Florida Motor Vehicle Insurance Requirements

Friday, January 13, 2023

Edit

Florida Motor Vehicle Insurance Requirements

What is Required?

Drivers in the state of Florida are required to carry a minimum amount of motor vehicle insurance coverage. The minimum requirements are that drivers must have liability insurance which includes a minimum of the following coverage amounts: $10,000 for personal injury protection (PIP), $10,000 for property damage liability (PDL), and $10,000 for bodily injury liability (BIL). This is known as the 10/20/10 rule. In addition to the minimum requirements, drivers can also purchase additional coverage such as comprehensive and collision coverage, uninsured motorist coverage, and medical payments coverage.

Proof of Insurance

Drivers must be able to provide proof of insurance if asked by law enforcement or other state officials. Proof of insurance can be provided in the form of a printed insurance card, a copy of an insurance policy, a copy of a binder of insurance, or a signed letter from an insurance agency. Additionally, some insurance companies offer electronic proof of insurance which can be provided in the form of a smartphone app or an email from the insurance company.

Penalties for Not Having Insurance

Drivers who are found to be operating a vehicle without the required insurance coverage can be subject to fines and license suspension. The fines for not having the required coverage can range from $150 to $500 and the license suspension can last up to three years. Additionally, drivers can be responsible for paying any damages caused by an accident if they are found to be uninsured.

Can You Drive without Insurance?

Drivers in the state of Florida are not allowed to operate a motor vehicle without the required insurance coverage. The only exception is for drivers who have been issued a Certificate of Financial Responsibility (CFR). A CFR is an official document issued by the Department of Highway Safety and Motor Vehicles (DHSMV) which allows a driver to drive without insurance coverage. In order to obtain a CFR, the driver must provide proof that they have sufficient assets to cover any damages caused by an accident and must submit an application to the DHSMV.

How to Get Insurance

Drivers in the state of Florida can purchase insurance coverage from a variety of insurance companies. The most common types of coverage are liability, comprehensive, and collision coverage. Drivers can also purchase additional coverage such as medical payments coverage, uninsured motorist coverage, and rental car coverage. Additionally, some insurance companies offer discounts for certain types of drivers, such as students or senior citizens. Drivers can also purchase insurance coverage from a licensed insurance agent or broker.

Conclusion

Motor vehicle insurance is required for drivers in the state of Florida. Drivers must carry a minimum amount of coverage as required by the 10/20/10 rule. Drivers must also be able to provide proof of insurance if asked by law enforcement or other state officials. Drivers who are found to be operating a vehicle without the required insurance coverage can be subject to fines and license suspension. The only exception is for drivers who have been issued a Certificate of Financial Responsibility (CFR). Drivers can purchase insurance coverage from a variety of insurance companies or from a licensed insurance agent or broker.

Lease Car Insurance Requirements Florida - empowered-crazybitch

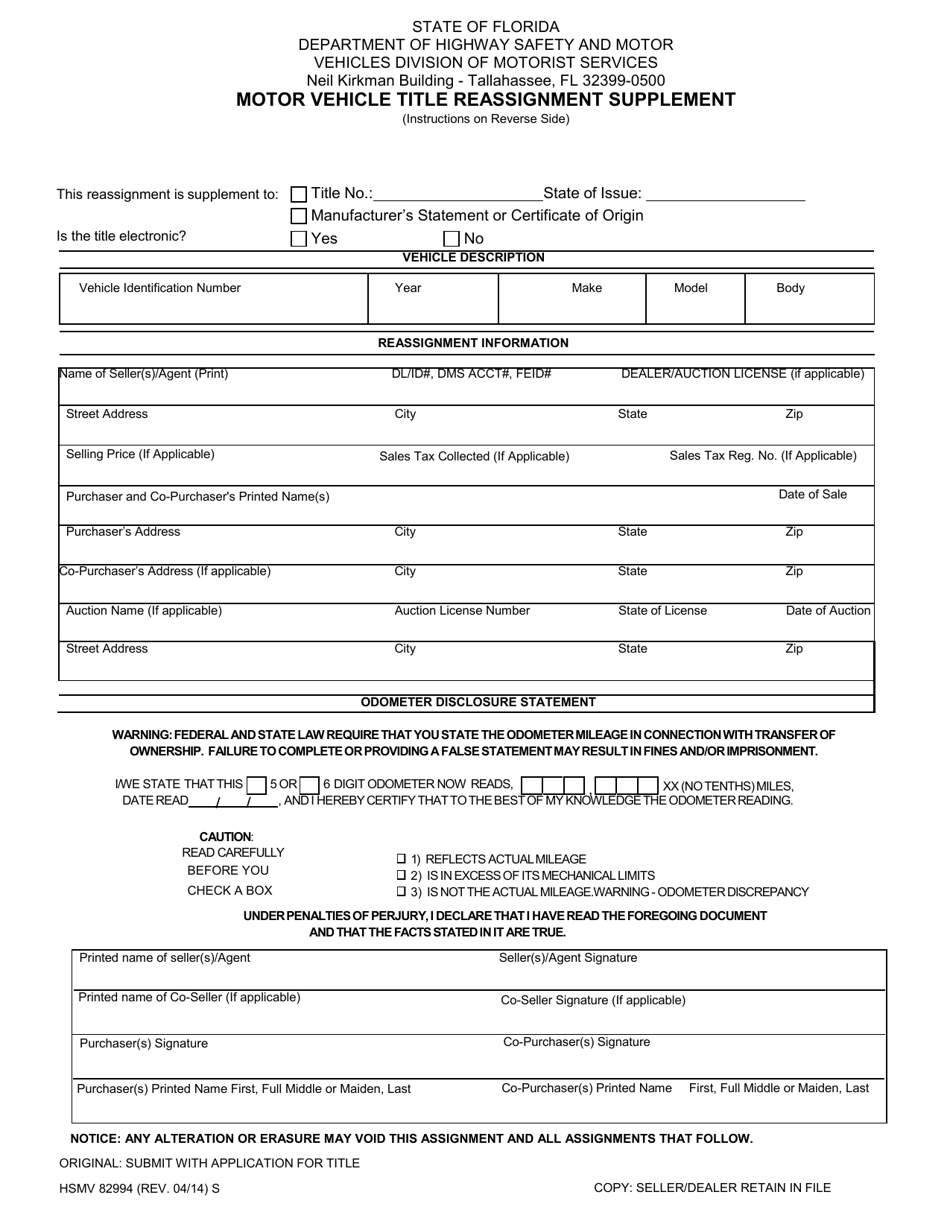

Form HSMV82994 Download Fillable PDF or Fill Online Motor Vehicle Title

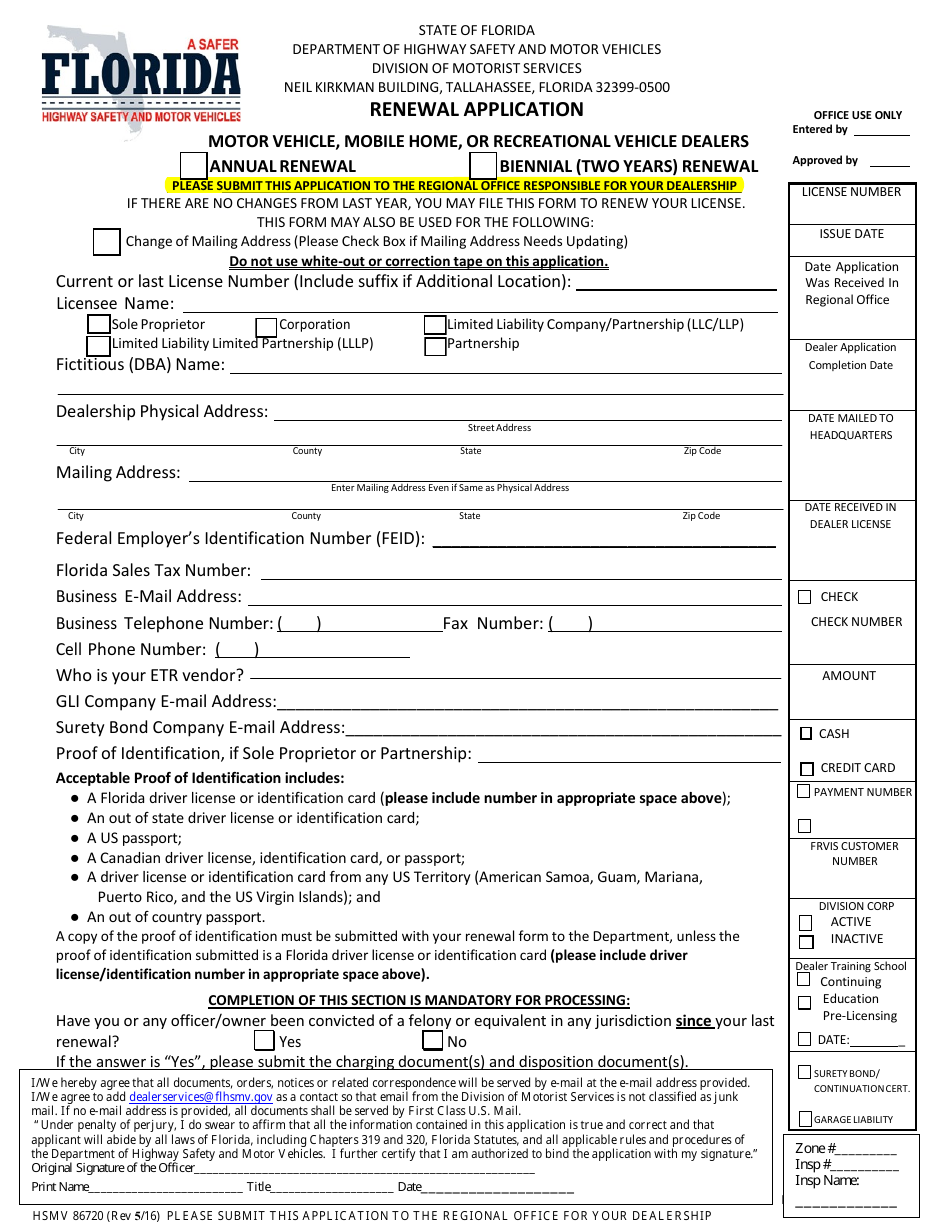

Form HSMV86720 Download Fillable PDF or Fill Online Renewal Application

Florida Division Of Motor Vehicles Titles - impremedia.net

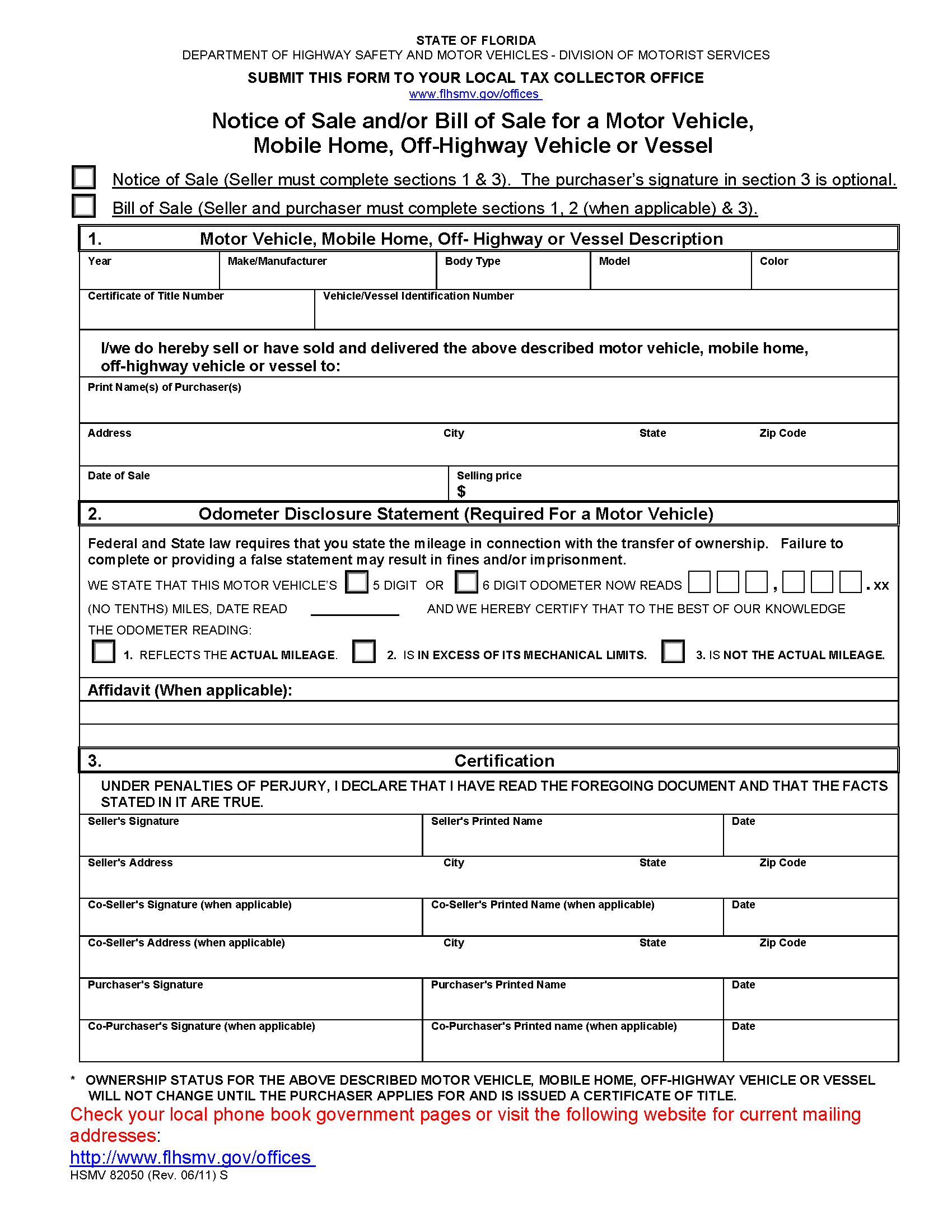

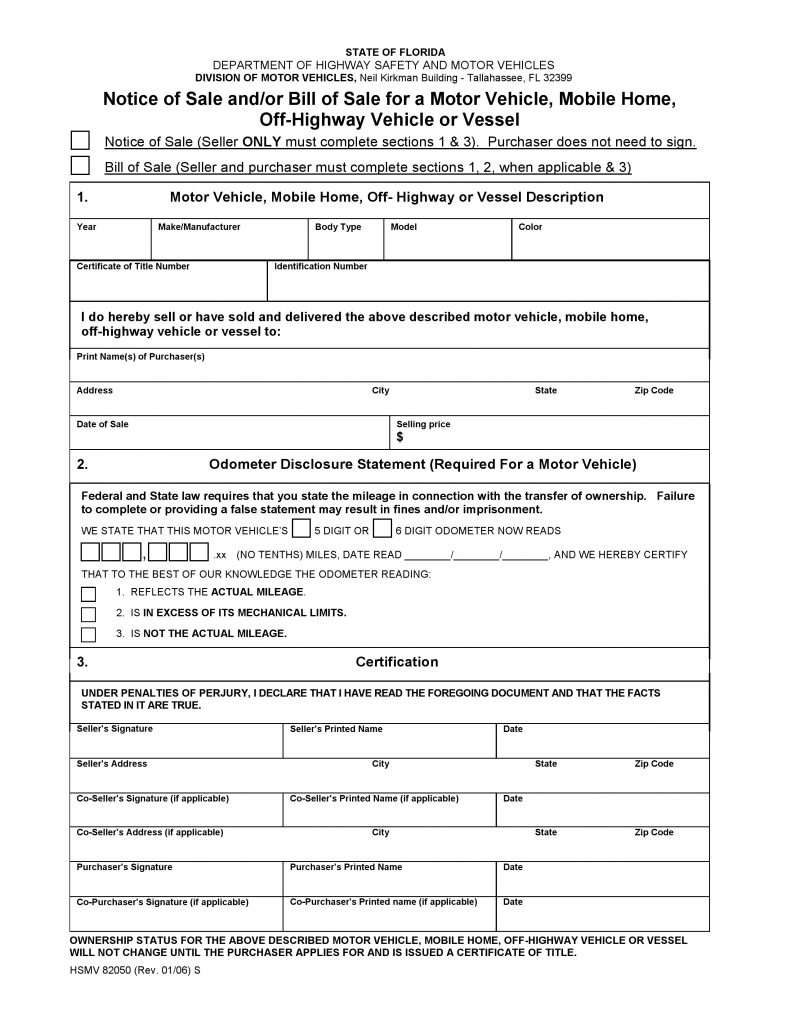

Free Florida Motor Vehicle Bill of Sale Form - PDF | Word