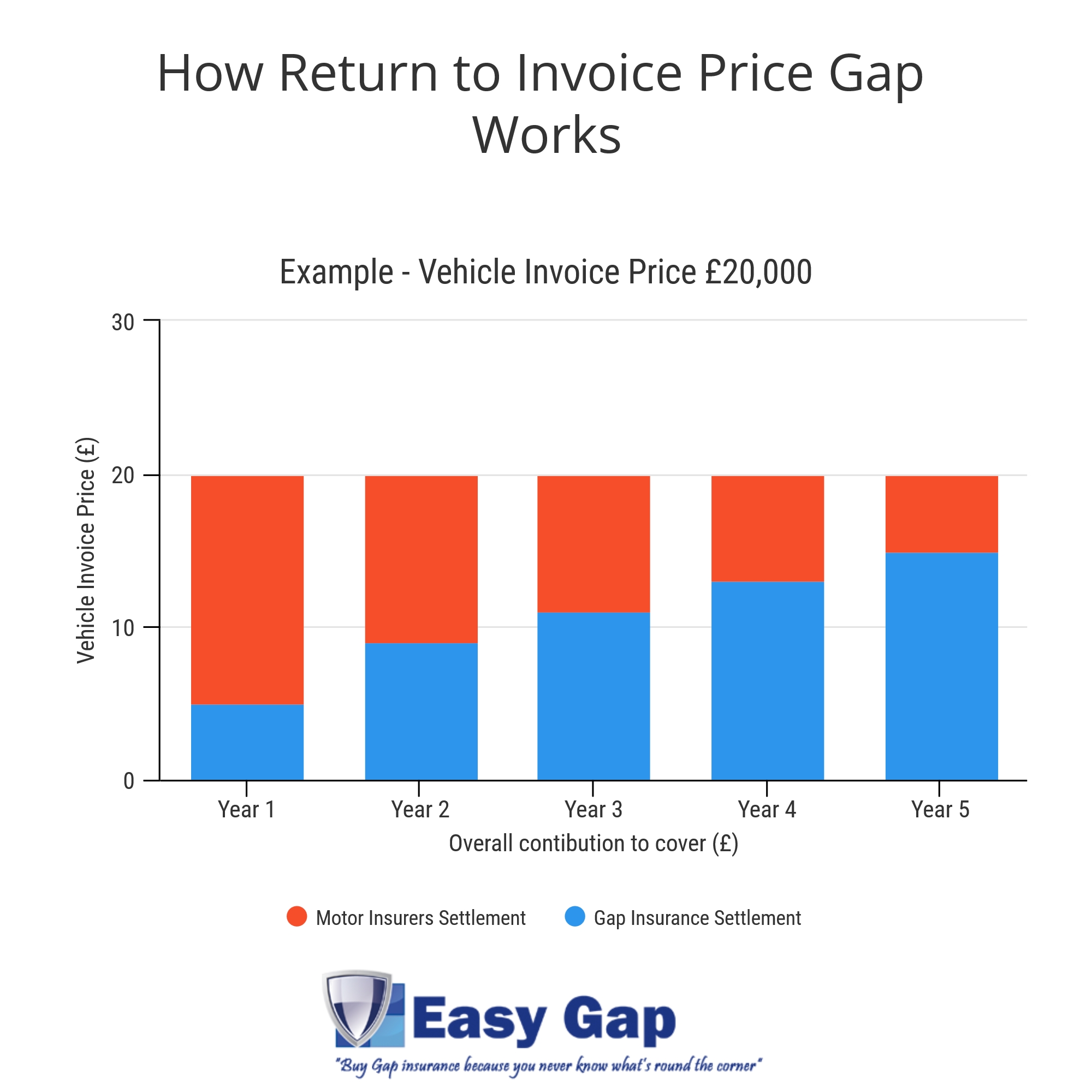

Return To Invoice Gap Insurance * Invoice Template Ideas

Which Insurance Companies Offer Gap Insurance

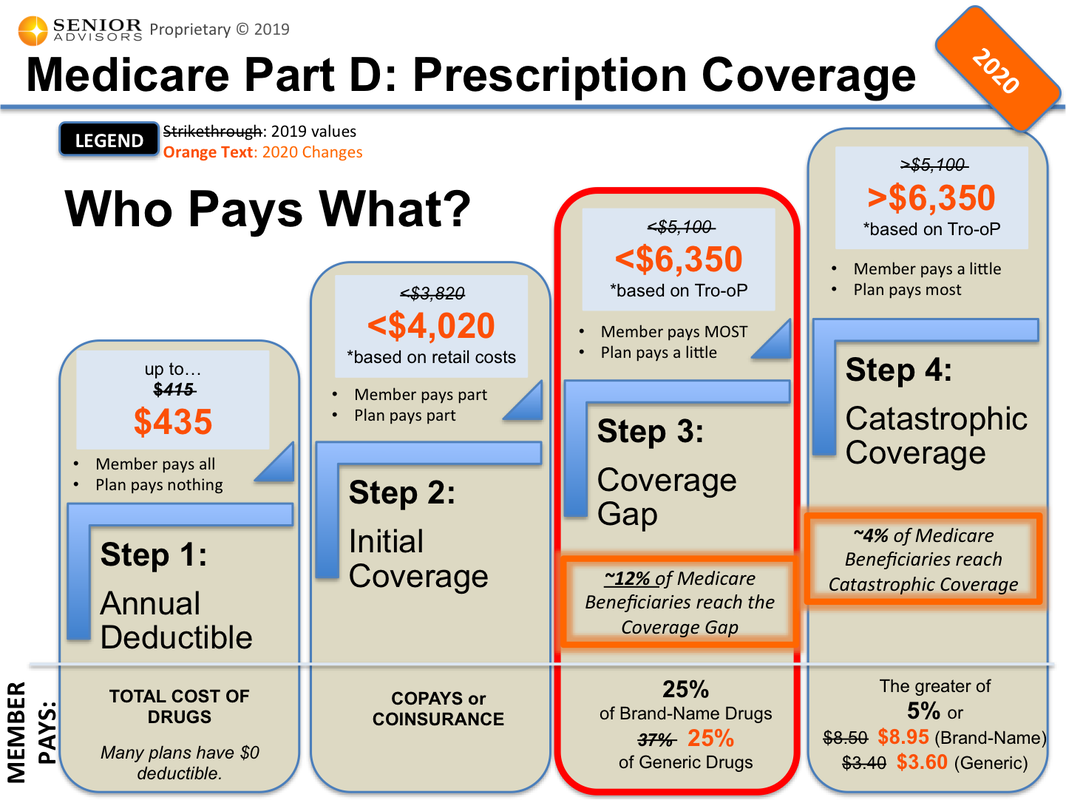

Medicare Blog: Moorestown, Cranford NJ - Senior Advisors