Nrma Third Party Fire And Theft Pds

Nrma Third Party Fire and Theft PDS

What is it?

Nrma Third Party Fire and Theft PDS is an insurance package offered by Nrma Insurance for motor vehicle owners in Australia. It provides financial protection for your car in the event of an accident, theft, or fire. It also includes extras such as roadside assistance, legal liability protection, and personal injury cover. This package is designed to provide you with peace of mind and financial security when driving your car.

What Does It Cover?

Nrma Third Party Fire and Theft PDS covers the cost of repair or replacement of your car if it is damaged due to fire, theft, or other accidental causes. It also provides you with legal liability protection in the event you are held liable for an accident that causes damage to someone else's property or injures someone else. The package also includes roadside assistance, which can help you if you break down and need help getting back on the road. Additionally, it provides personal injury cover to help you with medical expenses if you are injured while driving.

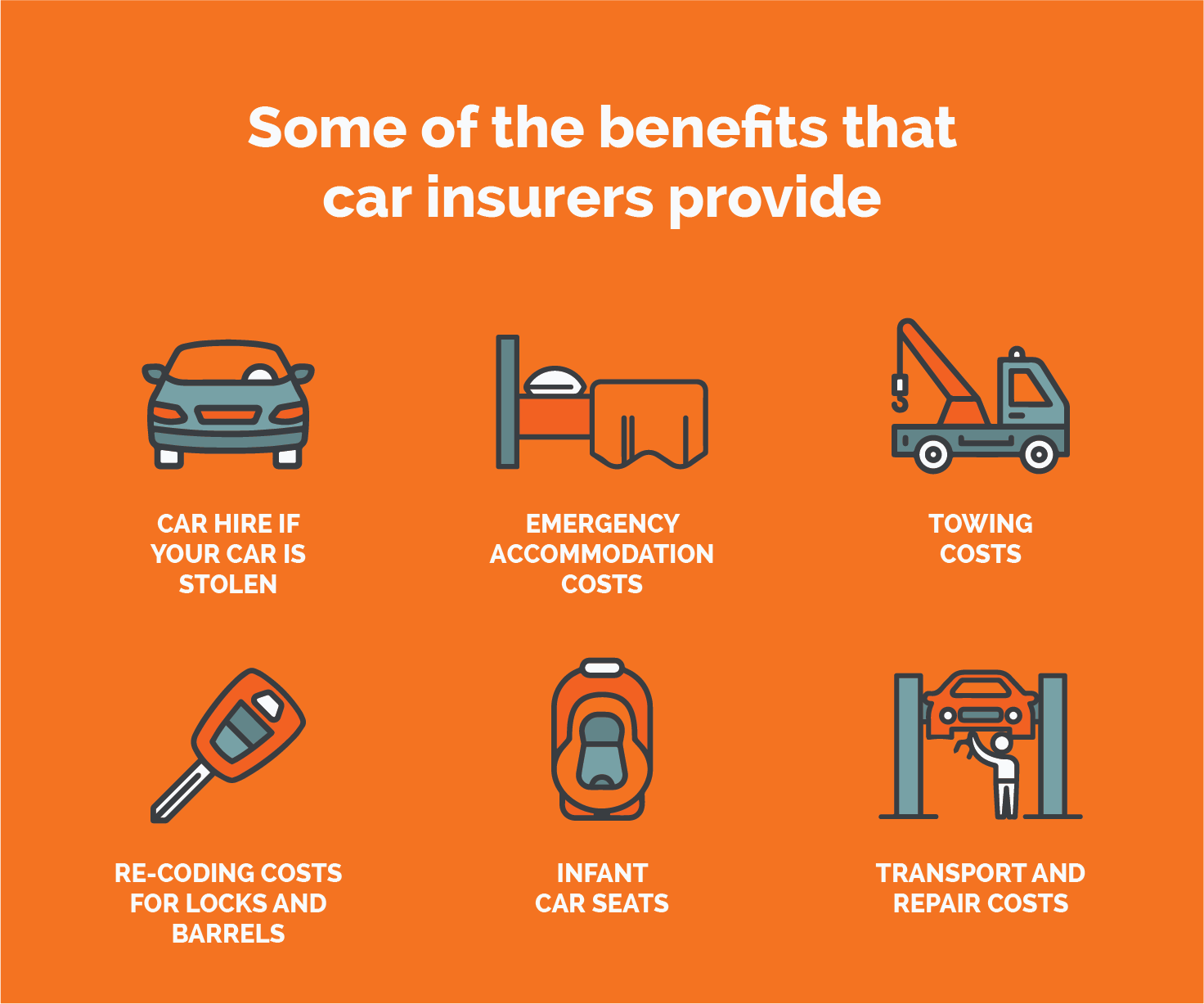

What Are The Benefits?

The main benefit of Nrma Third Party Fire and Theft PDS is the peace of mind it provides. Having this type of coverage can help you feel secure in the event of an accident, theft, or fire. Additionally, it can help cover the costs of repairs or replacement of your car. It also provides you with legal liability protection, as well as roadside assistance and personal injury cover. All of these features can help to make sure you are protected in the event of an emergency.

What Are The Drawbacks?

The main drawback of Nrma Third Party Fire and Theft PDS is that it does not cover damage caused by negligent driving. Additionally, it does not provide coverage for damage to your own car if you are at fault in an accident. Furthermore, the package does not provide coverage for any loss or damage caused by natural disasters such as floods, storms, or earthquakes. Additionally, the policy does not cover any damage to your car caused by vandalism or malicious intent.

Is It Worth It?

Nrma Third Party Fire and Theft PDS can be a great way to protect yourself and your car while on the road. It provides financial protection in the event of an accident, theft, or fire, as well as legal liability protection and roadside assistance. It also provides personal injury cover to help you with medical expenses if you are injured while driving. All of these features can help to make sure you are protected in the event of an emergency. It is worth considering this type of coverage if you are looking for extra peace of mind and financial security for your car.

Conclusion

Nrma Third Party Fire and Theft PDS is an insurance package that can provide you with financial protection and peace of mind in the event of an accident, theft, or fire. It provides legal liability protection, roadside assistance, and personal injury cover. It is worth considering this type of coverage if you are looking for extra protection and financial security for your car.

MULTIPLAYER in Dangerous Driving?!? | Third Party, Fire, and Theft

Third-party, fire and theft cover - Cover levels - QD

Third Party Fire & Theft Archives | BodyShop News

NRMA Firefighter-EMT wins ZOLL 2018 EMT scholarship | News

Third Party Fire and Theft know more about it | peeker automotive