Insuring A Car For More Than It Worth

Insuring A Car For More Than Its Worth - What You Need To Know

What Is Overinsurance?

Overinsurance is the practice of insuring a vehicle for more than its market value. This type of insurance is often taken out by car owners who want to ensure that their vehicle is covered for any repairs or replacements that may be necessary in the event of an accident or other incident. It is important to be aware of the potential risks associated with over-insuring a vehicle, as well as the potential benefits.

What Are The Risks Of Overinsurance?

The primary risk of overinsurance is that you may be overpaying for your car insurance. This can be especially true if the vehicle is not worth as much as you have insured it for. If you are in an accident and the damage to the vehicle is more than the market value of the car, you may be responsible for paying the difference out of pocket. Additionally, if you are involved in a lawsuit, the court may determine that you are liable for the difference between the market value of the car and the amount of insurance you have taken out on it.

What Are The Benefits Of Overinsurance?

The primary benefit of overinsurance is that it can provide peace of mind for car owners. If you are involved in an accident and the damage to the vehicle is more than the market value of the car, you will not be held liable for the difference if you have overinsured the vehicle. Additionally, in some cases, the cost of overinsurance can be offset by the savings from not having to pay out of pocket for any repairs or replacements. This can be especially true if you have taken out a comprehensive insurance policy.

Should I Overinsure My Car?

Whether or not you should overinsure your car is ultimately a personal decision. It is important to consider the potential risks and benefits of overinsurance before taking out the policy. Additionally, it is important to understand the terms and conditions of the policy in order to ensure that you are adequately covered and not overpaying for your insurance.

In Summary

Insuring a car for more than its market value is known as overinsurance. It can provide peace of mind for car owners, but it is important to be aware of the potential risks associated with this type of insurance. Additionally, it is important to understand the terms and conditions of the policy in order to ensure that you are adequately covered and not overpaying for your insurance.

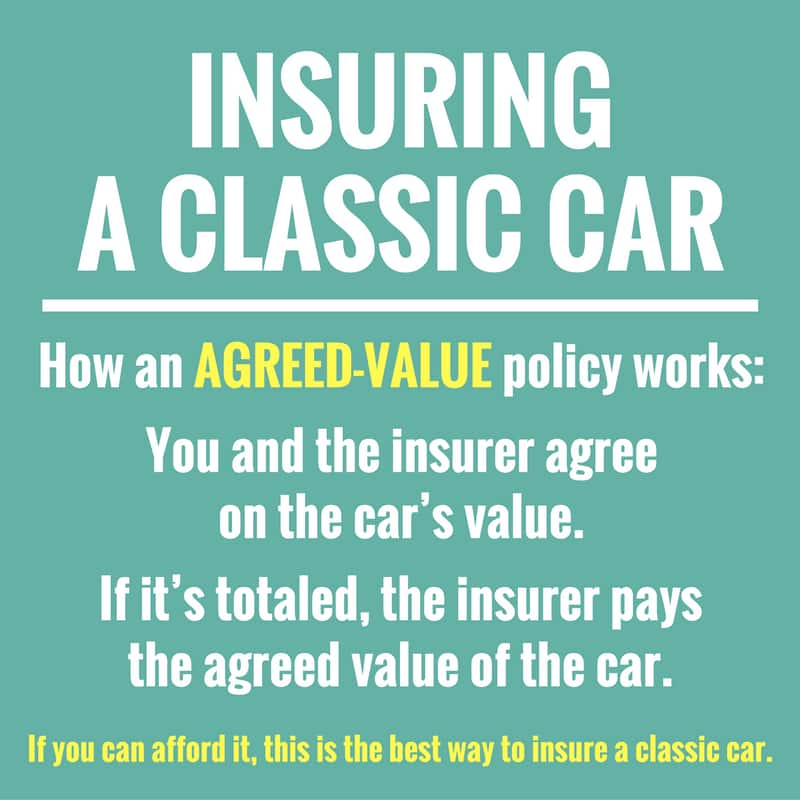

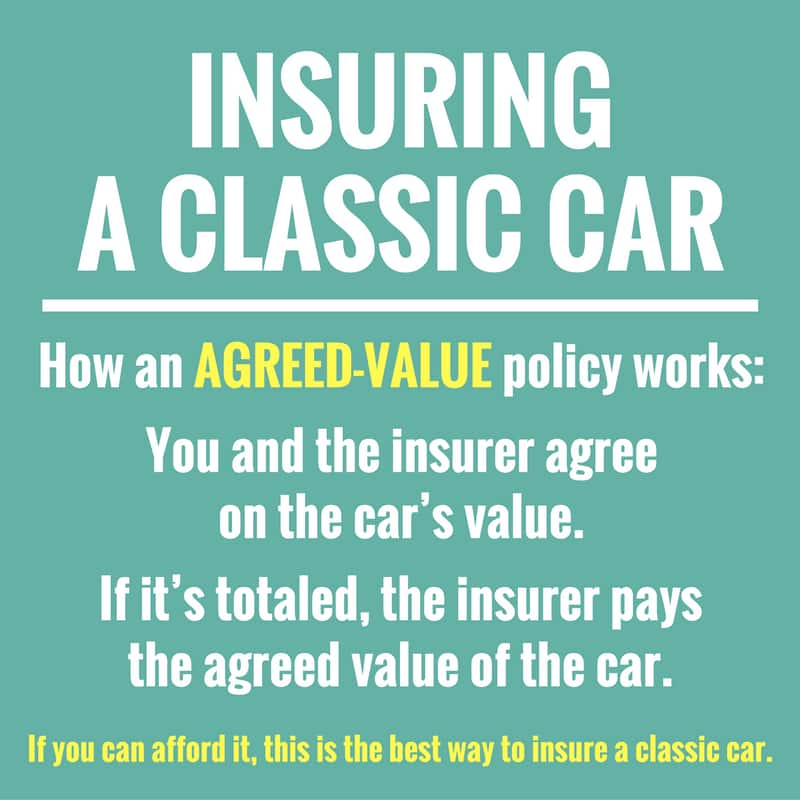

Agreed Value Modified Car Insurance / Agreed Value Option to Avoid

Car owners in Mumbai, New Delhi, Chennai and Kolkata may have to pay 15

Options for Insuring your Car – Just Insure S.A.

Average Car Insurance: Insuring Electric Cars